Scam Token Risk Calculator

Token Risk Calculator

Risk Assessment

Estimated Liquidity

$0.00

Max Sellable Amount

$0.00

Estimated Loss

0%

WARNING: This token has extreme liquidity risk. Real-world trading volume is $0.42 (less than coffee), making it nearly impossible to sell without massive losses.

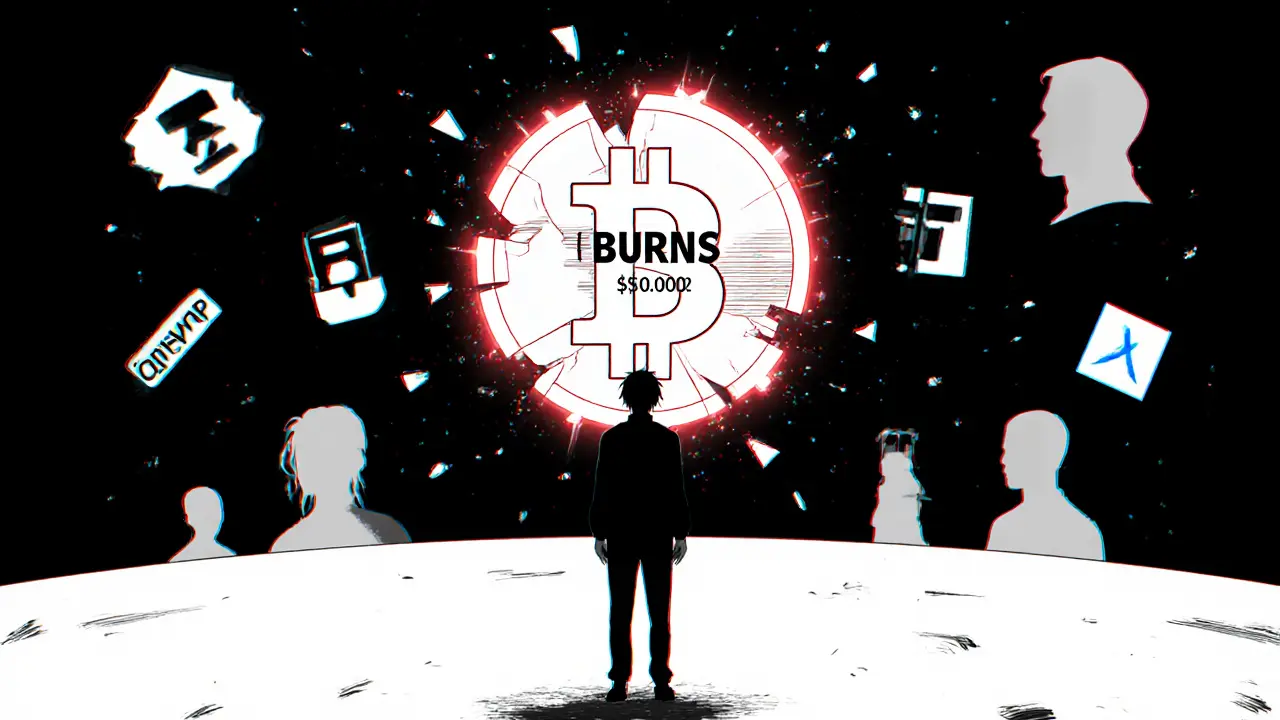

Based on article data: Burnsdefi (BURNS) has a 24h volume of $0.42. For a $100 investment at $0.0002 price, you'd only be able to sell $0.04 before market manipulation occurs.

There are over 25,000 cryptocurrencies out there. Most of them vanish without a trace. Burnsdefi (BURNS) isn’t just another obscure coin - it’s a ghost. If you’ve seen it listed on a random exchange with a price like $0.0002, you might think it’s a hidden gem. It’s not. It’s a warning sign.

What Burnsdefi (BURNS) actually is

Burnsdefi (BURNS) is a token that claims to be part of the DeFi space, but it has no real DeFi function. No lending. No staking. No yield farming. No smart contract users. No TVL (Total Value Locked). Nothing. The name sounds like it should do something - maybe burn tokens to reduce supply, or reward holders - but there’s zero proof of that. No whitepaper. No GitHub. No team members. No roadmap. Just a token name and a price on a few small exchanges.The price is meaningless

You’ll see BURNS priced at $0.00018 on Bitget, $0.00025 on another, and $0.002 on Kriptomat. That’s not a market - that’s chaos. The price changes wildly because there’s almost no trading. On November 26, 2023, the 24-hour trading volume was $0.42. That’s less than the cost of a coffee. For comparison, Bitcoin trades over $15 billion in the same time. When volume is this low, a single buyer can push the price up 50% in seconds. Then, they sell. That’s how these tokens work.Market cap? More like market zero

CoinCodex listed Burnsdefi’s market cap as $0.00 in late 2023. That’s not a typo. It means either no one owns it, or the circulating supply is so tiny it doesn’t register. Even if you take the highest price estimate ($0.002), and multiply it by the maximum possible supply, you’re still looking at under $10,000 in total value. That’s below the threshold most legitimate exchanges require to list a token. Bitget’s own transparency report says they only list tokens with a $50,000 minimum market cap. So why is BURNS still there? Because some platforms list anything that pays them a fee.No one’s talking about it

Check Reddit’s r/CryptoCurrency - 3.2 million members. Search for “Burnsdefi.” Nothing. Bitcointalk? No threads. Telegram? No groups. Trustpilot? No reviews. Even obscure but real micro-cap tokens have at least a few hundred people chatting about them. BURNS has silence. That’s not because it’s too new - it’s because no one cares. And if no one cares, why should you?

Why experts ignore it

Messari, Delphi Digital, CoinTelegraph - none mention BURNS. TokenInsight analyzed 147 DeFi projects in November 2023 and didn’t include Burnsdefi once. CertiK, the top smart contract auditor, says tokens ranked below #15,000 have a 92.7% chance of being scams or broken. BURNS sits at #19,600. That’s not a gamble - that’s a statistic. Morningstar’s Kristoffer Inton calls tokens like this “ghost tokens.” They’re priced so low, they have no utility, and they’re only kept alive by speculators hoping for a miracle pump.It’s not DeFi - it’s a trap

Real DeFi tokens like Uniswap or Aave have transparent code, active developers, and millions in locked value. BURNS has none of that. It’s named like a DeFi project to trick people into thinking it’s serious. But there’s no infrastructure behind it. No audits. No security checks. No team. Just a token with a name that sounds smart. That’s the oldest trick in the crypto book.What happens if you buy it?

Let’s say you buy $100 worth of BURNS. You might think you’re getting a lot of coins because the price is so low. But here’s the catch: when you try to sell, you won’t find a buyer. The order book is empty. You might get $0.50 back - if you’re lucky. Or your wallet might get stuck with it forever. Exchanges delist these tokens all the time. Once that happens, your coins become worthless digital paper. There’s no way to trade them. No way to move them. Just a memory of a bad decision.

18 Responses

Wow. This post reads like a gothic novel about digital ghosts… and honestly? I’m obsessed. BURNS isn’t just dead-it’s been cremated, scattered in a crypto windstorm, and then forgotten by the gods of blockchain. It’s not a token. It’s a cautionary haiku written in zero liquidity.

There’s something poetic about a token that has no team, no code, no purpose… yet still dares to whisper its price on exchanges like a ghost begging for change. I’d rather kiss a toaster than buy this.

It’s not even a bad investment-it’s an anti-investment. A negative asset. A black hole that eats hope and spits out FOMO dust.

And the fact that it’s still listed? That’s not negligence. That’s performance art. The exchange is the artist. The traders? The audience. And we’re all just standing there, holding our breath, waiting for the punchline.

But the punchline? It never comes. Because the joke’s been dead since 2021.

I wish more people wrote like this. Not just about crypto-but about the absurdity of human greed. We chase pennies like they’re diamonds… while ignoring the entire cathedral of real innovation right next door.

Thank you for this. I’m printing it out. Framing it. Hanging it above my desk. Next to my ‘Don’t Touch the Shitcoins’ sign.

Ohhhhh so THIS is what they don’t want you to know!!!

THEY’RE USING BURNS AS A DISTRACTION!!!

While you’re all busy laughing at this $0.0002 token… the real manipulation is happening in the shadows!!

Who owns the exchange that listed it? Who owns the wallet that’s been moving 0.0000001 BURNS every 3 hours? Who paid the dev team to vanish??

It’s not a scam-it’s a psyop. A test. A probe. They’re seeing how many sheep will bite at the cheapest thing on the board… so they can map your brain for the next pump.

They already know you’re here. They’ve been watching you scroll. They’re building your profile. You’re not buying a token-you’re feeding data to the AI that’ll crash your portfolio next month.

Don’t think you’re safe just because you didn’t buy it. You’re still part of the experiment.

They’re coming for you next.

…and they already own your IP address.

Zero TVL. Zero team. Zero soul.

Why are we even talking about this?

It’s not a coin.

It’s a tombstone.

And you’re all standing around it, taking selfies.

Let’s be real-BURNS is a perfect example of a zero-alpha, zero-beta, zero-liquidity, zero-utility token with a market cap that’s statistically indistinguishable from noise.

The fact that it’s still on Bitget is a regulatory failure. The fact that anyone’s even looking at it is a behavioral finance case study in cognitive dissonance.

When you see a token with a 24h volume under $1, you’re not looking at a market-you’re looking at a liquidity trap masquerading as a trading pair.

And the worst part? People think they’re ‘getting in early’-but early to what? A funeral?

This isn’t DeFi. It’s a liquidity ghost town with a .eth domain and a Discord that hasn’t posted since 2022.

Just don’t.

Don’t even open the chart.

It’s not worth your time. Or your bandwidth.

And if you’re still holding it? You’re not a degens-you’re a data point in someone’s behavioral model.

Yall are overthinking this. This ain't even crypto. This is like buying a napkin with a logo on it and calling it a stock.

USA got real crypto-Bitcoin, Ethereum, Solana. This BURNS trash? That's what you get when you let foreigners run the exchanges.

Why's it even listed? Because some dude in India got paid $50 to put it up.

Don't be a sucker. Stick to American crypto. Or go back to playing with your PlayDoh tokens.

I just want to say-thank you for writing this with such clarity and care.

I’ve seen so many new people get burned (pun intended) by tokens like this, and it breaks my heart.

It’s not about being smart or dumb-it’s about being new, curious, and hopeful.

And that’s beautiful. But it’s also dangerous when the system doesn’t protect you.

So thank you for being the voice that says: ‘Hey, this isn’t real. Walk away.’

You’re not just saving someone money.

You’re saving them from a kind of hope that never had a chance.

That’s rare. And important.

So I bought $20 of BURNS last year just to see what it was.

Turns out, it was a lesson.

I thought ‘low price = more coins = more potential’.

Turns out, low price = no one wants it.

I still have the tokens. I’ll keep them as a reminder.

Not as an investment.

As a museum piece.

Kinda like a VHS tape of a movie that never got made.

Also, I’m now obsessed with real DeFi. Aave, Uniswap, Lido. That’s where the magic is.

Real people. Real code. Real utility.

Not ghosts.

Man… I saw this token on a coin tracker once.

Thought it was a typo.

Turns out… it wasn’t.

Worst part? I almost bought it.

Good thing I didn’t.

Now I just laugh every time I see it pop up.

It’s like a zombie in a horror movie.

Still walking… but dead inside.

Wow. Someone actually wrote a whole essay about this garbage.

Who cares?

It’s a $0.0002 coin.

It’s not even worth your breath.

Stop giving it attention.

It’s like yelling at a wall that doesn’t even exist.

I appreciate how calmly you laid this out.

No yelling. No drama.

Just facts.

And honestly? That’s what’s missing in crypto.

Not hype.

Not memes.

Just… truth.

Thank you.

Someone needed to say this.

Stop buying fake coins.

Real ones exist.

Learn them.

Or stay poor.

I’ve seen this token before.

It pops up every few months.

Same price.

Same silence.

Same empty order book.

It’s like a digital echo.

It doesn’t mean anything.

It just repeats.

And we keep listening.

Wait… so BURNS is real? I thought it was a typo for BURNSWETH or something.

Also I think I bought some last year?

Oh god.

Did I just waste my life?

…I’m gonna go cry now.

Let me break this down for you in 3 bullet points:

- No TVL = no DeFi.

- No audit = no security.

- No volume = no liquidity.

That’s it.

That’s the entire thesis.

Why are we having this conversation?

It’s not a ‘debate’. It’s a taxonomy error.

This isn’t a ‘crypto asset’. It’s a placeholder.

And you’re all treating it like a lottery ticket.

It’s not.

It’s a digital ghost.

And ghosts don’t pay dividends.

They just haunt your portfolio.

Who even created this?

Some bored dev? A bot?

It’s not a project.

It’s a glitch.

And we’re all pretending it’s real.

That’s the real scam.

Not the token.

Our belief in it.

I’ve got 3 BURNS in my wallet.

Not because I think they’re worth anything.

But because I like the name.

It’s poetic.

Like a dying fire.

And I’m the only one who gets it.

😉

I’ve worked with crypto projects for over a decade.

I’ve seen hundreds of tokens rise and fall.

Most vanish quietly.

This one? It’s screaming.

It’s screaming because it has nothing to say.

And that’s the most dangerous kind.

Because it’s not trying to build.

It’s trying to trick.

And the people who buy it? They’re not greedy.

They’re just new.

And that’s why we need posts like this.

Not to shame.

But to shield.

Thank you for being the shield.

This is why America needs to ban foreign exchanges.

Why is a token with zero market cap even allowed on a platform that calls itself ‘crypto’?

This is a national security risk.

Our youth are being poisoned by this garbage.

Time to shut it down.

For the good of the country.