ETF Fee Impact Calculator

Calculate Your Investment Impact

See how ETF fees impact your long-term returns for Bitcoin and Ethereum investments. Based on historical performance data and industry averages.

Ethereum staking yields approx. 4-5% annually when enabled

Did you know that the first spot Bitcoin ETF launched in the United States just over a year ago? The rollout of both Bitcoin and Ethereum ETFs has turned the crypto world upside‑down, blending Wall Street rigor with the wild frontier of digital assets. If you’ve been wondering how these products got the green light, why investors are buzzing, and what changes lie ahead, you’re in the right place.

Regulatory Milestones: From Rejection to Green Light

For more than a decade the U.S. Securities and Exchange Commission (U.S. Securities and Exchange Commission the federal agency that regulates securities markets in the United States) turned down every spot Bitcoin ETF request. Thirteen applications from 2013 to 2023 were rejected until a court ruling in Grayscale Investments LLC v. SEC (August 2023) forced the commission to admit it had been applying inconsistent standards.

On January 10, 2024 the SEC finally approved the first spot Bitcoin ETF, paving the way for BlackRock’s iShares Bitcoin Trust (IBIT) and a cascade of other products. Less than a year later, on July 23, 2024, the agency gave the nod to the first spot Ethereum ETFs, opening the door for offerings from BlackRock, Fidelity, Grayscale, VanEck, Ark Invest/21Shares, and several others.

These approvals didn’t happen in isolation. In July 2025 the SEC broadened the rules to allow in‑kind creation a mechanism where authorized participants can deliver or receive the actual cryptocurrency when creating or redeeming ETF shares for crypto‑linked exchange‑traded products. The move aligned crypto ETFs with traditional commodity ETPs like gold and reduced tax inefficiencies for large holders.

How Spot Bitcoin and Ethereum ETFs Differ

At a glance, both Bitcoin and Ethereum ETFs look similar: they trade on major exchanges, they’re regulated, and they offer investors exposure without needing a digital wallet. Dig a little deeper and the differences become clear.

| Feature | Spot Bitcoin ETFs | Spot Ethereum ETFs |

|---|---|---|

| Launch date (first approved) | January 10, 2024 | July 23, 2024 |

| Number of products (as of Oct 2025) | 11 | 11 |

| Average management fee | 0.25% (range 0.00%-0.90%) | 0.35% (range 0.15%-1.50%) |

| In‑kind creation | Allowed (cash‑only initially, in‑kind approved July 2025) | Allowed (same timeline) |

| Staking rewards | None (Bitcoin is proof‑of‑work) | Available in 5 of 11 ETFs; e.g., Grayscale’s ETHE stakes 4.2% of holdings |

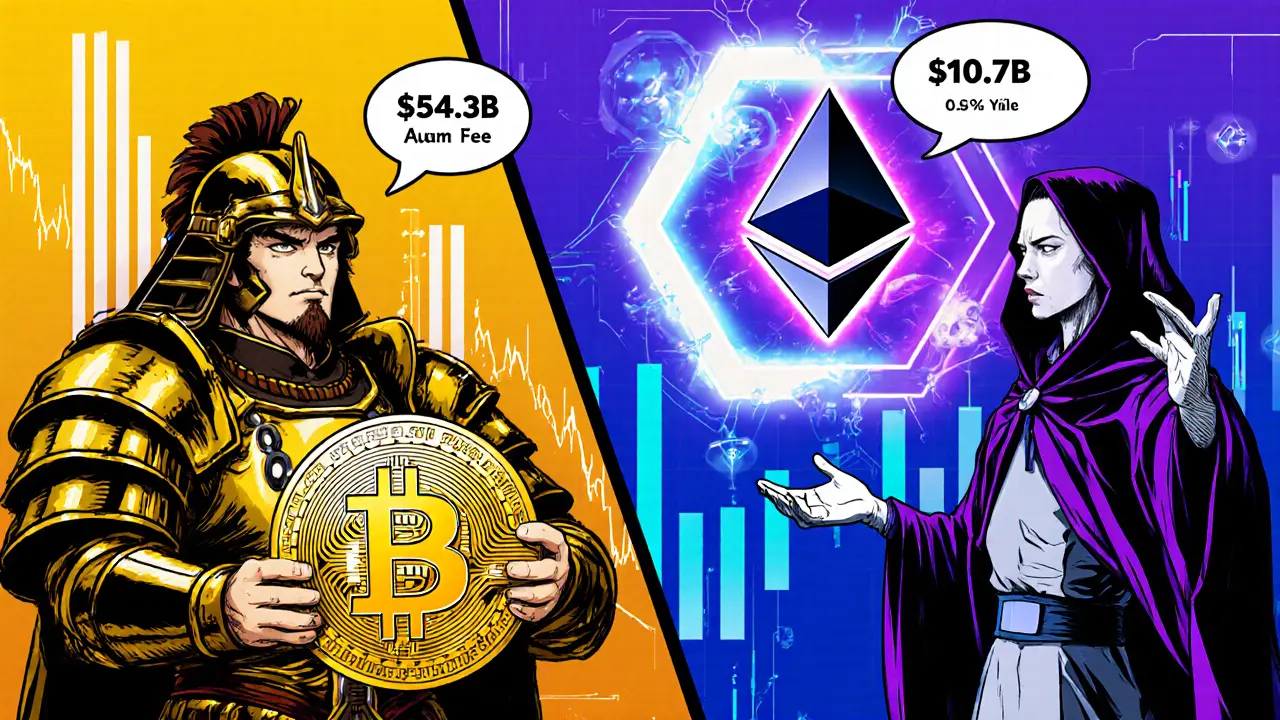

| Average AUM (Sep 2025) | $54.3 B | $18.7 B |

| Premium to NAV | ≈ 0.08% | ≈ 0.23% |

The presence of staking rewards is the biggest technical split. Ethereum’s proof‑of‑stake consensus lets ETF providers allocate a slice of ETH to validators and pass the resulting yield on to shareholders. Bitcoin ETFs, by contrast, simply hold the coin.

Market Impact: AUM, Fees, and Investor Behaviour

Since their debut, spot crypto ETFs have sucked in massive capital. By the end of September 2025, Bitcoin ETFs held $54.3 billion, with BlackRock’s IBIT alone accounting for $16.9 billion (31% of the market). Ethereum ETFs, while smaller, still amassed $18.7 billion, led by Grayscale’s ETHE at $5.1 billion.

Fees matter, especially for institutional investors watching cost curves. Bitcoin ETFs average 0.25% annually, but Fidelity’s FBTC runs at 0.00%-a rare zero‑fee offering. Ethereum ETFs charge a bit more, averaging 0.35%; VanEck’s EETH is the cheap‑shot at 0.15%, while Grayscale’s ETHE tops out at 1.50% because it bundles staking and conversion services.

In‑kind creation, approved in July 2025, has already changed the game. Bloomberg reported that Bitcoin whales moved over $3 billion into ETF shares without selling their underlying BTC, sidestepping a taxable event. Institutional surveys show 78% of large investors now prefer holding Bitcoin via ETFs for easier collateral use.

However, the two asset classes are reacting differently to macro pressures. In Q3 2025 Bitcoin ETFs recorded $1.2 billion in net outflows as rising interest rates dented risk appetite, while Ethereum ETFs attracted $478 million of net inflows, reflecting investors’ belief in DeFi‑linked upside.

Key Players and Their Strategies

Several heavyweight firms dominate the space:

- BlackRock the world’s largest asset manager, launching the iShares Bitcoin Trust (IBIT)

- Grayscale Investments originally a crypto trust, now offering both Bitcoin and Ethereum ETFs with staking capabilities

- Fidelity provides low‑fee Bitcoin and Ethereum ETFs, including the zero‑fee FBTC

- VanEck, Ark Invest/21Shares, and other boutique managers round out the competitive field.

Each firm has a slightly different angle. BlackRock leans on its massive distribution network, Grayscale capitalizes on existing trust relationships, while Fidelity pushes ultra‑low fees to attract cost‑conscious investors.

Regulatory Outlook: What’s Next for Crypto ETFs?

The SEC’s recent statements suggest more crypto products are on the horizon. Chairman Paul S. Atkins has signaled a “fit‑for‑purpose” framework, and the October 2025 orders explicitly allow in‑kind creation for a broad set of crypto‑linked ETPs. That opens the door for spot ETFs tied to other leading tokens-think Solana, XRP, or even Layer‑2 solutions.

Still, uncertainty remains. Harvard Law’s John Coates warned that Ethereum’s staking exposure could introduce systemic risk if regulators don’t clarify how validator incentives are treated. Until the SEC issues clear guidance on staking‑related disclosures, providers may limit staking or adopt hybrid structures.

Globally, the Hong Kong Stock Exchange launched a spot Solana ETF in October 2025, and the EU is expected to roll out similar products by mid‑2026. These parallel moves could pressure the SEC to keep US offerings competitive.

Practical Takeaways for Investors

- Know the fee landscape. Even a 0.10% difference compounds over years.

- Consider in‑kind creation. If you already own BTC or ETH, converting in‑kind can avoid a taxable sale.

- Watch staking exposure. Ethereum ETFs that stake offer extra yield but may carry regulatory risk.

- Balance diversification. Bitcoin and Ethereum ETFs together give exposure to both store‑of‑value and smart‑contract markets.

- Stay tuned to SEC updates. New rulings on other tokens could affect liquidity and premiums.

Following these steps can help you navigate the evolving crypto‑ETF landscape without getting lost in the jargon.

Frequently Asked Questions

What is a spot Bitcoin ETF?

A spot Bitcoin ETF holds actual Bitcoin (or an equivalent amount) and issues shares that trade on traditional stock exchanges, giving investors direct price exposure without needing a crypto wallet.

How does in‑kind creation work for crypto ETFs?

Authorized participants can deliver the underlying cryptocurrency (BTC or ETH) to the ETF sponsor in exchange for new shares, or receive the crypto when redeeming shares, bypassing a cash conversion and reducing tax events.

Do Ethereum ETFs earn staking rewards?

Only a subset do. About 45% of the approved Ethereum ETFs allocate a portion of their holdings to staking validators and pass the earnings to shareholders, while the rest hold ETH without staking.

Are crypto ETFs taxable?

Yes. Shares are treated like any other security for capital gains purposes. In‑kind conversions can defer taxable events, but selling ETF shares triggers capital gains or losses.

What’s the outlook for new crypto ETFs?

The SEC’s recent approvals suggest more tokens could get ETF status, especially those with strong market cap and clear custody solutions. Watch for announcements on Solana, XRP, and possibly Layer‑2 assets by 2026.

11 Responses

Oh great, now we can invest in crypto without actually learning how to use a wallet 😂

In‑kind creation is a game‑changer – it lets whales move BTC straight into fund shares without a taxable event. That’s why we’re seeing billions shift into ETFs instead of holding the raw coins. The SEC’s July 2025 rule really opened the floodgates. :)

For newcomers, it is essential to differentiate between spot and futures‑based products. Spot ETFs hold the underlying asset, offering pure price exposure, whereas futures ETFs rely on derivative contracts that may deviate from spot performance. Understanding fee structures and the impact of in‑kind creation will help investors make informed decisions. Additionally, investors should be aware of the tax implications associated with both types of holdings.

Did you guys notice how the fee war is heating up? BlackRock’s zero‑fee offering is a lightning‑fast attractor for cost‑sensitive traders, while the higher‑priced Ethereum funds compensate with staking yields. If you’re balancing a portfolio, mix a low‑fee Bitcoin ETF with a staking‑enabled Ethereum ETF to capture both upside and yield. Keep an eye on AUM trends – they’re a solid proxy for market confidence.

The recent SEC greenlights have not only legitimized crypto exposure but have also sparked a cascade of strategic innovations across the asset management industry; Institutions that once feared custody risks are now embracing spot ETFs as a compliant bridge to the digital economy; In‑kind creation, formally recognized in July 2025, eliminates the need to liquidate underlying assets, thereby preserving tax efficiency for large holders; This mechanism mirrors the gold‑linked ETP model and signals a convergence of traditional and decentralized finance infrastructures; Moreover, the staggered fee schedules – ranging from a groundbreaking 0.00% for Bitcoin to a modest 0.35% for Ethereum – reflect competitive pressure to attract capital without eroding returns; Staking rewards embedded in select Ethereum ETFs introduce an additional yield layer, yet they also raise regulatory questions about validator incentivization; Investors should scrutinize the proportion of staked versus non‑staked holdings, as this can affect both performance and risk profile; The AUM figures, now exceeding $70 billion across both asset classes, demonstrate robust investor appetite and provide economies of scale for providers; BlackRock’s distribution network continues to dominate, but boutique firms like VanEck and Ark are carving niches through specialized offerings; The global race is on, with Hong Kong launching a Solana ETF and the EU preparing its own crypto‑linked products, which could pressure the SEC to broaden its approval horizon; Regulators remain cautious, especially concerning the systemic implications of large‑scale staking, as highlighted by academic critiques from Harvard Law; Until clear guidance emerges, providers may adopt hybrid structures that blend staking yields with conservative custody solutions; From a tax perspective, in‑kind conversions remain a powerful tool, allowing investors to defer capital gains while rebalancing portfolios; However, the liquidity premium on Ethereum ETFs remains slightly higher than Bitcoin, reflecting market expectations of smart‑contract growth; Overall, the evolving regulatory landscape suggests that future spot ETFs could encompass a broader set of tokens, provided they meet custody and surveillance standards; Staying informed about fee adjustments, staking policy shifts, and cross‑border ETF launches will be key for savvy participants in this dynamic market.

It’s encouraging to see the market adapt, and the in‑kind creation feature can really help investors protect their tax positions while staying fully exposed to price movements. Keep focusing on the fundamentals, like fee differentials and staking exposure, and you’ll navigate the terrain with confidence.

Diversify wisely and the market will reward you! 🚀

While the fee compression is notable, investors must also weigh the impact of net asset value tracking errors, especially in high‑volatility periods where premium‑to‑NAV fluctuations can erode returns. A balanced approach that monitors both expense ratios and tracking accuracy will mitigate unintended drag.

Honestly, the hype around these ETFs feels overblown; most people just want a shortcut without learning the basics.

One must question whether the SEC’s sudden openness is genuinely market‑driven or the result of covert lobbying by the megafund conglomerates seeking to entrench their dominance over the nascent crypto ecosystem.

Even with the SEC’s friendly stance, the true test will be whether retail demand sustains beyond the novelty phase, because without broad participation the ETFs could become another liquidity mirage.