OKX Swap Crypto Exchange Review: Deep Liquidity, Low Fees, and Regulatory Risks

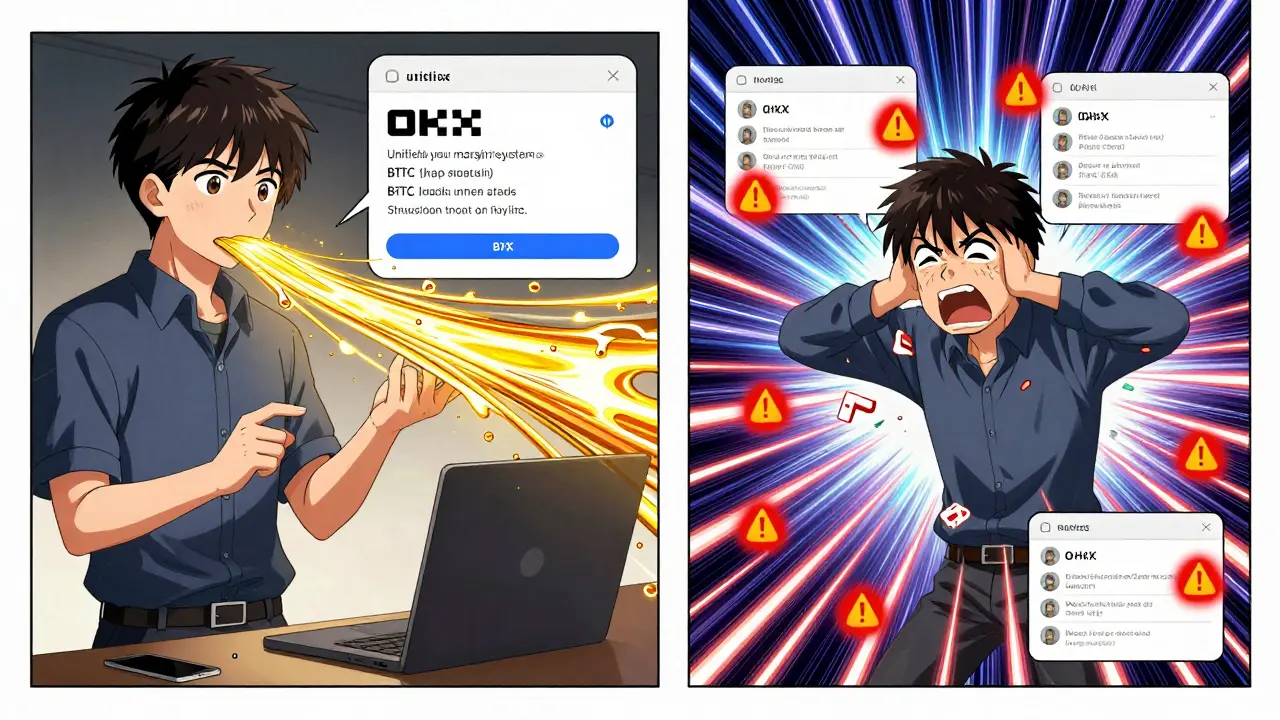

If you're trading perpetual swaps in crypto, you need a platform that doesn’t blink when the market swings 10% in five minutes. That’s where OKX comes in. It’s not just another exchange-it’s built for traders who move fast, use leverage, and demand deep order books. But is it right for you? Let’s cut through the noise.

OKX, formerly OKEx, rebranded in 2021 and has since become the second-largest perpetual swap exchange in the world. In December 2024, it handled $20.7 billion in 24-hour futures volume, just behind Binance. But volume alone doesn’t tell the story. What matters is how smoothly your trades execute, how much you pay in fees, and whether your funds are actually safe.

Why Traders Choose OKX for Perpetual Swaps

Most retail traders don’t realize how much swap trading costs add up. On Binance, the taker fee for perpetual swaps is 0.06%. On OKX, it’s 0.05%. Sounds small? Over 100 trades a month, that’s $50 saved on a $100,000 trading volume. Maker fees? Just 0.02%. That’s among the lowest in the industry.

But fees aren’t the only advantage. OKX’s unified margin system lets you use the same balance for spot, margin, and derivatives trading. On other platforms, you need separate accounts for each. That means if you’re long BTC on spot and want to open a short swap position, you can’t borrow from your spot balance unless you transfer funds manually. On OKX, it’s automatic. This cuts capital requirements by 30-40%, according to FXEmpire’s January 2025 analysis.

Then there’s liquidity. For BTC-USDT perpetual swaps, OKX maintains an average order book depth of 1,850 BTC within 0.5% of the mid-price. Competitors like Binance and Bybit average around 1,200 BTC. That means when you place a $50,000 order, you’re less likely to get slippage. In October 2024, one Reddit user executed 127 consecutive BTC swaps during a volatility spike with an average slippage of just 0.03%.

Performance Under Pressure

During the March 2024 market crash, many exchanges froze or lagged. OKX didn’t. Its matching engine handled over 300,000 orders per second with an average latency of 3.2 milliseconds-even when volatility hit 80%. That’s not marketing. It’s benchmarked by RankFi in November 2025.

Why does this matter? Because when the market tanks, you need to exit fast. If your order takes 200ms to fill while others are at 50ms, you’re losing money. OKX’s infrastructure is built for institutional-grade execution. That’s why 68% of advanced traders (those doing 50+ trades monthly) rank it as their top platform for swaps.

The Web3 Wallet Advantage

OKX isn’t just a trading platform. It’s an ecosystem. Its native Web3 wallet supports 130+ blockchains and integrates with 200+ decentralized exchanges through its X Routing algorithm. This reduces average swap costs by 0.87% compared to using a single DEX.

Want to earn yield? The wallet lets you stake stablecoins directly and earn up to 14.5% APY as of Q1 2025. Compare that to centralized platforms like Coinbase, which offer 4-5% on USDC. You’re not just trading-you’re building a DeFi stack inside one app.

What’s Missing: Regulation and Accessibility

OKX has a major flaw: it’s not available in many key markets. If you’re in the U.S., Canada, or parts of the EU, you can’t trade spot or derivatives on OKX. You can only use the non-custodial wallet. That’s because OKX is headquartered in Seychelles and hasn’t secured licenses in most Western jurisdictions.

Compare that to Coinbase, which serves all 50 U.S. states. Or Kraken, which is fully licensed in the U.S. and Europe. OKX’s absence from the UK’s Financial Conduct Authority’s temporary registration regime is a red flag for serious traders. In Q3 2024, 178 users reported account freezes due to KYC issues-more than double Binance’s 89 cases during the same period.

One user on Trustpilot, identified as James M., had his account frozen for 17 days after trying to withdraw $8,300-even though he completed KYC. That’s not rare. It’s a pattern.

Usability: Great for Pros, Tough for Beginners

OKX’s interface is powerful-but not intuitive. OpenExo’s usability testing found that new traders took 27% longer to execute their first perpetual swap trade on OKX than on Binance. The platform assumes you know what unified margin means, how funding rates work, and why you’d choose isolated vs. cross-margin.

There’s no hand-holding. If you’re new, expect to spend 8-10 hours watching OKX’s Academy tutorials before trading live. The good news? Their documentation is excellent. 76% of users rated it highly, especially for explaining swap mechanics and risk tools.

For those who stick with it, the rewards are real. The platform’s Advanced Perp Grid bot, launched in November 2024, has been adopted by over 287,000 users. It automates grid trading for perpetual swaps and generated $4.2 million in monthly fee revenue by December 2024.

Fees and Withdrawals: Transparent, But Not Cheap

Trading fees are low. But fiat on-ramps? Not so much. OKX uses third-party providers like Mercuryo and Banxa, which charge 3.5-4.9% to buy crypto with a credit card. That’s nearly triple Coinbase’s 1.49% bank transfer fee.

Withdrawal fees are dynamic and based on blockchain congestion. As of December 2024, BTC withdrawals cost $1.23 on average. ETH was $2.47. These are competitive, but they’re not fixed. You’ll pay more during network spikes.

Security: Strong, But Not Perfect

OKX stores 95% of assets in cold storage. It has a $700 million Secure Asset Fund for Users (SAFU). And it publishes monthly Proof of Reserves using zk-STARKs-a cryptographic method that lets you verify your funds are fully backed without revealing private data.

As of March 2025, OKX reported $30.8 billion in transparent reserves. That’s more than enough to cover all user balances. But transparency doesn’t prevent account freezes. And that’s the real risk.

Who Should Use OKX?

OKX is perfect if:

- You trade perpetual swaps regularly and care about low fees

- You use leverage and need deep liquidity to avoid slippage

- You want a unified margin system to maximize capital efficiency

- You’re comfortable with a complex interface and willing to learn

- You’re outside the U.S., Canada, or restricted EU countries

OKX is not for you if:

- You’re a beginner who wants a simple, guided experience

- You live in the U.S. or Canada and need full trading access

- You rely on cheap fiat on-ramps and hate paying 4% fees

- You’re risk-averse and can’t tolerate potential account freezes

What’s Next for OKX?

OKX has big plans. By Q2 2026, it plans to replace centralized price oracles with Chainlink’s decentralized feeds. In Q3 2025, it’ll integrate with Ethereum’s Proto-Danksharding to slash swap transaction costs by 60-75%. That’s a game-changer for high-frequency traders.

It’s also expanding its licensing. It’s now licensed in Hong Kong, Malta, and has provisional approval under the EU’s MiCA framework. But without access to the U.S. market, its growth is capped. Bernstein analysts warn that if OKX can’t crack the U.S., its user base may never exceed 25 million-while Binance could hit 55 million.

For now, OKX remains the go-to for serious swap traders outside the U.S. It’s not the easiest, but it’s one of the most powerful. If you’re ready to trade like a pro, it’s worth the learning curve.

Is OKX safe for trading perpetual swaps?

Yes, but with caveats. OKX stores 95% of assets in cold storage, has a $700 million SAFU fund, and publishes monthly Proof of Reserves using zk-STARKs cryptography. You can verify your funds are fully backed. However, users report frequent account freezes during KYC checks, especially in Q3 2024. Safety isn’t just about fund storage-it’s about access. If your account gets locked, recovering funds can take weeks.

Can I use OKX if I live in the United States?

No. OKX blocks full trading access for U.S. residents due to regulatory restrictions. You can still download the non-custodial Web3 wallet and interact with DeFi protocols, but you cannot trade spot, margin, or perpetual swaps on the exchange. For U.S. traders, Coinbase or Kraken are better options.

How does OKX’s fee structure compare to Binance?

OKX has slightly lower fees. For perpetual swaps, OKX charges 0.02% maker and 0.05% taker. Binance charges 0.02% maker and 0.06% taker. That 0.01% difference adds up-on $100,000 in monthly trading, you save $10. OKX also offers better liquidity depth in altcoin swaps like SOL and ADA, reducing slippage costs further.

What is unified margin and why does it matter?

Unified margin lets you use one balance across spot, margin, and derivatives trading. On other platforms, you need separate balances for each. That means if you’re long BTC on spot and want to open a short swap position, you must transfer funds manually. On OKX, your entire balance is available as collateral. This reduces capital requirements by 30-40%, making it far more efficient for active traders.

Are OKX’s withdrawal fees high?

They’re average. BTC withdrawals cost around $1.23 and ETH around $2.47 as of December 2024. These fees adjust based on blockchain congestion, so they can rise during spikes. They’re lower than many competitors, but the real cost comes from fiat on-ramps-OKX charges 3.5-4.9% to buy crypto with a card, which is much higher than Coinbase’s 1.49% bank transfer fee.

Is OKX better than Bybit for swap trading?

For pure swap trading, they’re close. Both have low fees and deep liquidity. But OKX has two clear advantages: a unified margin system and an integrated Web3 wallet. Bybit is a centralized exchange only. OKX lets you stake, swap, and interact with DeFi without leaving the app. If you want a full crypto ecosystem, OKX wins. If you just want a simple swap platform, Bybit is easier.

What’s the learning curve like for beginners?

Steep. OKX assumes you know terms like funding rate, isolated margin, and leverage tiers. Beginners need 8-10 hours of tutorials before trading live. The interface is cluttered, and options aren’t labeled clearly. If you’re new, start with Binance or Kraken. Once you’re comfortable with swaps, switch to OKX for lower fees and better liquidity.

Does OKX offer automated trading for swaps?

Yes. In November 2024, OKX launched Advanced Perp Grid-a bot designed specifically for perpetual swap trading. It automatically places buy and sell orders across price grids. As of December 2024, over 287,000 users adopted it, generating $4.2 million in monthly fee revenue. It’s one of the most popular tools on the platform for active traders.

10 Responses

I've been using OKX for over a year now, and honestly, the liquidity is insane. I traded 200 BTC during the March crash and barely moved the market. Fees are low, and the unified margin saves me so much hassle. Only downside? The interface is a beast for newbies. But if you stick with it, it pays off.

Also, for anyone from India-yes, it works fine here. No issues with withdrawals, and the app’s stable even on 3G.

One must question the underlying architecture of centralized exchanges that tout 'transparency' while operating from offshore jurisdictions with no accountability. The zk-STARKs are merely a performative gesture-a digital illusion of security. The fact that 178 users experienced account freezes in Q3 2024 alone suggests systemic vulnerability, not robustness. One cannot trust an institution that refuses to be bound by the rule of law in sovereign territories.

I get why people love OKX for swaps, but I just can’t ignore how often accounts get frozen. I had a friend in Texas who used the wallet only and still got flagged for 'suspicious activity' after sending $2k to a DeFi protocol. It’s like they want your money but don’t want you to have control. Feels more like a walled garden than a platform.

I’ve tried both OKX and Bybit. OKX’s unified margin is a game-changer if you’re doing multiple types of trades. But I switched back to Bybit because their UI is just… less overwhelming. I don’t need 17 tabs to place a simple order. Maybe OKX is for pros, but I’m just trying to hedge my BTC without a PhD in trading.

OKX is the only exchange that doesn’t make me want to throw my laptop out the window during a flash crash. The 3.2ms latency? That’s not tech-that’s witchcraft. And the fact that they let you stake stablecoins at 14.5% APY? Bro, that’s like free money while you sleep. The only thing holding it back is the U.S. government being scared of innovation.

low fees for sure but the fiat onramp is a joke. 4.9% to buy btc with card? that’s robbery. i just use binance for buying and okx for trading. dont be dumb and buy on okx unless you like paying extra.

I’ve spent a lot of time analyzing this, and I think it’s important to recognize that while OKX’s infrastructure is objectively superior in terms of latency and order book depth, the regulatory risk profile is not just a footnote-it’s the central thesis of any rational evaluation. The fact that they’re headquartered in Seychelles, lack FCA registration, and have a documented pattern of account freezes (178 cases in one quarter) means that while the platform is technically excellent, it’s institutionally fragile. For someone who values both performance and legal recourse, this is a non-starter. You’re trading with a platform that could vanish or freeze your assets without warning, no matter how many cold wallets they claim to have. The $700M SAFU fund sounds impressive until you realize it’s discretionary, unregulated, and not insured. In a true crisis, would it even be accessible? I don’t think so.

You people act like OKX is some kind of crypto god. It’s not. It’s a glorified offshore casino with a fancy UI. The 'proof of reserves'? That’s just fancy math hiding the fact that they’re probably rehypothecating your assets. And don’t get me started on the account freezes-people are getting locked out for weeks over tiny KYC mismatches. This isn’t innovation. It’s predatory convenience. If you’re using OKX, you’re not a trader-you’re a gambler who doesn’t know the house always wins.

I’ve used OKX since 2022. Solid platform. Low fees. Good liquidity. No complaints. The interface is a bit much for beginners, sure, but if you’re serious about trading, you learn it. The wallet integration is actually pretty slick. As for the U.S. ban? Fair enough. They’re not breaking any rules by not serving markets they can’t legally serve. Other exchanges do the same. Just don’t pretend it’s shady.

If you're in the U.S. and still using OKX, you're asking for trouble. This isn't 'freedom'-it's financial recklessness. The U.S. has regulations for a reason: to protect people from places like this. Stop pretending offshore exchanges are 'better.' They're just unregulated. And if your account gets frozen? Too bad. You signed the waiver.