Velo (VELO) isn’t just another cryptocurrency trying to ride the DeFi wave. It’s a working bridge between your bank account and your crypto wallet - designed to make real payments, real loyalty programs, and real business finance work on blockchain without the chaos of speculation. While most tokens fade after a hype cycle, Velo has been quietly building infrastructure used by actual businesses and millions of users, especially across Asia.

What Velo actually does - not just what it promises

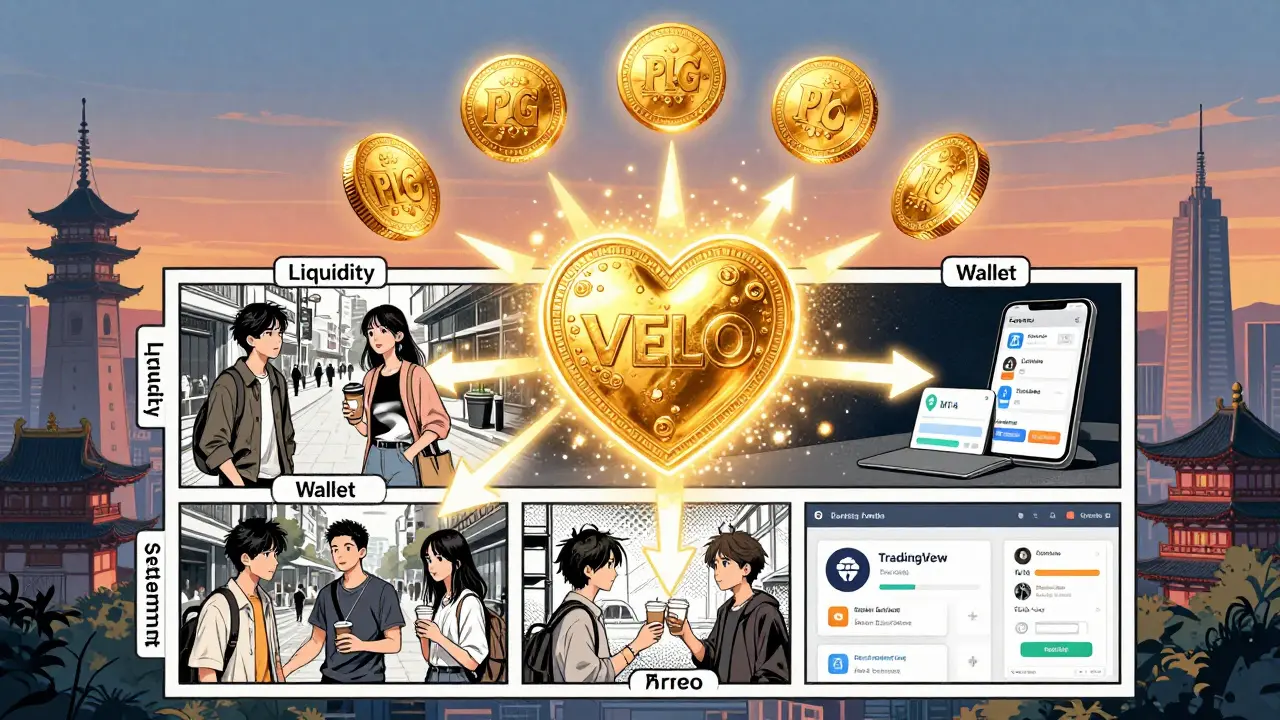

Velo isn’t trying to replace Bitcoin or compete with Ethereum. Instead, it solves a boring but critical problem: how do you move money from traditional banking systems into decentralized finance without breaking compliance, losing speed, or scaring off businesses? The answer is three layers. First, the Liquidity Layer connects real-world assets like gold and stablecoins to DeFi protocols. The PLG Gold RWA Token, for example, lets institutions trade tokenized gold on-chain with full regulatory oversight. Second, the Wallet Layer powers payment systems for merchants. Think loyalty points you earn at a local store that can be spent across apps, exchanged for crypto, or even used to pay bills - all in one place. Third, the Settlement Layer uses VELO PAYFAI, an AI system that automatically settles cross-border trade finance deals in seconds, replacing days of paperwork. This isn’t theory. Over 1 million unique wallets have interacted with Velo’s dApps since its launch. That’s not speculative traders - that’s real people using loyalty programs, making payments, and trading assets through Velo’s tools.How VELO token fits into the ecosystem

The VELO token isn’t just a currency. It’s the fuel that powers the whole system. You need it to pay for transaction fees on Velo’s network, to stake in liquidity pools, to earn rewards in the Omni Points loyalty program, and to participate in governance decisions. Unlike many tokens that exist only for trading, VELO has a clear, daily utility inside the ecosystem. Its total supply is 22 billion tokens, but not all are in circulation. A major unlock of 3 billion tokens (13.6% of total supply) is scheduled for September 20, 2025. That’s worth roughly $43 million at today’s prices. History shows similar unlocks in June 2025 caused 11-15% price drops as early investors sold. So while long-term adoption is growing, short-term price pressure is real. Velo’s team delayed another unlock to avoid flooding the market during key development phases - a sign they’re prioritizing ecosystem health over quick price pumps.Price and market performance - what the numbers say

As of October 2025, VELO trades around $0.0132. That’s down from its 2024 highs but stable compared to most altcoins. Daily volatility is around 6.9%, which is moderate for crypto - not wild, not dead. Technical indicators show mixed signals. The 14-day RSI is at 45.22, meaning neither buying nor selling pressure dominates. The 50-day moving average ($0.0145) is just above the current price, suggesting short-term resistance. The 200-day average ($0.0144) is nearly identical, showing long-term consolidation. Market sentiment is split. CoinCodex shows a “Greed” index of 63, while DroomDroom sees “Fear.” That’s not unusual for a project with strong fundamentals but a looming token unlock. The real question isn’t whether it’ll go up - it’s whether the ecosystem can grow fast enough to absorb the coming supply increase.

Price predictions - why they’re all over the place

You’ll see wild claims. CoinLore says VELO could hit $1.54 in 2025 - that’s over 11,000% growth. CoinCodex expects $0.013-$0.025. DroomDroom predicts $0.0205 by year-end, but also $0.0111 in one month. These aren’t contradictions. They’re different scenarios. The $1.54 prediction assumes Velo becomes the dominant bridge between Asian banks and DeFi, with institutional adoption skyrocketing. That’s possible - but it requires flawless execution of their 2025 roadmap. The $0.02 range is more realistic if they hit their milestones: launching the liquidity aggregator, expanding cross-chain support, and onboarding 5-10 new enterprise partners. That’s not fantasy - it’s what they’ve already started doing. The $0.0111 forecast? That’s based purely on the September 2025 token unlock. If sellers dominate and adoption doesn’t accelerate, the price could dip temporarily. But if the ecosystem grows faster than supply, the drop becomes a buying opportunity.What’s next in 2025 - the roadmap that matters

Velo isn’t waiting for the market to turn. They’re building. - Lightyear Trading Bot: Now integrates with MT4, MT5, and TradingView. Traders can copy strategies across Web2 platforms and execute them on-chain with VELO. This is huge for retail traders who want DeFi access without learning new tools. - SoFinX Social Trading: Users can copy top traders’ moves automatically. Profits are shared in VELO. This isn’t just a gimmick - it’s turning passive users into active participants. - Omni Points Loyalty System: Powered by Orbit tech, it lets businesses issue branded loyalty tokens redeemable for goods, services, or crypto. Think Starbucks points - but usable across 100+ partners. - Multi-chain Expansion: Full Solana integration is live. More chains are coming. This isn’t about being on every chain - it’s about being where the users are. - White-label Loyalty Platform: Businesses can plug in Velo’s system and launch their own crypto-powered rewards programs in days. This could be their biggest growth engine. If Velo delivers even half of this, it won’t be a “crypto coin.” It’ll be a financial infrastructure layer - like PayPal for Web3.

Who’s using Velo - and why

You won’t find Velo on Binance’s trending list. But you’ll find it in places you’d never expect. - A chain of convenience stores in Thailand uses Omni Points for loyalty rewards, letting customers earn VELO by buying coffee. - A fintech in Singapore uses VELO PAYFAI to settle trade invoices between Chinese suppliers and Indonesian buyers - cutting settlement time from 5 days to 90 seconds. - A crypto exchange in South Korea lets users stake VELO to earn interest in stablecoins, with no lock-up period. These aren’t marketing stories. They’re live, operational use cases. Velo’s strength isn’t its price - it’s that real businesses are building on top of it.Is Velo a good investment?

If you’re looking for a quick 10x, Velo isn’t it. The token unlock in September 2025 will likely cause volatility. If you buy now and sell before then, you might lose money. But if you believe in the future of real-world assets on blockchain - if you think payments, loyalty, and trade finance will move on-chain - then Velo is one of the few projects actually building that future. It’s not a gamble. It’s a bet on execution. The team has shown discipline: delaying unlocks, launching real products, and focusing on adoption over hype. They’re not chasing memes. They’re building systems. If you’re holding VELO, track their roadmap. Watch for announcements about enterprise partnerships, new chain integrations, and growth in unique active wallets. Those are the real indicators - not price charts.Final take

Velo (VELO) isn’t the flashiest crypto out there. It doesn’t have a dog mascot or a viral Twitter campaign. But it’s solving problems that matter: payments that work, loyalty programs that stick, and finance that doesn’t need a middleman. Its price might swing. Its token unlock might hurt. But its ecosystem? It’s growing - slowly, steadily, and with real users. If you want to understand where crypto is going beyond speculation, look at what Velo is building - not what its price is today.Is Velo (VELO) a good long-term investment?

Velo isn’t a get-rich-quick token. It’s a long-term infrastructure play. If you believe real-world finance will move on-chain - payments, loyalty, trade finance - then Velo is one of the few projects actually building that. The September 2025 token unlock could cause short-term price drops, but if adoption keeps growing, the long-term potential is real. Hold if you’re betting on utility, not hype.

Can I use VELO to make payments today?

Yes, but not directly like Bitcoin or USDT. VELO powers payment systems through Velo’s partners. For example, merchants using the Omni Points loyalty program let customers pay with VELO-backed rewards. You can’t yet use VELO to buy coffee at Starbucks, but you can earn it there and use it across a growing network of partners in Asia. Direct VELO payments are coming as more businesses adopt the white-label platform.

What makes Velo different from other DeFi projects?

Most DeFi projects focus on lending, trading, or yield farming. Velo focuses on payments, loyalty, and trade finance - the boring stuff that actually moves the global economy. It’s built for businesses, not just traders. Its AI-powered settlement system (VELO PAYFAI) and real-world asset tokens (like PLG Gold) are rare in crypto. It’s not trying to replace banks - it’s helping them work better with blockchain.

Why is Velo focused on Asia?

Asia has the highest adoption of mobile payments, digital wallets, and cashless systems. Countries like Thailand, Singapore, and South Korea have strong fintech infrastructure and regulatory clarity around crypto. Velo targets this region because it’s the perfect testing ground for bridging traditional finance and blockchain. Success there can be scaled globally.

How does the token unlock affect VELO’s price?

The September 20, 2025 unlock of 3 billion VELO tokens (13.6% of supply) is the biggest risk to the price. Similar unlocks in June 2025 caused 11-15% price drops as early investors sold. If the ecosystem hasn’t grown enough to absorb that supply, the price will likely fall. But if adoption accelerates - new users, new partners, more utility - the sell-off could be absorbed. Watch wallet growth and enterprise deals after the unlock.

Is Velo safe to use?

Velo’s infrastructure has been audited and is live with real users. The team has a track record of delivering on milestones. But like all crypto, you’re responsible for your own wallet security. Never share your private keys. Use hardware wallets for large holdings. While the protocol is secure, third-party apps using VELO may carry risks - always check the source before connecting your wallet.

14 Responses

Okay but let’s be real - Velo’s not trying to be the next Dogecoin. It’s the quiet kid in class who actually passes all the exams. I’ve seen Thai convenience stores use their loyalty points like crypto cash. That’s not hype, that’s adoption. And honestly? We need more projects like this, not more meme coins with cartoon dogs.

Stop chasing 10x and start supporting infrastructure. This is how crypto becomes useful.

broooooo i just used velo to pay for my chai at this little shop in bangkok last week 😍 like i earned points from buying noodles and then swapped em for crypto?? no cap. this shit works. why are we still talking about price when real people are using it?? 🤯

People keep comparing Velo to Ethereum or Bitcoin - that’s like comparing a water pipe to a fountain. Velo’s not the water, it’s the plumbing. The PLG Gold token? That’s institutional-grade RWA on-chain. VELO PAYFAI? AI settling trade finance in 90 seconds? That’s not a feature - that’s a revolution.

And yeah, the token unlock in September is a risk, but look at how they delayed other unlocks to avoid crashing the market. That’s discipline. Most teams would’ve dumped and vanished. This team’s building something that outlives the next bull run.

Typical crypto bros patting themselves on the back for using a loyalty program. You think Thailand’s adoption makes this ‘real’? They’re using it because their government tolerates it, not because it’s superior. In the U.S., you can’t even get a bank to accept crypto payments without a 3-month compliance audit. This is a glorified gift card system with a blockchain sticker on it.

Don’t confuse utility with viability. If it can’t scale to Western markets, it’s just a regional curiosity.

There is a profound epistemological distinction between speculative asset valuation and infrastructural utility. Velo does not exist to satisfy the hedonic impulses of retail traders; it exists to mediate the friction between legacy financial systems and decentralized protocols. The token unlock is not a market event - it is a systemic pressure test.

To reduce its significance to price predictions is to misunderstand the nature of institutional adoption. One does not measure the success of a bridge by the volume of people jumping off it - but by how many safely cross.

Let me break this down for you slow folks: 3 billion tokens unlocking = $43M dumped into the market. Who’s buying? Not institutions. Not real users. It’s gonna be the same idiots who bought at $0.02 and are now crying because they’re underwater. And guess what? The team’s been quietly buying back tokens from the market for months. They’re not dumb. They know this is a trap.

Don’t be the sucker who buys the dip after the dump. This isn’t an investment - it’s a trapdoor.

I’ve been watching Velo since 2022 and honestly I didn’t think much of it at first. I mean, another crypto right? But then I started seeing how small businesses in Indonesia and Malaysia were using it for payroll and supplier payments. One guy told me he used to wait 7 days to get paid by a buyer in Singapore - now it’s 2 minutes. No bank fees. No intermediaries. No paperwork.

And the Omni Points thing? My cousin works at a chain of tea shops in Phuket and her whole team gets paid in VELO now. They cash out to stablecoins every Friday. It’s not flashy. It’s not glamorous. But it’s real. And that’s why I’m still holding. Not because I think it’ll hit $1. But because I believe in what it’s doing. Even if no one else gets it.

From India here - we’re seeing similar use cases with local fintechs integrating Velo for micro-payments and remittances. The white-label loyalty platform is a game-changer for small merchants who can’t afford complex systems. No need for app development, no need for KYC nightmares. Just plug in and go.

And the Solana integration? Huge. Faster, cheaper, and way more scalable than Ethereum. Velo’s not trying to be everything - just the best at what it does. And that’s enough.

There’s something deeply human about the way Velo operates - it doesn’t scream for attention. It doesn’t need to. It works quietly in the background, making transactions smoother for people who never even knew they needed blockchain. That’s the quiet power of utility.

Most crypto projects are about spectacle. Velo is about dignity. The dignity of a Thai shopkeeper getting paid on time. The dignity of a Singaporean SME settling a trade without begging a bank for approval. The dignity of being able to own your money without asking permission.

That’s not a coin. That’s a revolution wrapped in plain packaging.

so velo is basically paypal for people who hate banks but still want to pay for coffee? got it.

if you’re holding velo you’re just a sucker waiting for the rug pull. everyone knows the team is gonna dump after the unlock. wake up.

Okay, I’ll admit - I was skeptical. But then I read about that Singaporean fintech cutting settlement time from 5 days to 90 seconds. That’s not innovation. That’s a goddamn time machine.

And the fact that they delayed unlocks? That’s not luck. That’s strategy. Most crypto teams are con artists. This one’s engineers. And honestly? I’d rather back the engineers.

Price will swing. But infrastructure? That sticks.

Let me ask you something - who really controls the liquidity layer? Is it the team? Or is it a hidden entity tied to a central bank? The PLG Gold token is labeled ‘regulated,’ but regulation in Asia often means state control. What if this is a Trojan horse for surveillance finance? What if every transaction is monitored? What if your loyalty points become a tool for behavioral tracking?

They call it ‘utility.’ I call it quiet authoritarianism dressed in blockchain.

Look, I used to think Velo was legit. But then I dug into their team’s past. One of the devs got banned from a major exchange for wash trading. The CEO’s LinkedIn says ‘crypto pioneer’ but he worked at a failed fintech that got sued for fraud. And now they’re pushing this ‘infrastructure’ narrative like it’s gospel?

Don’t be fooled. This isn’t building - it’s branding. And the token unlock? That’s the exit strategy. Buy now, sell before September. Or get wrecked.