Rug Pull Risk Checker

Token Risk Assessment Tool

Check if a cryptocurrency token has rug pull risk indicators based on key red flags from the article.

Risk Assessment Results

A rug pull isn’t just a risky investment-it’s a deliberate theft. In cryptocurrency, it’s when the team behind a token vanishes overnight, taking millions with them, leaving investors holding worthless digital pieces of code. This isn’t science fiction. In 2022 alone, rug pulls stole over $2.8 billion from retail investors, making them the most common form of crypto crime. Unlike hacking or phishing, rug pulls don’t break into wallets. They trick you into putting your money in-and then lock the door behind you.

How a Rug Pull Actually Works

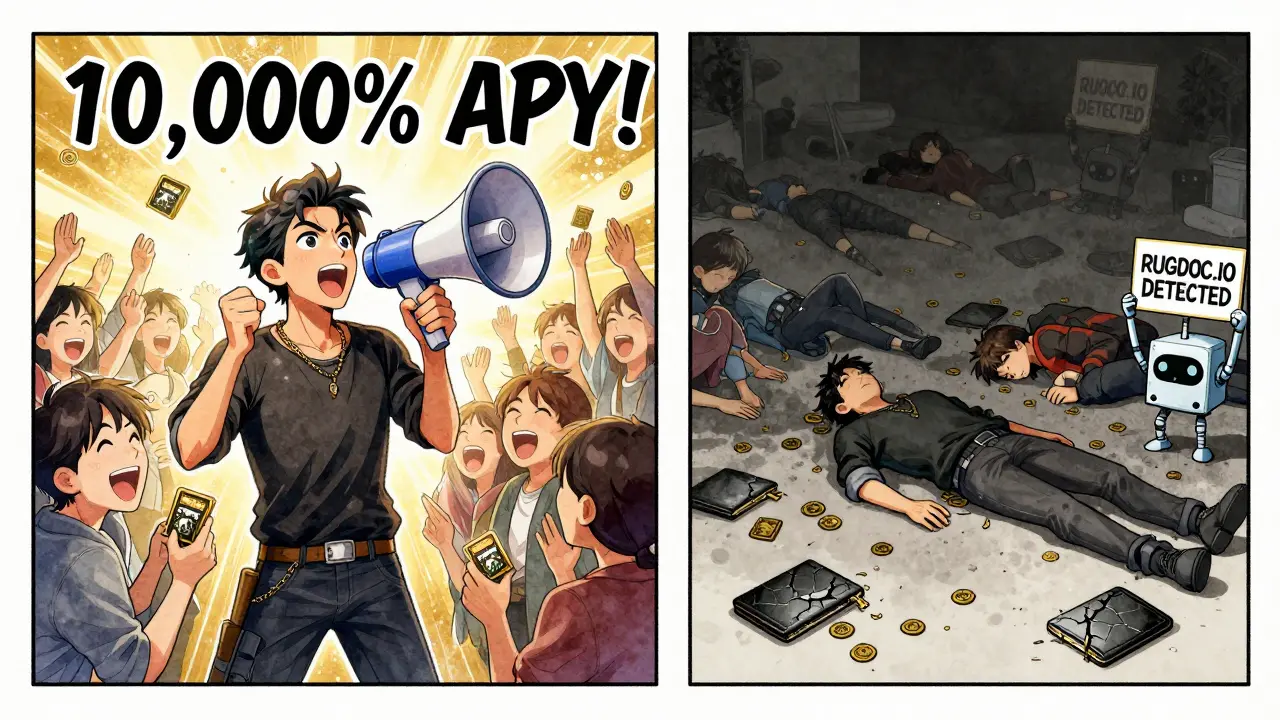

It starts with a shiny new token. Maybe it’s called something catchy like $SQUID or $BANANA. The team claims it’s the next big DeFi project-offering 10,000% APY, a play-to-earn game, or a revolutionary NFT ecosystem. They flood Telegram, Discord, and Twitter with hype. Influencers post about it. You see people making quick profits. You jump in.

Then, within days, something changes. The token price spikes. You’re excited. But you can’t sell. Or worse-you try to sell, and your transaction fails. That’s when you realize: the contract was rigged from day one.

There are two main types of rug pulls: hard and soft.

A hard rug pull uses malicious code. Developers build a smart contract that lets them drain the liquidity pool-where all the money is stored-or prevent anyone else from selling. The $SQUID token in 2021 was a textbook example. The contract had a hidden function that allowed the team to sell all their tokens while locking everyone else out. They walked away with $3 million in under a week.

A soft rug pull doesn’t need code tricks. Instead, the team pumps the token using fake volume, bot accounts, and paid promoters. When the price hits its peak, they sell everything-no code needed. The token crashes. The team disappears. No one can prove they ever intended to build anything real.

Why Rug Pulls Are So Common

The problem isn’t just bad actors. It’s the system.

Decentralized exchanges like Uniswap and PancakeSwap let anyone list a token in minutes. No background checks. No KYC. No oversight. If you can write a basic smart contract and pay a small fee, you can launch a token that looks legitimate.

Most retail investors don’t know how to check the code. They trust influencers. They see rising charts. They assume if it’s on a popular exchange, it’s safe. But the truth? Over 83% of rug pull projects had no third-party audit. Nearly 92% had anonymous teams. And 73% of all rug pulls happened on BNB Chain, where fees are low and scrutiny is minimal.

It’s a perfect storm: low barriers to entry, zero accountability, and a crowd of people chasing fast returns.

Red Flags You Can’t Ignore

You don’t need to be a coder to spot a rug pull. Here are the top five warning signs:

- Anonymous team - No names, no LinkedIn profiles, no real photos. If the team is “a group of passionate developers,” that’s a red flag. Legitimate projects doxx themselves.

- Unlocked liquidity - Liquidity is the money in the pool that lets people buy and sell. If it’s not locked for at least 6 months (preferably longer), the team can pull it out anytime. Check BscScan or Etherscan. If the lock is expired or missing, walk away.

- Unrealistic returns - “Earn 500% weekly” or “10,000% APY” isn’t innovation-it’s a trap. No legitimate project can sustain those numbers. Even Bitcoin doesn’t do that.

- No audit - If the project hasn’t been audited by a reputable firm like CertiK, OpenZeppelin, or PeckShield, treat it like a sketchy website with no SSL certificate.

- Developer wallet has too much - If the team holds more than 15% of the total supply, they have too much power. A healthy project keeps developer holdings under 10% and locks them.

One user on Reddit lost $8,000 on a token that promised “free NFTs.” The team had no website. No whitepaper. The only thing they had was a Discord server with 15,000 bots. He didn’t check the liquidity. He didn’t look at the contract. He just saw the price going up.

How to Protect Yourself

There’s no 100% guarantee-but you can drastically reduce your risk.

Here’s a simple 5-step checklist you can do in under an hour:

- Check the team - Google every name. Look for LinkedIn, Twitter, GitHub. If they’re all new accounts created last week, run.

- Verify liquidity lock - Go to BscScan or Etherscan. Find the liquidity pool. Look for a lock transaction. Is it locked for 12 months? Good. Is it unlocked? Get out.

- Read the audit - Don’t just look for “Audit Completed.” Read the report. Did they find critical vulnerabilities? Was it a full audit or just a quick scan? CertiK’s reports are public. Read them.

- Check token distribution - Use a blockchain explorer to see who holds what. If the top 5 wallets own 60% of the supply, it’s a pump-and-dump waiting to happen.

- Watch the community - Is the Discord full of bots? Are the same 10 people posting “BUY NOW” every 30 seconds? Real communities have questions, debates, and criticism.

Tools like RugDoc.io and TokenSniffer can help. They scan contracts for honeypots, unlimited minting, and hidden admin keys. They’re not perfect-but they catch 7 out of 10 rug pulls before launch.

What Happens After a Rug Pull?

Once the money’s gone, it’s almost impossible to get back. Blockchain transactions are irreversible. There’s no customer support. No chargeback. No bank to call.

Some victims form groups and try to track the scammers. A few have succeeded-like the PancakeSwap community that stopped a $2.1 million rug pull in early 2023 by spotting suspicious liquidity changes. But that’s rare.

The U.S. SEC has brought 17 rug pull cases since 2022. The European Union’s MiCA regulations, which took effect in 2024, require teams to disclose their identities and lock liquidity. That’s a step forward. But until every exchange enforces these rules, the risk stays high.

Institutional investors-hedge funds, venture firms-rarely touch new DeFi tokens. They know the odds. Retail investors? They’re the targets.

Why This Isn’t Going Away

Some say better tools will fix this. And they’re right-sort of. Projects using time-locked liquidity have 11.7 times fewer rug pulls. Doxxed teams reduce risk by 89%. But scammers adapt.

In 2023, soft rug pulls jumped 217%. Why? Because they’re easier. No code to write. No audit to bypass. Just hype, fake volume, and a quick exit. And with AI-generated influencers and bot networks, it’s cheaper than ever.

MIT’s Digital Currency Initiative says it best: “Rug pulls are not a bug in DeFi-they’re a feature.” Permissionless systems allow innovation. But they also allow fraud. The only real defense is awareness.

You can’t outsmart every scam. But you can refuse to be the next victim.

Frequently Asked Questions

Can you get your money back after a rug pull?

Almost never. Blockchain transactions are irreversible. Once the developers drain the liquidity pool, the funds are gone. You can report the scam to authorities or try to track the wallet address, but recovering funds is extremely rare. Your best defense is prevention-never invest in a project you haven’t thoroughly vetted.

Are all new crypto projects rug pulls?

No, but the majority of new tokens on decentralized exchanges are high-risk. Most legitimate projects are built by teams with public identities, audited contracts, and long-term liquidity locks. If a project launches with no team info, no audit, and unlocked liquidity, treat it as a potential rug pull until proven otherwise.

How do I check if a token’s liquidity is locked?

Go to BscScan (for BNB Chain) or Etherscan (for Ethereum). Find the token’s contract address. Look for the liquidity pool pair (usually with BNB or USDT). Check the transaction history for a “Lock Liquidity” event. If it’s locked for 12+ months with a verifiable lock contract (like Unicrypt), it’s safer. If there’s no lock or it expired, avoid it.

Do major exchanges like Binance or Coinbase list rug pull tokens?

No. Major exchanges like Binance and Coinbase have strict listing rules: mandatory audits, verified teams, and long-term liquidity locks. Tokens listed on these platforms are far less likely to be rug pulls. But be careful-some platforms let users trade tokens not officially listed, like through spot markets or third-party integrations. Always check the official listing page.

Is it safe to invest in tokens with high APY?

High APY is one of the biggest red flags. Legitimate DeFi protocols offer 5-20% APY on stablecoins. Anything above 50% is unsustainable. Above 1,000%? That’s a classic rug pull signal. High yields are used to attract victims before the team drains the pool. If it sounds too good to be true, it is.

Can a rug pull happen on Ethereum?

Yes. While Ethereum has stronger security and more audits, rug pulls still happen there. In fact, 22.7% of all rug pulls in 2022 occurred on Ethereum. The difference? Ethereum projects tend to have higher funding and longer lifespans before the scam is exposed. But the mechanics are the same: anonymous teams, unlocked liquidity, and malicious contracts.

17 Responses

Been there, done that. Bought into a token called $BANANA because the Discord was buzzing. Turned out the dev wallet had 40% of supply and liquidity was unlocked. Lost my rent money. Never trust hype again.

Bro, you’re still falling for this? Everyone knows rug pulls are the norm. The real scam is believing crypto is ‘decentralized finance’ when it’s just a casino with smart contracts.

Thank you for this. As someone who mentors new investors, I’ve seen too many people lose life savings chasing 10,000% APY. This checklist is gold. Save it. Print it. Tape it to your monitor.

Let’s be clear: retail investors are the primary vector for systemic collapse in DeFi. Their cognitive biases-FOMO, authority bias, and narrative susceptibility-are exploited with surgical precision by actors who understand behavioral economics better than most MBA grads. The lack of institutional-grade due diligence is not a bug-it’s the architecture.

While your analysis is technically accurate, you’re missing the meta-layer: rug pulls are the inevitable outcome of permissionless innovation without social contract enforcement. The fact that 83% of projects lack audits isn’t negligence-it’s rational cost-benefit calculus by developers who know 97% of participants won’t check. This isn’t fraud; it’s market equilibrium under asymmetric information.

Also, why are you still using BscScan? The entire BNB Chain ecosystem is a honeypot subsidized by tax-funded venture capital from Chinese state-linked entities. You’re not getting rug-pulled-you’re being weaponized.

Same. I lost $12k on $SQUID. I didn’t even know what a liquidity pool was. Now I check every contract on Etherscan. It’s painful, but worth it.

So true 😭 I used to think crypto was the future… now I just see it as a digital Wild West where everyone’s armed and no one’s the sheriff 🤡

Anyone else notice how all the ‘anonymous dev’ teams have the same Discord template? Like literally copy-pasted from the same GitHub repo? And the same 3 emojis in every channel? 🤔

Just wanted to say I’m so glad you shared this. I was about to invest in a new token with a 2000% APY last week. Your post saved me. Thank you for being the voice of reason in this chaos.

Westerners always complain about rug pulls. In India, we just call it ‘jugaad’-smart hustle. If you can’t protect your money, you don’t deserve to have it. Stop whining.

Big respect to the author. I used to be the guy buying tokens because the Twitter thread looked cool. Now I check the lock, the audit, the team. Took me 3 losses to learn. Don’t be like me.

Everyone’s acting like rug pulls are new. Newsflash: this is how every Ponzi scheme starts. Remember BitConnect? Remember OneCoin? This is the same script. The only difference is the blockchain.

And don’t tell me ‘but the tech is decentralized!’-the wallets are still controlled by one person with a private key. You’re not owning crypto. You’re trusting strangers with your life savings.

I get why people do this. I’ve been broke. I’ve seen my friends lose jobs. When you’re desperate, a 10,000% return sounds like salvation. But this post? It’s the kind of thing that could actually save someone. Thank you.

Why are you wasting time on crypto? In Nigeria, we just buy Bitcoin and HODL. No tokens. No hype. Just BTC. Simple.

While I appreciate the practical checklist, I must emphasize that the underlying issue is epistemological: the erosion of epistemic authority in decentralized systems. The absence of gatekeepers doesn’t empower individuals-it fragments collective discernment, rendering consensus impossible. Without institutional validation, trust becomes a statistical artifact, not a social contract. This is why rug pulls flourish: not because of malice, but because the epistemic infrastructure necessary to evaluate risk has been systematically dismantled.

Furthermore, the reliance on third-party auditors like CertiK is a false heuristic. These firms operate under commercial incentives and are often contracted by the very teams they audit. Their reports are marketing documents disguised as technical evaluations. True security requires on-chain verification via formal methods, not human-readable summaries.

Until we institutionalize open-source, verifiable, and formally proven smart contracts-deployed on immutable, permissionless ledgers with transparent governance-we are not building a financial system. We are constructing a theater of trust, with actors who vanish after the final curtain.

Stop acting like this is rocket science. If you don’t know how to check a contract, don’t invest. Simple. The fact that you need a 5-step checklist means you shouldn’t be in crypto at all. This isn’t Wall Street. It’s the wild west. You don’t get a safety net.

Wait… what if the whole ‘rug pull’ narrative is a distraction? What if the real rug pull is the entire crypto industry being used to launder money for private equity firms and hedge funds? The retail investors are just the decoys. The real players are the ones who dumped before the hype even started.

And don’t tell me about ‘audit firms’-they’re all owned by the same VC groups. This isn’t fraud. It’s systemic control.