The MVRV ratio isn’t just another crypto indicator-it’s one of the most reliable signals for spotting when the Bitcoin market is overheating or hitting rock bottom. Unlike price charts or technical indicators that react to noise, MVRV looks at what actual holders paid for their coins. It cuts through the hype and shows you where the real money is sitting. If you’ve ever wondered why Bitcoin crashes after a big rally, or why smart investors buy during panic, MVRV holds the answer.

What Is the MVRV Ratio?

MVRV stands for Market Value to Realized Value. It’s a simple formula: divide Bitcoin’s total market cap by its realized cap. Market cap is easy-it’s the current price multiplied by how many coins are in circulation. Realized cap is trickier, but more meaningful. It adds up the price at which every single Bitcoin was last moved on the blockchain. If you bought a Bitcoin for $10,000 and never touched it, it still counts as $10,000 in realized value-even if the price is now $70,000.

This difference matters because market cap reflects what people are willing to pay right now. Realized cap reflects what they actually paid. When the market cap shoots way above realized cap, it means most holders are sitting on huge profits. That’s a red flag. When market cap drops below realized cap, it means most coins are underwater-people are selling at a loss. That’s often a buying opportunity.

The metric was developed in 2018 by Murad Mahmudov and David Puell, building on earlier work by Coinmetrics. Since then, it’s become a cornerstone of on-chain analysis. Platforms like Glassnode, CryptoQuant, and Santiment all track it daily. Over 78% of professional crypto analysts use it regularly, according to a 2023 CoinDesk survey.

How MVRV Signals Market Tops

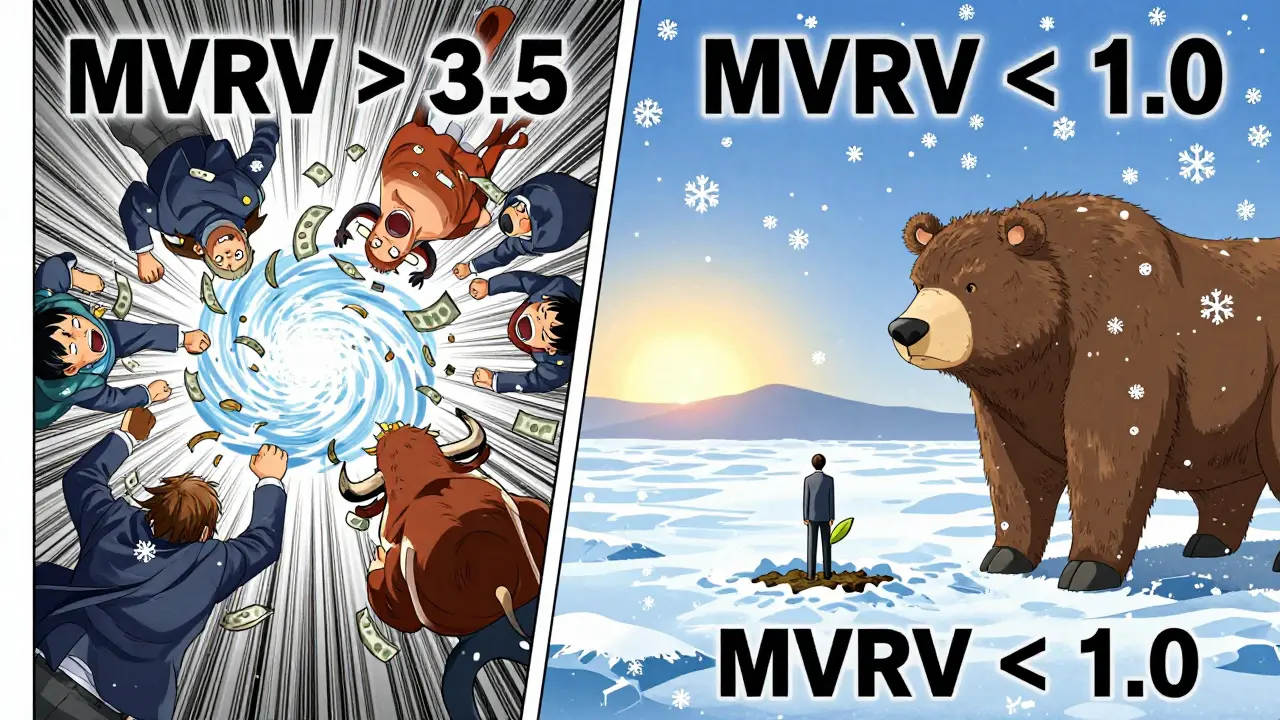

Historically, MVRV ratios above 3.5 have preceded major Bitcoin corrections. In 2017, MVRV hit 3.7 just before Bitcoin peaked at nearly $20,000. The price then dropped over 80% in the next year. In 2021, it climbed even higher-to 4.2-before Bitcoin fell from $69,000 to $16,000. These aren’t coincidences. They’re patterns.

Why does this happen? When MVRV climbs past 3.5, it means the majority of Bitcoin holders are in profit. That creates a perfect storm: new buyers rush in hoping to catch the last wave, while long-term holders start selling to lock in gains. The market becomes saturated with sellers, and the price collapses. It’s not about fear-it’s about profit-taking on a massive scale.

One key insight from Glassnode’s research: MVRV has correctly identified 9 out of the last 10 major Bitcoin tops, with an average lead time of 23 days before the price peak. That’s not luck. That’s data.

How MVRV Signals Market Bottoms

On the flip side, MVRV below 1.0 is a powerful sign of capitulation. When the ratio drops under 1, it means the average Bitcoin holder is losing money. That’s when panic selling peaks and most weak hands have already exited.

Look at March 2020. Bitcoin crashed to $3,800 during the COVID sell-off. MVRV fell to 0.82. Within 18 months, the price rose over 670%. In 2022, after the Terra collapse and FTX meltdown, MVRV dropped to 0.94. Bitcoin rebounded from $15,500 to $49,000 by mid-2023.

These aren’t just recovery stories. They’re textbook examples of market psychology turning. When MVRV is below 1, there’s little upside for sellers-they’re already underwater. That forces the market to stabilize. And when the first big buyer steps in, the cycle begins again.

MVRV-Z Score: Smarter Than Just a Number

But MVRV alone can be misleading. What if the entire market is more expensive than before? What if the historical average has shifted? That’s where MVRV-Z score comes in.

The Z-score tells you how many standard deviations the current MVRV is from its historical mean. A Z-score above +3 means MVRV is unusually high compared to the past. A Z-score below -1.5 means it’s unusually low. This adjusts for changing market conditions.

In 2017, the MVRV-Z score peaked at 6.3-extremely rare. In 2022, it hit -1.8, signaling a deep bottom. This metric helps you avoid mistaking a new bull market for a repeat of the past. It’s not just about the number-it’s about how extreme it is relative to history.

Why MVRV Beats Other Metrics

Many investors rely on price-to-earnings ratios or moving averages. But Bitcoin doesn’t have earnings. And technical indicators like RSI or MACD are based on price alone-they don’t know who bought what or when.

MVRV is different. It uses blockchain data that can’t be faked. Every transaction is public. Every coin’s last movement is recorded. That’s why MVRV has a 0.87 correlation with Bitcoin’s 6-month price performance-higher than RSI (0.42) or MACD (0.38), according to CoinMetrics’ 2023 study.

Compare it to Stock-to-Flow, which predicts price based on scarcity. It worked well in 2020, but failed in 2021 when Bitcoin surged past its predicted range. MVRV, however, accurately reflected the market’s euphoria and then its collapse.

Even NVT (Network Value to Transactions), which measures usage, doesn’t capture investor sentiment like MVRV does. MVRV answers one question: Are people holding Bitcoin because they believe in it-or because they’re hoping to flip it for a quick profit?

Limitations and When MVRV Fails

MVRV isn’t perfect. It can give false signals during extreme volatility. In March 2020, price gaps and frozen exchanges distorted on-chain data. MVRV spiked briefly, then crashed-creating noise instead of clarity.

It also works best for Bitcoin. Altcoins like Solana or Ethereum have less reliable on-chain data. Their wallets are more fragmented, and exchanges dominate trading volume. MVRV for altcoins is often misleading.

And here’s the biggest trap: using MVRV alone. A 2022 Presto Labs study found that 18% of signals were false when MVRV was used in isolation. That’s why top analysts combine it with other metrics.

The most common combo? MVRV + NUPL (Net Unrealized Profit/Loss) + Exchange Netflow. NUPL tells you how much profit is unrealized across the network. Exchange Netflow shows if Bitcoin is moving to or away from exchanges-signaling accumulation or distribution. Together, they confirm what MVRV suggests.

How to Use MVRV in Practice

You don’t need to be a quant to use MVRV. Here’s how real analysts apply it:

- Watch for MVRV > 3.5 - This is your early warning for a potential top. Don’t sell immediately, but start reducing exposure.

- Watch for MVRV < 1.0 - This is your signal to start accumulating. Don’t wait for the bottom-buy in stages.

- Check the MVRV-Z score - If it’s +4 or higher, you’re in extreme greed territory. If it’s -2 or lower, you’re in deep fear.

- Combine with exchange flows - If MVRV is high but Bitcoin is leaving exchanges, it’s likely being held long-term, not sold. That changes the story.

Free tools like Bitbo.io give you live MVRV charts updated hourly. Santiment offers weekly data. For deeper analysis, Glassnode and CryptoQuant charge monthly fees-but they’re worth it if you’re serious about timing the market.

How the Metric Is Evolving

The old rule-MVRV > 3.5 = top-is becoming outdated. In 2021, Bitcoin hit 4.2 and kept going. The market is maturing. So now, platforms like Glassnode use Dynamic MVRV Thresholds. They adjust the warning level based on which halving cycle you’re in. Early-cycle tops might trigger at 3.2. Late-cycle tops wait until 4.0.

CryptoQuant’s new MVRV Confidence Bands use Bayesian stats to give you a probability: “There’s an 89% chance a reversal is coming at this MVRV level.” That’s a game-changer.

Future versions may even include Lightning Network data-tracking how much Bitcoin is moving off-chain. That could help spot short-term cycles faster.

What Experts Say

Murad Mahmudov, one of MVRV’s creators, says: “It’s a lens, not a crystal ball.” He’s right. No single metric predicts the future. But MVRV gives you the clearest view of what’s already happened-and what’s likely to happen next.

Willy Woo, a top crypto analyst, gave MVRV a 4.7 out of 5. He calls it “unparalleled in identifying extremes.” Preston Pysh warns that thresholds are shifting, and we need to adapt. That’s why dynamic models are now the standard.

And here’s the bottom line: 87% of top crypto hedge funds use MVRV. Public companies like MicroStrategy use it to time their Bitcoin buys. If it’s good enough for institutions with billions at stake, it’s worth learning.

Final Thoughts

MVRV doesn’t tell you when to buy or sell. It tells you where the market is emotionally. When MVRV is high, greed is running the show. When it’s low, fear has taken over. The best investors don’t fight the crowd-they watch it, wait for the turning point, and act when the data confirms it.

Bitcoin’s history shows that markets repeat. MVRV is the tool that lets you see those patterns before they happen. It’s not magic. It’s math. And in a world full of noise, that’s the most valuable signal of all.

What does an MVRV ratio above 3.5 mean?

An MVRV ratio above 3.5 means Bitcoin’s market value is significantly higher than the average cost basis of all holders. Historically, this has signaled extreme market greed and often precedes major price corrections. It indicates that most coins are in profit, triggering widespread profit-taking by long-term holders.

Is MVRV reliable for altcoins like Ethereum or Solana?

MVRV is far less reliable for altcoins. Bitcoin has the most mature, transparent, and decentralized on-chain data. Altcoins have higher exchange trading volume, fragmented wallet usage, and less consistent transaction history, which distorts the realized value calculation. MVRV works best as a Bitcoin-specific metric.

Can MVRV predict the exact top or bottom of a market cycle?

No, MVRV cannot predict the exact timing of a top or bottom. It signals when the market is in an extreme state-overbought or oversold-but not the precise moment of reversal. It works best when combined with other metrics like Exchange Netflow, NUPL, and SOPR to confirm signals.

How do I access MVRV data for free?

You can view free MVRV charts on Bitbo.io (updated hourly) and Santiment’s free tier (weekly data). These platforms provide enough data for retail investors to track major trends. For advanced features like MVRV-Z score or confidence bands, paid platforms like Glassnode and CryptoQuant are required.

Why is MVRV better than price-to-earnings ratios for crypto?

Traditional P/E ratios rely on corporate earnings, which don’t exist in decentralized networks like Bitcoin. MVRV uses on-chain data-what users actually paid for their coins-to measure market sentiment. It’s based on real behavior, not assumptions, making it uniquely suited for crypto markets.

10 Responses

Bro this MVRV thing is like the financial version of a mood ring 🤓 When it hits 3.5, you know the whole crypto Twitter is about to cry into their Binance app. I bought at 18k in 2021 thinking I was smart… turned out I was just the last guy holding the bag while the whales cashed out. MVRV saw it coming. I didn’t. Lesson learned.

MVRV > 3.5 = sell. MVRV < 1 = buy. That’s it. No charts. No indicators. Just math. If you’re still using RSI in 2024, you’re using a flip phone in the age of smartphones.

While I appreciate the rigorous data-driven approach outlined here, I must emphasize the profound psychological undercurrents that drive market behavior. MVRV, though statistically robust, does not account for the emergent collective consciousness of market participants - a phenomenon often overlooked in purely quantitative models. One might argue that sentiment, not just realized value, is the true driver of price.

This is one of the clearest breakdowns of MVRV I’ve seen. The Z-score adjustment alone makes this infinitely more useful than the old 3.5 rule. I’ve been using Glassnode’s dynamic thresholds since last cycle and it’s cut my false signals by half. If you’re not tracking MVRV-Z, you’re flying blind.

so mrvv is like when people buy high and sell low? i think i get it now

Altcoins are not Bitcoin. MVRV works because Bitcoin has a decade of on-chain history. Ethereum’s wallet fragmentation and Solana’s high-frequency trading make realized value meaningless. Stick to BTC if you want real signals.

bro i just bought at 48k because mrvv was at 3.1 and now its 3.7 and its going to 100k i know it i feel it

Who controls the blockchain data? The same people who control the Fed. MVRV is just another tool to trick little investors into buying at the top while the elites dump. They even made a fancy graph to make it look scientific. Wake up. This is all a game.

Ok but like… why do we even care about some math thing? Can’t we just buy when it goes up and sell when it goes down? Why overcomplicate it? Also I bought at 50k and I’m not selling no matter what 😘

If MVRV tells us where the market has been… then what are we really predicting? The past repeating itself? Or are we just pattern-seeking primates looking for meaning in noise? The data doesn’t lie… but maybe we’re the ones lying to ourselves by believing it can tell us the future