When you trade crypto on a decentralized exchange, you don’t want to pay high fees, wait hours for trades, or lose money because your liquidity is spread too thin. PancakeSwap V3 (Base) was built to fix exactly those problems - and it mostly delivers. Launched in 2023 on Coinbase’s Base blockchain, this version isn’t just an update. It’s a complete rethinking of how decentralized trading works.

How PancakeSwap V3 (Base) Works Differently

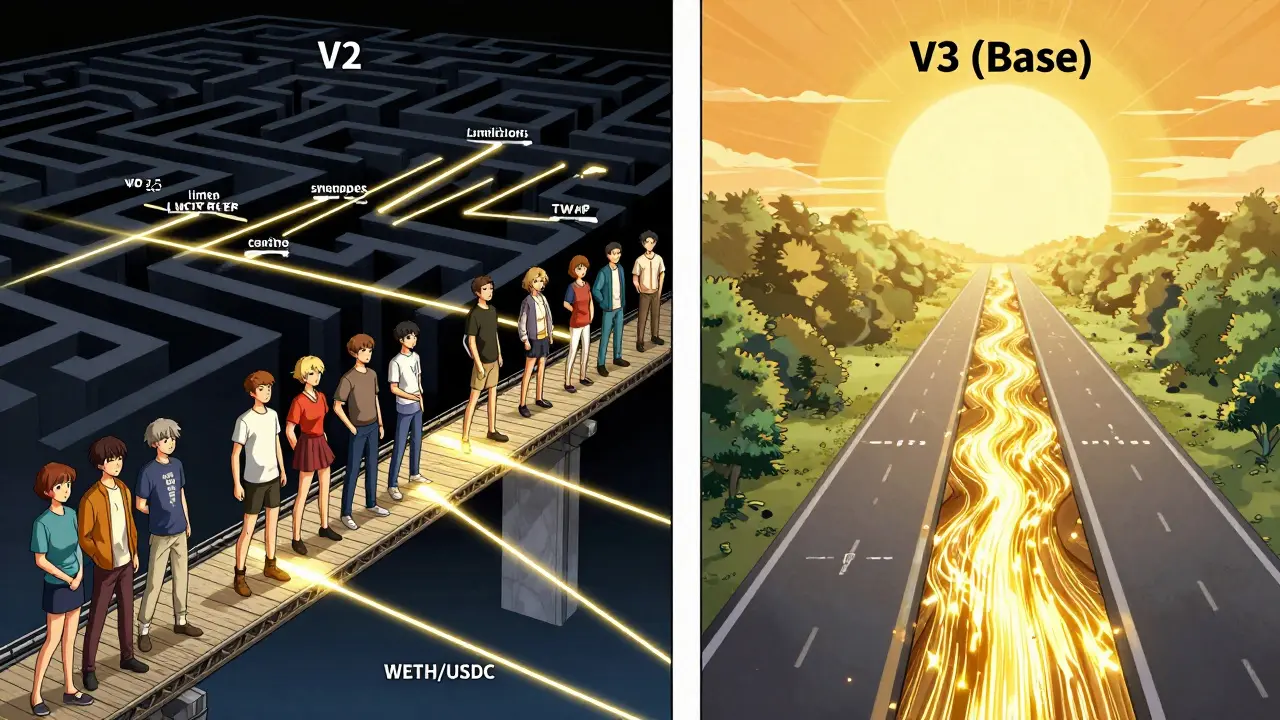

Most decentralized exchanges, like the original PancakeSwap V2, use what’s called a constant product market maker. That means your money is spread evenly across every possible price. If you’re providing liquidity for ETH/USDC, your funds are used whether ETH is at $1,800 or $3,500. The problem? Most of your capital sits idle most of the time. PancakeSwap V3 changes that with concentrated liquidity. Instead of spreading your funds across a wide range, you pick a specific price zone - say, $1,900 to $2,100 for ETH. All your capital works only in that range. If the price stays there, you earn way more fees than on V2. If it moves outside, your position becomes inactive until it returns. It’s like renting out a house only when the renter’s in town, not keeping it empty all year. This isn’t just a tweak. It cuts the capital needed to earn the same yield by up to 40x. Liquidity providers on V3 are making more with less. According to data from FxVerify, the platform’s 24-hour trading volume hits $235 million, with WETH/USDC alone accounting for over $112 million. That’s more than most centralized exchanges handle on smaller chains.Trading Fees and Cost Advantages

Here’s the kicker: PancakeSwap V3 (Base) charges 0.00% for both maker and taker fees. That’s not a typo. Unlike centralized exchanges like Binance or Coinbase, which charge 0.1% to 0.5% per trade, you pay nothing in platform fees. You still pay gas - but on Base, that’s under $0.01 per trade, even during spikes. The platform also uses smart order routing. When you swap tokens, it doesn’t just check one pool. It scans dozens of liquidity sources across multiple pairs to find the best price. That means less slippage and better fills, especially on large orders. For traders moving $10,000 or more, this isn’t a luxury - it’s essential. You can even set limit orders and TWAP orders. Limit orders let you buy or sell at a set price - no need to stare at your screen. TWAP (Time-Weighted Average Price) breaks a big trade into smaller ones over minutes or hours, so you don’t move the market. Both features are rare in DeFi. Uniswap V3 offers them too, but on Ethereum, gas fees make them impractical for most users. On Base, they’re usable.What You Can Trade

PancakeSwap V3 (Base) supports 59 tokens and 113 trading pairs. That’s not as many as Uniswap on Ethereum, but it’s more than enough for daily trading. The most popular pair is WETH/USDC, followed by WBTC/USDC and SOL/USDC. New tokens show up fast - especially those launched on Base through IFOs (Initial Farm Offerings). The platform also connects to other chains. You can trade tokens from BNB Chain, Ethereum, Solana, and more using built-in bridges. That’s a big deal. You don’t need to jump between five different apps to trade across networks. PancakeSwap handles it in one place.

Who It’s Best For (and Who Should Stay Away)

If you’re a casual trader who just swaps $50 of BNB for CAKE once a month, V3 might feel overkill. The interface is clean, but the advanced features - concentrated liquidity, range setting, fee tiers - can be confusing. You’re better off using V2 or a simple aggregator like 1inch. But if you’re active - trading daily, providing liquidity, or managing positions - V3 is a game-changer. Liquidity providers report 3x to 5x higher returns compared to V2, even after accounting for the extra work. One user on Reddit managed $8,000 in liquidity and earned $1,200 in fees over three months, mostly from a single ETH/USDC range. Advanced traders love the precision. You can set multiple positions at different price levels, hedge against volatility, and automate trades. It’s like having a professional trading desk - but without the middlemen. The downside? No regulation. PancakeSwap V3 (Base) isn’t licensed by any government. That means no investor protection, no chargebacks, no recourse if something goes wrong. If you lose funds due to a smart contract bug or a rug pull, you’re out of luck. Institutional investors won’t touch it. But for retail users who understand DeFi risks, that’s just part of the game.Usability and Learning Curve

Connecting your wallet - MetaMask, Trust Wallet, or Coinbase Wallet - takes 30 seconds. Swapping tokens is as easy as on any app. Click, select, confirm. Done. But concentrated liquidity? That’s a different story. Setting a price range requires understanding volatility, support/resistance levels, and how long you plan to hold. You can’t just throw money in and forget it. A beginner might set a range too narrow, get “out of range” after a small price move, and earn zero fees for days. The platform has guides, but most users rely on YouTube tutorials and Discord communities. One popular guide walks you through setting up a 5% range around the current price of ETH, then adjusting it every 48 hours. That’s the sweet spot for most active LPs. The interface has improved since launch. The dashboard now shows your active positions, estimated fees, and impermanent loss projections in real time. Still, it’s not beginner-friendly. If you’re new to DeFi, start with a small amount - $100 or $200 - and learn before going all in.Performance and User Engagement

PancakeSwap’s main site gets over 1.2 million visits a month - almost all organic. That’s rare. Most crypto sites rely on ads or airdrops to drive traffic. People come back because it works. Users spend over five minutes per session and view eight pages on average. That’s not just trading. They’re checking positions, adjusting ranges, farming yields, and exploring the NFT marketplace. The bounce rate is just 36%, meaning most visitors find what they need on the first try. Transaction speeds are fast. On Base, confirmations take under 3 seconds. Gas fees rarely exceed $0.02. That’s why traders from high-fee chains like Ethereum are moving over.

How It Compares to the Competition

| Feature | PancakeSwap V3 (Base) | Uniswap V3 (Ethereum) | SushiSwap (Polygon) | |--------|------------------------|------------------------|---------------------| | Trading Fees | 0.00% | 0.05%-0.30% | 0.00%-0.20% | | Avg. Gas Cost | $0.005-$0.02 | $5-$20 | $0.01-$0.05 | | Concentrated Liquidity | Yes | Yes | No | | Limit Orders | Yes | Yes | No | | TWAP Orders | Yes | Yes | No | | Supported Chains | 9+ | 1 | 3 | | 24h Volume | $235M | $1.2B | $45M | Uniswap V3 has higher volume, but it’s stuck on Ethereum. High fees and slow speeds make it impractical for small traders. SushiSwap offers lower fees but lacks advanced tools. PancakeSwap V3 (Base) hits the sweet spot: powerful features, near-zero fees, and blazing speed.What’s Next for PancakeSwap V3 (Base)

The team is working on more advanced analytics for liquidity providers - think real-time volatility alerts and automated range rebalancing. They’re also expanding cross-chain bridges to support more tokens from Solana and Avalanche. Expect more integration with the PancakeSwap ecosystem: prediction markets, perpetual futures, and the NFT marketplace will get deeper links. The goal? Become the one-stop shop for DeFi trading - not just swaps, but everything.Final Verdict

PancakeSwap V3 (Base) isn’t perfect. It’s complex. It’s unregulated. It won’t protect you from your own mistakes. But if you’re serious about trading or providing liquidity in DeFi, it’s the best tool available on a low-cost chain. The combination of concentrated liquidity, zero trading fees, and Base’s speed makes it uniquely powerful. You’re not just saving money - you’re making more from the same capital. For active users, that’s not an upgrade. It’s a necessity. Start small. Learn the ranges. Watch your positions. And if you’re still unsure - stick with V2 until you’re ready. But if you want to trade like a pro without paying a pro’s fees, V3 (Base) is where you need to be.Is PancakeSwap V3 (Base) safe to use?

PancakeSwap V3 (Base) is a decentralized platform with no central authority. That means no one can freeze your funds or reverse trades - for better or worse. The smart contracts have been audited by reputable firms like CertiK and PeckShield, but audits don’t guarantee safety. Always use a trusted wallet like MetaMask, never give away your private key, and only interact with official links (pancakeswap.finance). Never trust third-party sites claiming to offer “enhanced” versions.

Do I need to pay gas fees on PancakeSwap V3 (Base)?

Yes, but they’re extremely low - usually under $0.02 per transaction. That’s because Base uses a Layer 2 scaling solution built on Ethereum, which reduces congestion and cost. Gas fees are paid in ETH, but since Base has a native ETH-pegged token (Base ETH), you don’t need to hold Ethereum from the main chain. Just connect your wallet and you’re good to go.

Can I use PancakeSwap V3 (Base) on mobile?

Yes. You can access it through any mobile browser, but it works best with wallets like Trust Wallet or MetaMask that have built-in DEX browsers. Simply open the app, tap “Browser,” go to pancakeswap.finance, and connect your wallet. The interface is fully responsive and optimized for touch. No download needed.

What’s the difference between PancakeSwap V2 and V3?

V2 uses “unconcentrated” liquidity - your funds are spread across the entire price range, which is simple but inefficient. V3 lets you choose where your liquidity works, concentrating it in a narrow price band. This means higher returns, less capital needed, and more control. V3 also adds limit orders, TWAP, and multi-chain support - features V2 doesn’t have. V2 is easier for beginners; V3 is better for active traders and LPs.

Why is the trading volume down 39% from yesterday?

Crypto markets are volatile. A 39% drop in 24 hours is normal during market corrections or low-activity periods. Volume spikes during major news, token launches, or bull runs. The platform’s long-term volume trend is stable, and the 93rd percentile ranking shows it’s still among the top 7% of DEXs globally. Short-term dips don’t reflect platform health - they reflect market sentiment.

Can I earn passive income on PancakeSwap V3 (Base)?

Yes, but not the way you might think. You can’t just stake CAKE and earn 20% like in 2021. Today, the main way to earn is by providing liquidity to trading pairs and collecting trading fees. With concentrated liquidity, you can earn 3-5x more than on V2. There are also syrup pools for staking CAKE, and yield farming opportunities through IFOs. But returns vary daily based on volume and token volatility. Always check current APYs before committing funds.

Is PancakeSwap V3 (Base) better than Uniswap?

It depends on your needs. Uniswap V3 has higher overall volume and more token options, but it runs on Ethereum, where gas fees can hit $20+ per trade. PancakeSwap V3 (Base) has lower volume but near-zero fees and faster speeds. If you’re a small to medium trader, PancakeSwap is better. If you’re moving millions daily or need access to niche tokens, Uniswap still leads. Many users use both - trade on Base for speed, use Uniswap for rare assets.