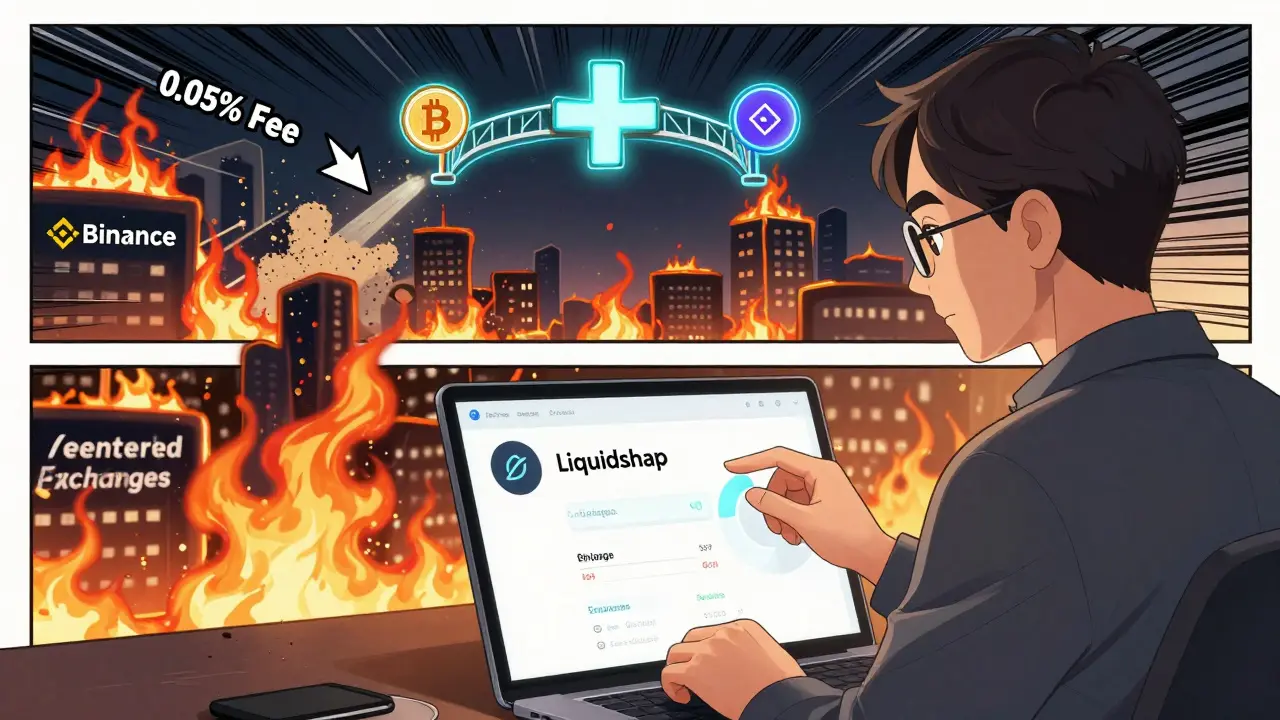

When you hear "crypto exchange," you probably think of Binance, Coinbase, or Kraken - big platforms with user-friendly apps, customer support, and clear rules. But what if you don’t want any of that? What if you want to trade directly from your wallet, with zero fees, and without handing over control of your coins? That’s where Liquidswap v0.5 comes in. It’s not for everyone. But if you’re already using Aptos, or you’re tired of paying trading fees, it might be exactly what you’ve been looking for.

What Is Liquidswap v0.5?

Liquidswap v0.5 is the first decentralized exchange (DEX) built on the Aptos blockchain. It launched in 2023 and hasn’t changed much since. Unlike centralized exchanges, it doesn’t hold your money. You connect your wallet - like Pontem, Martian, or Coin98 - and trade directly through smart contracts. No sign-up. No KYC. No waiting for withdrawals. You press "swap," and the blockchain does the rest.

The whole point? To remove middlemen. That means no fees. Liquidswap charges 0.00% for both makers and takers. Compare that to Coinbase’s 0.5% or even Uniswap’s 0.05% swap fee. On a $1,000 trade, that’s $5 saved. Over time, it adds up.

How It Works - No Fluff, Just Steps

Here’s how you actually use it:

- Get an Aptos-compatible wallet (like Pontem Wallet or Martian Wallet).

- Deposit some APT, USDT, or another supported token into it.

- Go to liquidswap.com and click "Connect Wallet."

- Select the tokens you want to swap - say, APT for USDT.

- Click "Swap." The transaction goes live on Aptos.

- Wait 1-3 seconds. Done.

That’s it. No forms. No email verification. No 2FA. You’re in control. But here’s the catch: you need to understand gas fees, slippage, and liquidity pools. If you’ve never used a DEX before, you’ll probably get confused. Liquidswap doesn’t hold your hand. It assumes you know what you’re doing.

What You Can Trade

Liquidswap supports 22 tokens and 30 trading pairs. That’s tiny compared to Uniswap (which has over 10,000 pairs) or even PancakeSwap (over 1,000). But it’s not trying to be everything. It’s focused on the Aptos ecosystem.

Here’s what’s actually available:

- APT (Aptos native token)

- USDT (Tether)

- USDC (USD Coin)

- WBTC (Wrapped Bitcoin)

- ETH (Ethereum via cross-chain)

- DAI

- LINK

- DOT (Polkadot)

- ATOM (Cosmos)

- And a few others like MOVR, NEAR, and SUI

Yes - you can swap Bitcoin and Ethereum directly. No wrapping. No bridging. Liquidswap uses cross-chain routers to pull in assets from other networks. That’s rare. Most DEXs only let you trade tokens native to their chain. Liquidswap lets you trade across chains without extra steps.

Pros: Why This Exchange Stands Out

- Zero trading fees - No maker, no taker. Just blockchain gas. That’s a game-changer for frequent traders.

- Non-custodial - Your keys, your coins. No exchange can freeze or lose your funds.

- Cross-chain swaps - Trade BTC, ETH, and DOT without converting to wrapped versions. Saves time and reduces risk.

- Liquidity pools - You can add liquidity and earn a cut of every trade. No need to stake. Just deposit tokens into a pool.

- No KYC - Trade from anywhere. No country restrictions. No identity checks.

If you’re a DeFi user who hates fees and trusts smart contracts, this is one of the cleanest interfaces out there. It’s simple. Fast. Transparent.

Cons: The Real Drawbacks

- Only 30 trading pairs - If you want to trade obscure altcoins, you won’t find them here. It’s not a full-market DEX.

- Low traffic - According to FxVerify, Liquidswap gets about 3,100 visits per month. That’s less than 1% of Uniswap’s traffic. Low volume means wider spreads and less liquidity.

- Not regulated - No government oversight. No insurance. If you get hacked or lose your seed phrase, you’re on your own.

- Slow data updates - CoinTelegraph reports price data updates lag by up to 24 hours. That’s dangerous if you’re day trading.

- Steeper learning curve - If you don’t know what slippage is or how to read a liquidity pool, you’ll make mistakes.

There’s no customer service. No phone number. No email ticket system. If the app breaks, you’re stuck until the devs fix it. And since it’s on Aptos, any network congestion or bug affects you directly.

Who Is This For?

Liquidswap v0.5 isn’t for beginners. It’s not for people who want to buy Bitcoin with a credit card. It’s not for traders who need real-time data on 500 coins.

It’s for three types of users:

- Aptos holders - If you own APT, USDT, or other Aptos tokens, this is the best place to swap them without fees.

- DeFi veterans - You know how to read smart contracts, set slippage, and manage liquidity. You don’t need hand-holding.

- Cross-chain traders - If you move between Ethereum, Bitcoin, and Solana, and want to swap directly without wrapping, Liquidswap’s cross-chain feature is rare and useful.

If you’re in one of those groups, Liquidswap is worth trying. If you’re not, you’re better off with Uniswap, PancakeSwap, or even a centralized exchange.

Liquidswap vs Other DEXs

| Feature | Liquidswap v0.5 | Uniswap v3 | PancakeSwap |

|---|---|---|---|

| Blockchain | Aptos | Ethereum | BSC |

| Trading Pairs | 30 | 10,000+ | 1,000+ |

| Trading Fees | 0.00% | 0.05% | 0.05% |

| Cross-Chain Swaps | Yes (BTC, ETH, DOT) | No | No |

| Liquidity Pools | Yes | Yes | Yes |

| User Traffic (Monthly) | ~3,100 | ~12 million | ~5 million |

| Regulation | None | None | None |

Liquidswap doesn’t compete with Uniswap. It competes with niche DEXs like SushiSwap or Trader Joe. Its edge? Zero fees and cross-chain swaps. Its weakness? Scale. It’s a specialist, not a generalist.

The Bottom Line

Liquidswap v0.5 is bold. It’s simple. It’s risky. And it’s one of the few DEXs that actually delivers on its promise: zero fees, full control, and cross-chain flexibility.

But it’s not a replacement for Coinbase or Binance. It’s a tool for people who already live in DeFi. If you’re deep into the Aptos ecosystem, it’s probably the best swap tool you’ve got. If you’re just starting out, or you need real-time data and customer support, look elsewhere.

Its future depends entirely on Aptos. If Aptos grows, Liquidswap grows. If Aptos stalls, Liquidswap fades. Right now, it’s a small, quiet exchange - but for the right user, it’s one of the most efficient tools in crypto.

Is Liquidswap v0.5 safe to use?

Yes - but only if you manage your own security. Liquidswap is non-custodial, meaning your funds are never held by the platform. That’s safer than centralized exchanges. But if you lose your wallet seed phrase, there’s no recovery. No customer support. No refunds. You’re fully responsible.

Can I trade Bitcoin on Liquidswap without wrapping it?

Yes. Liquidswap uses cross-chain routers to swap Bitcoin (WBTC) and Ethereum (ETH) directly without requiring you to wrap them first. This is rare among DEXs and saves time and gas fees. You trade BTC for APT or USDT in one step.

Why does Liquidswap have so few trading pairs?

It’s designed as an Aptos-native DEX, not a global exchange. It focuses on the most popular tokens in the Aptos ecosystem - APT, USDT, USDC, and a few cross-chain assets. Adding hundreds of pairs would require more liquidity and infrastructure, which it hasn’t built yet. It’s intentional - not a flaw.

Is Liquidswap better than Uniswap?

It depends. If you’re on Ethereum and trade hundreds of tokens, Uniswap is better. If you’re on Aptos and want zero fees with cross-chain swaps, Liquidswap wins. Uniswap has 12 million monthly users. Liquidswap has 3,100. But for Aptos users, it’s the only DEX with its specific advantages.

Do I need to pay gas fees on Liquidswap?

Yes. While Liquidswap charges 0% trading fees, you still pay gas fees to the Aptos blockchain to confirm your transaction. These are usually very low - around $0.01 to $0.05 - thanks to Aptos’ fast and efficient consensus. But you can’t avoid them entirely.

Can I earn passive income on Liquidswap?

Yes. By adding liquidity to trading pairs (like APT/USDT), you become a liquidity provider and earn a share of every trade. This is similar to Uniswap’s LP model. But because Liquidswap has lower volume, your rewards may be smaller. Still, it’s a way to earn without staking or locking tokens.

Is Liquidswap regulated?

No. Liquidswap operates without any government oversight. It’s fully decentralized, which means no KYC, no freezing of funds, and no legal protections. This gives you freedom - but also zero recourse if something goes wrong.

How often does Liquidswap update its prices?

Data updates lag by up to 24 hours, according to CoinTelegraph. This isn’t real-time. If you’re day trading or making quick decisions, this delay could cost you. For long-term swaps or liquidity provision, it’s less critical.

11 Responses

Liquidswap’s zero-fee model is insane if you’re swapping APT and USDT daily. I’ve been using it for months and saved over $80 in fees alone. No KYC, no waiting, no drama. Just connect, swap, go. The only thing I miss is a mobile app, but honestly, the web version works fine.

It’s not about how many pairs it has. It’s about how clean the transaction is. Most DEXes feel like a car dealership-pushy, confusing, hidden fees. Liquidswap is like buying gas at a corner station: you know the price, you pay, you leave. No upsells. No nonsense.

Bro, if you’re on Aptos and not using Liquidswap, you’re leaving money on the table. I swapped 5 APT for USDT last week-gas was $0.03, fee was $0.00. Uniswap would’ve charged me $0.25. That’s a coffee every time I trade. I’m telling you, this is the future. 🚀

Zero fees? Yes please. 🤑 I’ve been holding APT since last year and this is the only place I trade without feeling guilty about the gas. Also, cross-chain BTC swaps? Mind blown. 🤯

There’s something beautiful about a system that doesn’t ask for your identity to let you trade. It’s not just about privacy-it’s about autonomy. Liquidswap doesn’t assume you need permission. It just lets you do it. That’s radical, in the best way.

Be careful with slippage. I lost $12 once because I didn’t adjust it. Liquidswap doesn’t warn you. You have to know what you’re doing. Also, the 24-hour data lag? Yeah, that’s dangerous if you’re trading short-term. Double-check prices on CoinGecko before you swap. Always.

Low traffic means low liquidity. I tried swapping DOT for APT and got a 4% slippage. It was frustrating. But if you’re trading APT/USDT, it’s smooth. So it’s not broken-it’s just niche. Like a boutique coffee shop in a town of 500 people. You go there because you know the barista and trust the beans.

Let’s be brutally honest: this is a toy for degens who think they’re crypto anarchists. Zero fees? Cute. But with 3,100 monthly users, you’re trading against bots and whales who front-run you. The cross-chain swaps are clever, but they’re a security nightmare. WBTC on Aptos? That’s not innovation-it’s a vulnerability waiting to be exploited.

If you’re okay with zero regulation and zero recourse, then sure, go ahead. But what happens when someone drains your wallet because you clicked the wrong thing? You’re not a pioneer-you’re a fool. Crypto isn’t about freedom from responsibility. It’s about responsibility without freedom. And Liquidswap? It’s a trap dressed as a tool.

For newcomers: start with APT/USDT. It’s the most stable pair. And always check the liquidity pool depth before swapping. I’ve been using this for a year-no issues, no drama. Just remember: no support = no excuses. You’re the CEO of your wallet now. 💪❤️

I just swap APT for USDT and call it a day. Works fine. No stress.