THENA Leverage Calculator

Trade Risk Calculator

Calculate position size, margin requirements, and potential profit/loss at up to 60x leverage on THENA

Trading with leverage carries high risk. THENA's dual AMM system reduces slippage by up to 37% compared to Uniswap v2, but your position could be liquidated if the price moves against you.

Looking for a reliable THENA crypto exchange review? You're in the right place. THENA is a decentralized exchange built on BNB Chain and opBNB that combines spot trading, perpetual futures, and social elements in one unified interface. Launched in 2023, it's grown rapidly, managing over $1.24 billion in total value locked (TVL) as of April 2024. That's a 320% increase from the previous quarter. But is it the right choice for you? Let's break it down.

What Makes THENA Different?

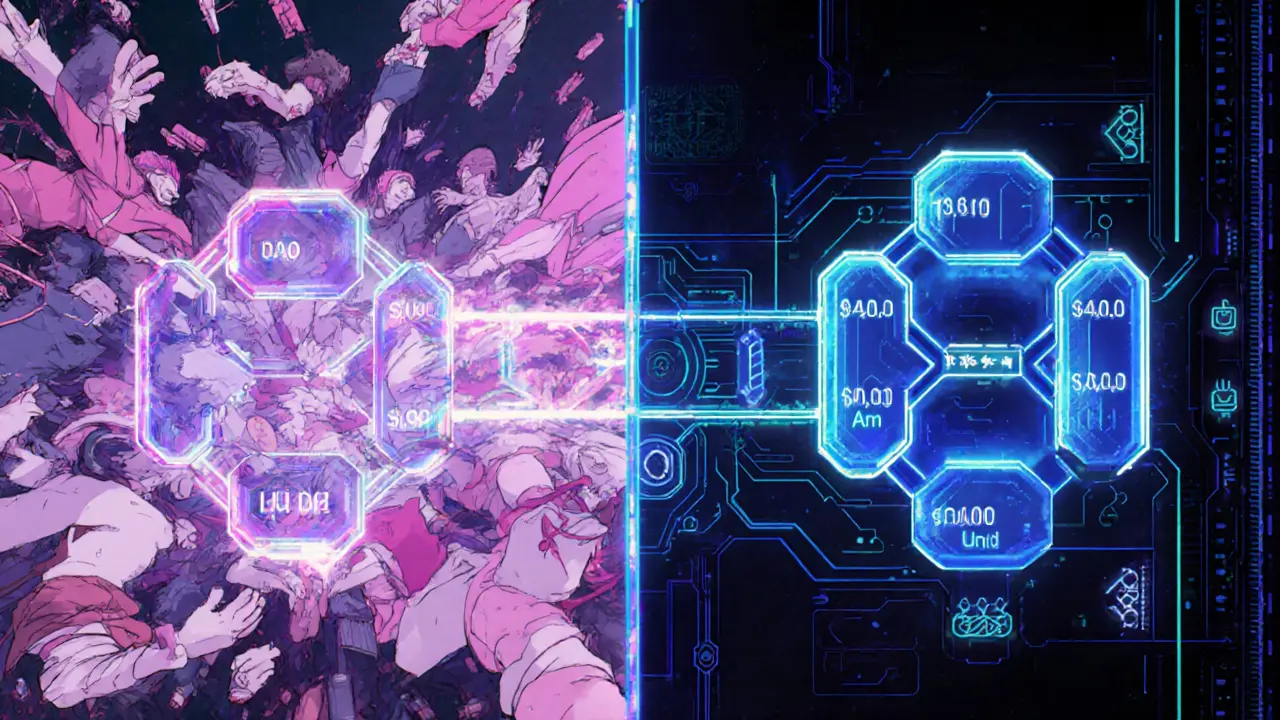

Most decentralized exchanges (DEXs) focus on one thing: spot trading. THENA goes further. It's a "SuperApp" that handles spot trading, perpetual futures with up to 60x leverage, and social trading competitions all in one place. Built on BNB Chain and opBNB, it uses a unique ve(3,3) mechanism and dual AMM model (vAMM and sAMM). This hybrid approach blends decentralized security with centralized exchange efficiency. For example, when trading large orders ($50,000+), THENA reduces slippage by 18-24% compared to standard DEXs like Uniswap v2.

THENA vs PancakeSwap, GMX, and Uniswap

| Feature | THENA | PancakeSwap | GMX | Uniswap |

|---|---|---|---|---|

| Assets | 150+ | ~100 | 27 | 1000+ |

| Max Leverage | 60x | 20x | 50x | N/A |

| Avg Spot Fee | 0.01% | 0.04% | 0.05% | 0.17% |

| TVL (April 2024) | $1.24B | $2.81B | $1.1B | $4.5B |

| Cross-chain Support | 7 blockchains | BNB Chain only | Arbitrum, Avalanche | Ethereum only |

THENA beats PancakeSwap in fee efficiency (22% lower) and handles more assets than GMX (150+ vs. 27). But Uniswap still leads in asset variety. The big win for THENA is its dual AMM system. Unlike standard DEXs that rely solely on automated market makers, THENA uses external liquidity pools when better rates are available. This cuts slippage by up to 37% for spot trades compared to Uniswap v2.

Pros of THENA

- Low slippage for large orders: Users report 12-15% better execution for trades over $50,000, according to MEXC's testing.

- Social trading features: ARENA lets you create custom trading competitions with precision down to 0.01% parameters. CoinDesk noted this could accelerate DeFi onboarding by 2-3x.

- High capital efficiency: THENA's TVL-to-volume ratio is 3.2x better than PancakeSwap, meaning less idle liquidity.

- Robust security: Audited by PeckShield and CertiK in late 2023, with no major exploits reported.

Cons and Challenges

- Steep learning curve: CryptoUserMetrics.com rates THENA 37% harder to learn than Uniswap. New users often need 3-4 hours of tutorials before trading.

- Gas issues on opBNB: 8.3% of transactions face gas estimation errors during high volatility, per THENA's internal analytics.

- ve(3,3) complexity: 41% of new users struggle with veTHE locking mechanics, often choosing suboptimal lock durations.

- Limited Ethereum support: While cross-chain swaps now include Ethereum, direct Ethereum-based trading isn't available yet.

Who Should Use THENA?

THENA shines for specific traders:

- High-frequency traders: If you're executing large orders or using leverage, THENA's dual AMM model saves money on slippage.

- BNB Chain users: With 18.3% of BNB Chain DEX volume (as of Q1 2024), it's the third-largest DEX on the chain after PancakeSwap and Rubic.

- Experienced DeFi users: Those comfortable with ve(3,3) mechanics and gauge voting can earn up to 15% monthly returns through strategic locking, as Reddit user "CryptoTrader87" reported in March 2024.

It's less ideal for beginners or Ethereum-focused traders. If you're new to DeFi, PancakeSwap's simpler interface might be better. If you need Ethereum-native trading, Uniswap or GMX on Arbitrum might suit you better.

What's Next for THENA?

THENA's roadmap is aggressive. In April 2024, they launched cross-chain swaps supporting 7 blockchains (Ethereum, Polygon, Arbitrum, Optimism, Avalanche, Fantom, Base). They also integrated Chainlink's AI analytics for trading signals. Upcoming features include:

- AI-powered liquidity provisioning (Q3 2024)

- Expansion to 15+ additional networks (Q4 2024)

- Fiat on-ramps for easy USD purchases (Q1 2025)

Binance Research predicts THENA could capture 25-30% of BNB Chain DEX volume by end-2024. But Reflexivity Research warns about "liquidity fragmentation risks" if gauge voting becomes too complex for average users.

FAQ

Is THENA safe to use?

Yes, but with caveats. THENA has been audited by PeckShield and CertiK, with no major security breaches reported. However, Reflexivity Research scored its security maturity at 6.9/10 due to rapid feature rollouts. Always use trusted wallets like MetaMask and avoid sharing private keys. The platform also implements Binance's travel rule compliance for transfers over $10,000.

How do I start trading on THENA?

First, connect a BNB Chain-compatible wallet (MetaMask or Trust Wallet). Fund it with BNB for gas fees. Visit the THENA website and select "Trade". For spot trading, choose a pair like BNB/USDT. For perpetuals, switch to the ALPHA tab and select your leverage (up to 60x). Start with small trades to get comfortable-THENA's interface has a 37% higher learning curve than Uniswap.

Does THENA support Ethereum?

Yes, but indirectly. As of April 3, 2024, THENA supports cross-chain swaps to Ethereum and six other blockchains. However, you can't trade directly on Ethereum Mainnet yet. You'll need to bridge assets from Ethereum to BNB Chain or opBNB first. For native Ethereum trading, Uniswap or GMX (on Arbitrum) might be better options.

What's ve(3,3) and why does it matter?

ve(3,3) is THENA's governance and incentives system. By locking THE tokens (the platform's native token), you earn voting power to influence fee distributions and liquidity rewards. Messari's DeFi research director called it "the most sophisticated evolution of vote-escrow governance since Curve's veCRV model." Optimal lock durations are 16-26 weeks-most new users pick 4-week locks by mistake, missing out on higher rewards.

How does THENA compare to PancakeSwap?

THENA has lower fees (22% cheaper than PancakeSwap), more advanced features like 60x leverage and social trading, and better capital efficiency. But PancakeSwap is simpler for beginners and has higher TVL ($2.81B vs. $1.24B). If you're new to DeFi or only trade spot pairs on BNB Chain, PancakeSwap might be easier. For advanced trading like leveraged perpetuals or social competitions, THENA is stronger.

19 Responses

I sometimes wonder if the people behind THENA are just another layer of control in the crypto world. The veil of decentralization feels thin when you dig deeper. They tout low slippage, but who decides the optimal routes? Maybe the same group that built the ve(3,3) system benefits most. In the end, freedom is an illusion if the code is written by secret hands.

It's curious how every new DEX claims to be the answer to all problems, yet they all share similar architectures. The dual AMM sounds impressive, but could it be a smokescreen for hidden fees? Perhaps the real profit lies in the governance tokens that most users never understand. One must stay vigilant and question every shiny feature.

Thank you for the comprehensive overview. The detailed comparison provides valuable insight for both newcomers and seasoned traders. I appreciate the inclusion of specific fee percentages and TVL figures, which aid in objective assessment. It is also noteworthy that the platform has undergone multiple audits, bolstering confidence in its security posture. However, the steep learning curve you mentioned may deter less experienced participants, and supplemental educational resources could mitigate this barrier. Overall, this review helps clarify the nuanced trade‑offs inherent in selecting a decentralized exchange.

The social trading arena on THENA is intriguing yet complex

It offers a fresh way to engage but demands a solid grasp of the mechanics

Without proper guidance users might slip into suboptimal strategies

Looks like another overhyped platform.

Oh, how original-yet another “super‑app” promising the moon while hiding a labyrinth of fees. One can almost admire the sheer audacity behind marketing such a convoluted product as user‑friendly. The ve(3,3) mechanism, for instance, is a masterclass in obscurity, ensuring only the initiated reap rewards. In short, it’s a brilliant showcase of how complexity can masquerade as innovation.

🧐 The architecture of THENA is certainly ambitious. By integrating spot, perpetuals, and social trading into a single interface, it attempts to reduce friction for power users. The dual AMM model, combining vAMM and sAMM, theoretically offers better price execution, which is a commendable technical feat. Nonetheless, every added layer introduces potential vectors for failure, especially under volatile market conditions. 📈 Consider the operational risks alongside the touted benefits before allocating significant capital.

Great points, Johnny! It’s exciting to see such innovation, and for those willing to put in the effort, the rewards can be substantial. Keep pushing forward and don’t let the complexity scare you away.

🚀 Another “game‑changing” platform? Please! Every time they hype up a new DEX, the market ends up the same-just a few whales profiting while the rest get left behind. The cross‑chain support sounds nice, but who cares if the underlying governance is a mess? Next thing you know, regulators will crack down and everyone will lose.

One must marvel at the sheer audacity of proclaiming a platform as “super‑app” when, in reality, it is a tangled web of mechanisms that only the initiated can navigate. The ve(3,3) model, while lauded by some, remains an enigma to the majority of traders who are forced to lock tokens without fully grasping the long‑term implications. Moreover, the promise of social trading competitions masks an underlying incentive structure that primarily benefits early adopters and token holders with deep pockets. It is not merely a matter of user interface; it is a sophisticated attempt to reshape the dynamics of liquidity provision and reward distribution, effectively concentrating power in the hands of a few.

From an ethical standpoint, platforms that prioritize high leverage and complex governance risk fostering reckless behavior. Users should be reminded that the pursuit of 60x leverage can lead to rapid loss, and the moral responsibility lies with both the platform and its participants. 😊

Sure, high leverage sounds exciting until you get liquidated on a Friday afternoon. The platform’s security audits are a nice touch, but they don’t guarantee safety against user error or market crashes. Good luck navigating that ve(3,3) maze.

I appreciate the thoroughness of the previous comment, and I’d like to expand on some of the points raised. Firstly, the dual‑AMM approach, while technically innovative, introduces an additional layer of decision‑making for traders who must assess which liquidity source to engage with at any given moment. This can be particularly challenging during periods of heightened volatility when slippage becomes a critical factor. Secondly, the ve(3,3) mechanism, though praised for aligning incentives, demands a nuanced understanding of lock durations and reward curves; missteps here can erode the very benefits users seek.

Furthermore, the social trading arena, while fostering community engagement, may inadvertently encourage herd behavior, which historically has amplified price swings in less liquid markets.

On the topic of leverage, a 60x multiplier is undeniably attractive for seasoned traders but poses a substantial risk of rapid account depletion for those who lack proper risk management tools. It is essential for platforms like THENY to provide robust education and automated safeguards to mitigate such exposure.

Lastly, while the platform’s audits by PeckShield and CertiK are commendable, continuous monitoring and transparent reporting are necessary to maintain user confidence, especially as new features roll out at a rapid pace. In summary, while THENA presents a compelling suite of functionalities, prospective users must weigh the technical sophistication against the operational complexities and potential pitfalls inherent in such an ambitious ecosystem.

Dear community, as we contemplate the evolution of decentralized finance, let us consider both the promise and the perils that accompany rapid innovation. THENA’s integrated framework exemplifies the drive toward greater efficiency, yet it also underscores the importance of responsible participation. May your trades be judicious, and your governance choices informed.

Thanks for the motivation bruh the ideas r cool but thnx for the heads up

The learning curve you mentioned is no joke; it feels like you need a PhD just to place a trade. Newcomers often get lost in the ve(3,3) lock options and end up with subpar yields. A better onboarding experience could significantly broaden the user base.

Everyone praises the low fees, yet ignores the hidden cost of complexity.

When evaluating a platform like THENA, it is essential to adopt a holistic perspective that balances technical innovation against user accessibility. The integration of spot, perpetual futures, and social trading within a single interface certainly represents a bold ambition, yet it simultaneously raises concerns about the cognitive load placed upon participants. For instance, the dual AMM architecture promises reduced slippage, but the decision matrix required to select the optimal liquidity source can be opaque, especially during periods of market stress.

Moreover, the ve(3,3) governance model, while theoretically aligning incentives, necessitates a sophisticated understanding of lock durations, voting power, and reward distribution. Users who misinterpret these parameters may inadvertently lock their assets for suboptimal periods, thereby diminishing potential returns.

Another dimension worth considering is the platform’s cross‑chain functionality. While supporting seven blockchains expands market reach, it also introduces additional layers of bridge risk, which have historically been exploited in various instances across the DeFi ecosystem.

Security audits by reputable firms such as PeckShield and CertiK are reassuring, yet the rapid rollout of new features-like AI‑driven liquidity provisioning-demands continuous vigilance and transparent post‑audit reporting.

From a user experience standpoint, the steep learning curve highlighted in the review could deter a sizable segment of retail traders. Simplified tutorials, guided walkthroughs, and community‑driven educational content could ameliorate this barrier.

In conclusion, THENA offers a compelling suite of tools for experienced traders seeking efficiency and advanced functionalities. However, prospective participants should weigh these advantages against the inherent complexities and potential risks, ensuring that their engagement aligns with both their skill set and risk tolerance.

Interesting recap-though I suspect the hype may outpace the substance. Let’s see if the promised AI features actually deliver, or if they’re just another buzzword.