Vietnam Crypto Adoption Index Calculator

Adoption Index Analysis

Enter your values and click "Calculate" to see how Vietnam's crypto adoption metrics compare to the 2025 Global Index.

Vietnam has surged into the upper‑echelon of the Vietnam crypto adoption landscape, appearing among the top five countries in the latest global crypto adoption rankings. The jump has sparked a wave of debate: what’s driving the rapid uptake, and how are the country’s strict rules shaping the market?

Understanding the 2025 Global Crypto Adoption Index

According to Chainalysis a blockchain analytics firm that publishes the Global Crypto Adoption Index, the index measures both on‑chain activity and population‑adjusted metrics. In the September2025 release, Vietnam landed at #6 in the population‑adjusted ranking, while the unadjusted list placed it at #5. The confusion between these two tables explains why many outlets reported different numbers.

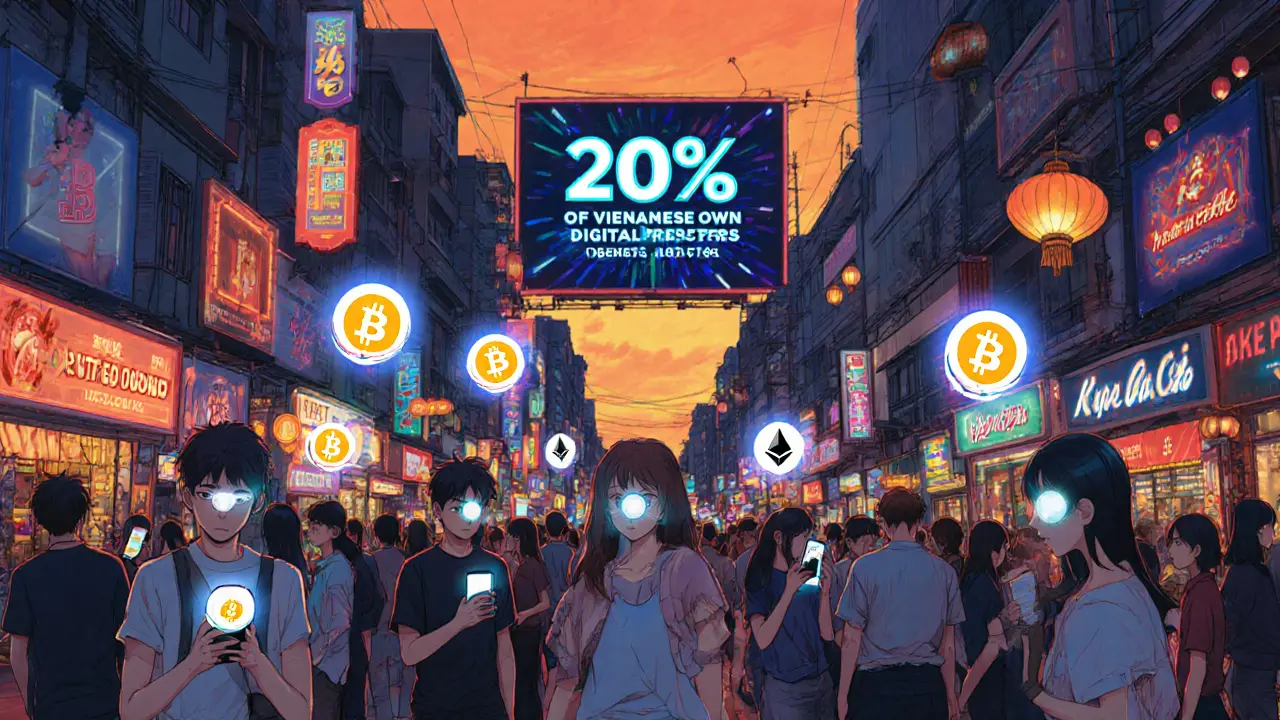

The index looks at five core pillars: retail transaction volume, centralized exchange usage, DeFi activity, institutional participation, and on‑chain asset holdings. Vietnam’s strength lies in retail and centralized exchange values, where it scores 20.3% of its population owning digital assets - the highest share in Southeast Asia.

Regulatory Landscape: A Double‑Edged Sword

The State Bank of Vietnam the central bank responsible for monetary policy and crypto regulation introduced the Law on Digital Technology Industry in June2025. The law officially legalises “crypto assets” such as Bitcoin (BTC) and Ether (ETH) but draws a hard line against fiat‑backed stablecoins and tokenised securities.

- All crypto trades must be settled in Vietnamese đồng (VND).

- Only Vietnamese‑registered companies may issue crypto assets, and those assets must be backed by tangible real‑world items, not fiat or securities.

- Crypto Asset Service Providers (CASPs) need a minimum capital of 10trillionVND (≈$379million USD).

These requirements aim to protect financial stability but also raise the entry barrier for startups. A sandbox pilot launched on 9September2025 received zero applications within the first month, underscoring the tension between innovation and regulation.

Market Dynamics: Users, Volume, and Offshore Dependence

Vietnam’s crypto community is vibrant and sizable. Recent surveys estimate roughly 17million active users - about 17.2% of the nation’s 98.8million people. In Q32025, on‑chain transaction value topped $100billion, contributing roughly 8.5% ($200.6billion) of the Asia‑Pacific’s total crypto volume.

Because stablecoins are banned, 87% of Vietnamese traders rely on offshore platforms. The most popular is Binance a global cryptocurrency exchange offering P2P services in Vietnam, used by 63% of traders for USDT‑VND swaps. Bybit and OKX follow with 21% and 19% market share respectively.

Users cite three main pain points: premium spreads of 3‑5% on P2P trades, lengthy KYC verification, and delayed conversion to VND. Despite these frictions, a September2025 OneSafe.io poll showed 74% of respondents use crypto for cross‑border remittances, enjoying average fees of 1.2% versus the 6.8% typical of traditional channels.

How Vietnam Stacks Up Against Regional Peers

When placed side‑by‑side with neighbours, Vietnam’s unique policy mix becomes clear. Singapore’s Monetary Authority of Singapore permits regulated stablecoins, fostering a 32% higher institutional adoption rate. The Philippines, with a permissive stance, has seen platforms like GCash’s GCrypto attract 8.7million users.

| Country | Population‑adjusted Rank | Retail Adoption % | Stablecoin Policy | Institutional Adoption % |

|---|---|---|---|---|

| Vietnam | #6 | 20.3% | Prohibited | 17% |

| Singapore | #3 | 15.2% | Allowed (regulated) | 49% |

| Philippines | #9 | 12.8% | Allowed | 22% |

| Thailand | #13 | 14.7% | Limited | 20% |

The table highlights that Vietnam leads Southeast Asia in pure retail adoption, yet its institutional share lags behind more permissive jurisdictions.

Opportunities, Risks, and the Road Ahead

Several forces could propel Vietnam higher in future rankings:

- IMF International Monetary Fund, which monitors financial stability warns that unregulated P2P activity (estimated at 92% of total crypto volume) poses integrity risks, prompting tighter oversight that could push activity onto licensed channels.

- The World Bank global development institution providing data on remittances notes $19.2billion in international remittances to Vietnam in 2024. If stablecoins were permitted, crypto could capture 15‑20% of that market, adding $2.9‑$3.8billion in regulated flow.

- SBV’s forecast of 20% credit growth in 2025 could inject $20‑$25billion of liquidity into the crypto market, based on a 0.78 correlation between credit expansion and trading volume.

Conversely, the high 10trillionVND capital threshold for CASPs deters smaller innovators. A PwC Vietnam assessment estimated an average compliance cost of $2.8million USD and a lead time of 11.3months to launch a fully licensed crypto service.

Looking forward, the SBV’s October2025 draft circular proposes a 2% VAT and a 0.1% transaction tax on crypto trades. Meanwhile, the central bank’s digital đồng pilot with 20 commercial banks may eventually bridge on‑chain assets and fiat, offering a smoother path for institutional players.

Chainalysis projects Vietnam could break into the top four of the 2026 index if the sandbox gains traction and stablecoin restrictions ease. Morgan Stanley’s outlook predicts 25‑30% annual growth in the Vietnamese crypto market through 2028, potentially capturing up to 15% of the nation’s e‑commerce spend ($137billion) and a sizable slice of the remittance market.

Key Takeaways

- Vietnam sits at #5‑#6 in the 2025 Global Crypto Adoption Index, leading Southeast Asia in retail ownership.

- Strict regulations (VND‑only trades, stablecoin ban, high CASP capital) boost stability but push most activity offshore.

- Retail users drive $100billion+ in yearly transaction volume; institutional participation remains modest.

- Regional comparison shows Singapore’s permissive stance yields higher institutional adoption, while the Philippines leverages crypto for remittances.

- Potential policy tweaks-stablecoin allowances, lower capital hurdles-could lift Vietnam into the global top four and unlock billions in remittance and e‑commerce value.

Frequently Asked Questions

Why does Vietnam rank differently in adjusted vs. unadjusted crypto adoption tables?

The adjusted table divides activity by population size, giving smaller countries a boost. Vietnam’s raw transaction volume is huge, placing it at #5 in the unadjusted list, but when divided by its 98.8million people, the rank drops to #6.

Can I trade stablecoins like USDT in Vietnam?

No. The 2025 law forbids fiat‑backed stablecoins. Most users resort to offshore P2P platforms, paying premiums and facing verification delays.

What are the capital requirements for a crypto exchange operating in Vietnam?

A Crypto Asset Service Provider must hold at least 10trillionVND (about $379million USD) in registered capital, plus meet 14 separate compliance certifications under Circular35/2025/TT‑BTC.

How does Vietnam’s crypto market compare to Singapore’s?

Singapore allows regulated stablecoins and has a 49% institutional adoption rate, far higher than Vietnam’s 17%. However, Vietnam leads in retail ownership at 20.3% vs. Singapore’s 15.2%.

What future policy changes could improve Vietnam’s crypto ranking?

Easing the capital requirement for CASPs, permitting regulated stablecoins, and streamlining the sandbox application process would likely shift more on‑chain activity into the formal sector, boosting institutional participation and overall ranking.

12 Responses

Hey folks! Vietnam’s crypto surge is pretty wild-over 20% of the pop holding assets, that’s huge. The new law is trying to keep things safe, but those offshore P2P trades are still the main flow. If you’re just getting started, try using the P2P Binance groups; they’re decent for low‑fee swaps. Keep an eye on the upcoming sandbox, it might open doors for local startups. Remember, diversifying between spot and DeFi can help you ride the volatility.

So, when we stare at the numbers-20.3% retail ownership, $100B volume, 17M users-it feels like we’re watching a digital revolution in fast‑forward mode 😮. The SBV’s heavy‑handed capital requirement is like a bouncer at a club that only lets in the big‑ticket holders, and that’s a deliberate move to keep the floor from collapsing 👀. Yet, the outrage over the stablecoin ban is louder than a market‑wide siren-people are shouting, “why not let us trade USDT?” and the answer is “because we want control”, which sounds like a paradoxical embrace of freedom while clutching the leash. The offshore reliance (87% on Binance, Bybit, OKX) shows a gap that could be filled if the regulators lowered that 10 trillion VND bar, turning a labyrinth into a highway. Think about the remittance angle: 74% of users already use crypto for cross‑border payments, cutting fees from 6.8% to 1.2%-that’s a real‑world impact that outshines any meme coin hype. On the institutional side, 17% participation may look modest, but compare it to Singapore’s 49%-it’s a catalyst that could accelerate once the sandbox turns on. The IMF’s warning about P2P integrity risks is like a storm cloud on the horizon, but it also nudges the market toward licensed channels, which could legitimize the 100B volume figure. If the draft VAT and transaction tax of 2% and 0.1% pass, we’ll see a new revenue stream that might fund better compliance frameworks. The CBDC pilot with 20 banks could finally bridge fiat and on‑chain assets, giving institutional players a safe tunnel. Remember, each regulatory tweak is a double‑edged sword-more stability can sometimes stifle the very innovation that sparked this surge. The data from the World Bank suggests that unlocking just 15% of the $19.2B remittance inflow could inject $2.9B‑$3.8B into the formal crypto ecosystem, a tidy boost for GDP. Looking ahead, Morgan Stanley’s projection of 25‑30% annual growth means we could see Vietnam capture 15% of e‑commerce spend-imagine $20B flowing through crypto wallets. So, while the law feels like a cage, it’s also a scaffold that, if tweaked, could lift Vietnam into the top‑four global rankings by 2026. Bottom line: the market’s momentum is undeniable, and the policy tweaks will decide whether it becomes a towering skyscraper or a shaky tower. 🚀

Listen up, the real issue isn’t that Vietnam loves crypto-it’s that the government’s rules are a massive roadblock for anyone not backed by billions. Those 10 trillion VND capital needs are insane, and they crush the little guys faster than a hammer. If you’re a startup, you’ll spend $2.8 million just to get a license, and that’s before you even think about building a product. The ban on stablecoins forces traders onto pricey offshore P2P, which adds 3‑5% premiums that eat into any profit. Cut the red tape, allow regulated stablecoins, and you’ll see a flood of institutional capital flowing in-no more “off‑shore only” nonsense. Until then, the market will stay fragmented, and the average Vietnamese user will keep paying ridiculous spreads for a simple swap.

Oh great, another “revolution” we can all ignore while paying extra fees. Nice job, folks.

Esteemed colleagues, it is evident that the stipulated capital threshold presents a formidable obstacle to nascent enterprises. May I propose a calibrated reduction, perhaps tiered according to projected transaction volumes, thereby fostering inclusivity without compromising fiscal prudence?

Vietnam’s crypto volume is massive, but regulation is throttling growth.

If you think Vietnam’s crypto scene is impressive, you’re blind to the fact that most activity is just offshore arbitrage, a hollow echo of real adoption, and the government’s heavy‑handed policies will only drown any genuine innovation.

I get where you’re coming from, but there’s also a lot of enthusiasm among everyday users who see real value in cheaper remittances and are willing to work within the current rules.

Behold the paradox of a nation perched on the precipice of digital sovereignty, where the specter of regulatory restraint dances with the phoenix of market exuberance, crafting a narrative so intricate it could make the most seasoned economists weep with both admiration and confusion.

In the grand tapestry of fintech ecosystems, Vietnam’s current policy matrix operates as a high‑frequency latency buffer-mitigating systemic risk yet inadvertently throttling liquidity provisioning, which, in turn, skews the market‑depth curves and inflates the bid‑ask spread equilibrium.

Looks like the crypto community in Vietnam is thriving despite the red tape, especially with that massive $100 B transaction volume; it’ll be interesting to see how the sandbox evolves.

Yeah, the vibe is pretty energizing-when a whole country starts treating digital assets as a regular part of daily life, it reminds us that technology really can reshape economies from the ground up.