The Mars Ecosystem Token, or XMS, isn’t just another crypto coin. It was built to fix a problem most stablecoins ignore - how to make a decentralized stablecoin actually work without relying on centralized reserves. Unlike USDT or USDC, which are backed by cash or bonds, XMS tries to create stability through its own internal economy. Think of it like a mini central bank built on blockchain, where the token itself helps hold the value of the stablecoin it supports.

How XMS Works: The Core Idea

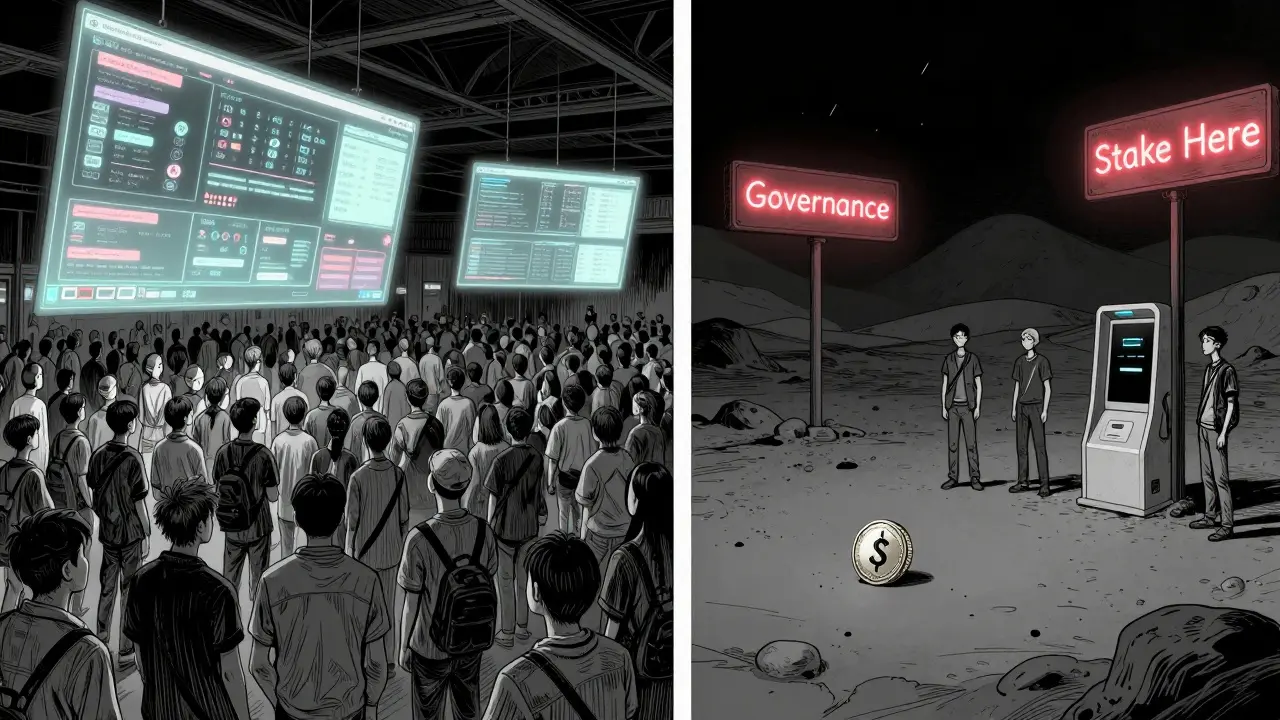

Mars Ecosystem was launched in 2021 with a bold goal: become the "central bank and reserve currency for DeFi." At its heart is the Mars Stablecoin, designed to stay pegged to $1. But instead of holding dollars in a vault, it uses two things: the Mars Treasury and the XMS token. The treasury holds a mix of crypto assets like ETH, BTC, and others. When the stablecoin’s value dips, the treasury buys it back. When it rises too high, it sells. And XMS? It’s the voting token. Holders decide how the treasury is managed - which assets to buy, how much to lend out, even how to spend fees.

This setup is meant to solve what experts call the "Positive Externality Problem." In plain terms: most stablecoin projects benefit from liquidity and usage, but don’t reward those who help build it. Mars says XMS holders should get a share of the system’s success. Every trade on Mars Swap, every loan on Mars Money Market, generates fees. A portion of those fees flows back to XMS stakers. It’s not just governance - it’s participation.

Current Value and Market Reality

When XMS hit its all-time high of $1.23 in November 2021, people believed in the vision. Today, it trades around $0.00036. That’s a drop of over 99%. The market cap hovers near $250,000. Compare that to MakerDAO’s MKR, which sits at over $1 billion, or even Frax’s FXS at $300 million. XMS doesn’t even crack the top 1,000 coins by market cap. It’s ranked #5,662 on CoinMarketCap.

Trading volume is painfully low. On a good day, you might see $600,000 in trades. That’s less than 0.002% of what USDC moves daily. Most of the trading happens on small exchanges like Binance Smart Chain, not major platforms. You won’t find XMS on Coinbase or Kraken anymore. The number of holders? Around 33,000. For context, DAI has over 1 million holders. This isn’t a coin with mass adoption - it’s a niche experiment.

What You Can Do With XMS

If you hold XMS, here’s what you can actually do:

- Vote on treasury decisions - like which assets to add or remove from the reserve.

- Stake your tokens on Mars Swap or Mars Stableswap to earn a cut of trading fees.

- Use it as collateral to borrow Mars Stablecoin (though few do, since the stablecoin itself has little usage).

The ecosystem includes three main tools: Mars Swap (a DEX), Mars Stableswap (for trading stablecoins), and Mars Money Market (for lending). But here’s the catch - very few DeFi protocols integrate with them. Only three small projects have connected to Mars Stablecoin, according to DeFi Llama. Meanwhile, DAI is used in over 300 protocols. Without adoption, the governance rights of XMS feel theoretical.

Why It’s Struggling

There are three big reasons XMS hasn’t taken off:

- No real-world use - No merchants accept Mars Stablecoin. No apps build on it. It’s stuck in DeFi circles.

- Low liquidity - If you try to sell a large amount of XMS, the price crashes. It’s hard to enter or exit without losing money.

- Team silence - The last major update was in late 2022. The roadmap promised cross-chain expansion, institutional partnerships, and mobile wallets - none happened. The community is left guessing.

Developers who’ve tried to build on Mars Ecosystem report frustratingly incomplete documentation. GitHub reviews give it 2.8/5 stars. One developer said it took over 50 hours just to set up a liquidity pool - twice as long as with Curve or Aave. That’s a huge barrier.

What Experts Say

Bitget calls XMS a "promising and dynamic proposition," praising its innovation. But CoinDesk analyst Maria Shen isn’t convinced: "Tokens addressing the Positive Externality Problem are interesting in theory, but without real adoption, they’re just math problems on a blockchain." The long-term price predictions? Bitscreener says XMS could hit $1.32 by 2030. That’s a 360,000% gain from today’s price. But that’s based on a model assuming the entire DeFi world adopts Mars Stablecoin - something no expert believes is likely. The odds of that happening? Less than 5%.

Who Should Even Care?

Right now, XMS isn’t for casual investors. It’s not for beginners. It’s not even for most DeFi users.

It’s only for two groups:

- Speculators - people betting on a miracle comeback. They’re hoping the team wakes up, partners with a major protocol, or gets listed on a big exchange.

- Academics - researchers studying how decentralized stablecoins can self-sustain. For them, XMS is a live lab experiment.

For everyone else? The risks far outweigh the rewards. The staking APY is under 1%. The gas fees on Ethereum are higher than potential returns. And if the Mars Treasury ever runs low on assets, there’s no safety net. No insurance. No backup.

The Bigger Picture

XMS sits in a $150 billion market of stablecoin governance tokens. But it owns 0.00015% of it. That’s not a failure - it’s a lesson. Building a decentralized stablecoin isn’t just about clever code. It’s about trust, liquidity, and adoption. XMS has the first. It’s missing the other two.

There’s still value in the idea. Maybe one day, someone else will build a better version. But as of early 2026, Mars Ecosystem Token is a quiet experiment - not a currency. A theory, not a tool. A ghost in the machine of DeFi.

Is Mars Ecosystem Token (XMS) a good investment?

As of early 2026, XMS is not a good investment for most people. Its price is down over 99% from its peak, trading volume is extremely low, and there’s no evidence of real adoption. While the underlying concept is interesting, the lack of partnerships, minimal liquidity, and inactive development team make it a high-risk speculative bet. Only experienced traders with a high risk tolerance should consider it.

Can I stake XMS to earn rewards?

Yes, you can stake XMS on Mars Swap or Mars Stableswap to earn a portion of transaction fees generated within the ecosystem. However, the current APY is under 1%, and the impermanent loss risks often outweigh the rewards. Gas fees on Ethereum-based transactions can also eat into profits. Most users report that staking XMS isn’t profitable compared to other DeFi options.

Why is XMS trading at such a low price?

XMS trades at a low price because of extremely low demand, minimal real-world use, and lack of exchange support. After its 2021 peak, the project failed to deliver on promised features like cross-chain expansion and institutional partnerships. With only 33,000 holders and almost no integration with major DeFi protocols, there’s little incentive for buyers. The market has priced in long-term neglect.

Is XMS used for anything besides speculation?

Currently, XMS has almost no practical use outside of speculation and governance voting. The Mars Stablecoin it supports isn’t accepted by merchants, apps, or services. No major DeFi platform uses it as collateral or liquidity. While the ecosystem includes tools like Mars Swap and Mars Money Market, they’re rarely used due to lack of users and liquidity. Its value is almost entirely tied to belief in a future that hasn’t materialized.

What happened to the Mars Ecosystem team?

Since late 2022, the Mars Ecosystem team has been largely silent. No major updates, no new partnerships, and none of the roadmap goals - like mobile wallets or cross-chain expansion - have been delivered. GitHub commits have slowed to a trickle. Community channels like Telegram and Discord show low activity. This lack of development has eroded trust and contributed to the token’s decline.