Crypto Order Book Reader

Order Book Simulation

Key Metrics

Highest Bid

$30,000

Lowest Ask

$30,200

Spread

$200

Liquidity Status

High

Order Book Display

| Price ($) | Amount (BTC) | Total ($) | Type |

|---|

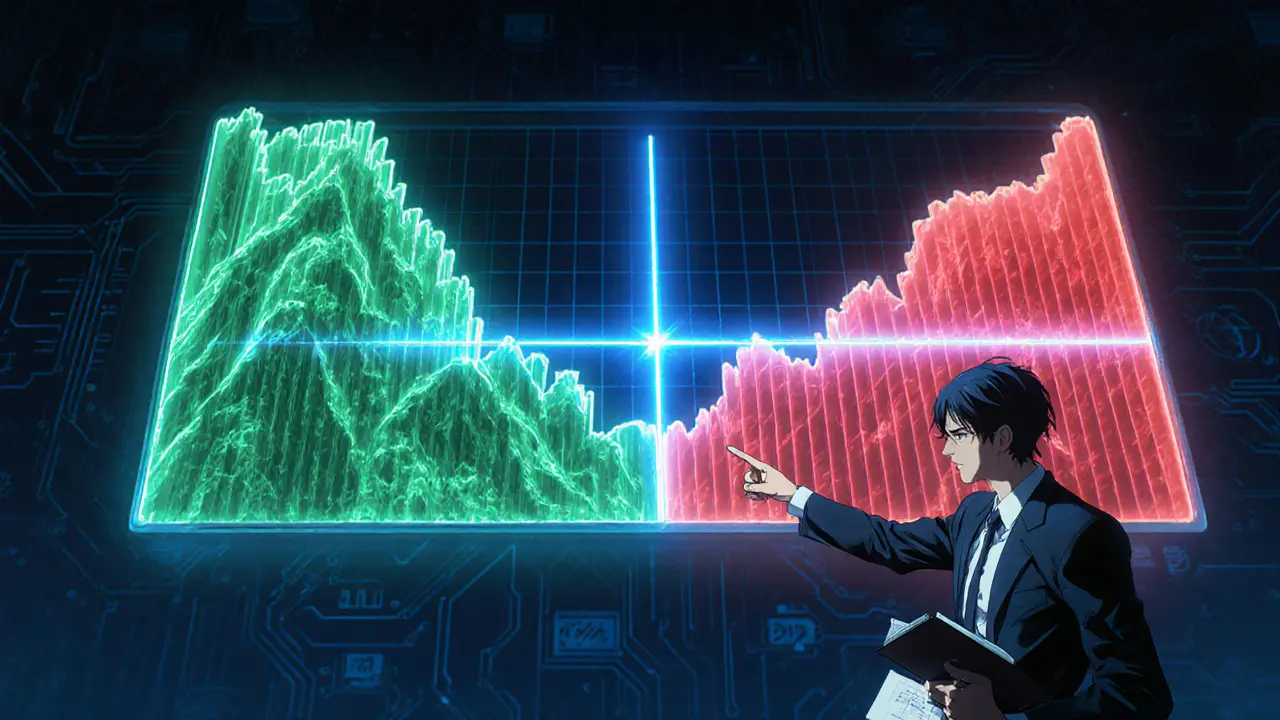

Market Depth Visualization

How to Interpret This Data

• Bid rows (green) show what buyers are willing to pay

• Ask rows (red) show what sellers are asking for

• Spread is the gap between highest bid and lowest ask

• Market Depth shows how much volume exists at each price level

Quick Take

- crypto order book shows every pending buy and sell order in real time.

- Green rows are Bid (buy) orders; red rows are Ask (sell) orders.

- The Spread is the gap between the highest bid and the lowest ask - a key liquidity signal.

- Market depth tells you how many units sit at each price level.

- Use Depth charts or heatmaps for a visual snapshot.

What Is a Crypto Order Book?

A Crypto Order Book is a real‑time electronic ledger that lists every pending buy and sell order for a specific digital asset on an exchange. Exchanges don’t hold the assets themselves; they simply match the orders that appear in the book. The system follows a first‑in‑first‑out rule combined with price‑time priority, meaning the oldest order at a given price is filled first, and newer orders wait behind it.

Spotting the Bid and Ask Columns

When you open the order‑book view, you’ll see two vertical sections. The left side (usually green) displays the Bid side - the prices traders are willing to pay. Prices are sorted from highest to lowest, so the topmost bid is the most aggressive buyer. The right side (typically red) shows the Ask side - the prices sellers are willing to accept. These are ordered from lowest to highest, making the bottom‑most ask the most aggressive seller.

Because the two sides are mirrored, the space between the highest bid and the lowest ask is the so‑called Spread. A narrow spread signals that buyers and sellers agree closely on price, which usually means the market is liquid.

Reading the Spread and Market Depth

The spread is simply:

Spread = Lowest Ask - Highest Bid

When the spread widens, it can be a warning sign: liquidity is thin, and any trade you place may move the price more than you expect.

Market Depth goes deeper than the top of the book. It aggregates the total quantity of orders at each price tier, giving you a sense of how much you could buy or sell before the price shifts substantially. For example, if you see 5BTC waiting at $30,000 on the ask side and another 10BTC at $30,200, you can estimate the impact of a 7BTC market order.

Decoding Order Sizes and Totals

Each row in the book typically shows two numbers:

- Amount - the number of coins or tokens offered at that price.

- Total - the monetary value, calculated as Amount × Price. This helps you gauge the dollar (or USDT) exposure at each level.

Seeing a massive amount clustered around a certain price can act as a magnet - traders often interpret that as a support (if on the bid side) or resistance (if on the ask side) level.

Order Types: Market vs. Limit

When you place a trade, you choose how it interacts with the order book. The two most common types are market and limit orders.

| Feature | Market Order | Limit Order |

|---|---|---|

| Execution Speed | Immediate - hits the best available price | Delayed - only fills at your specified price or better |

| Price Certainty | None - you may receive a worse price in a thin market | High - you control the exact price |

| Typical Use‑Case | Quick entry/exit, small positions | Targeted entry, stop‑loss, large orders |

| Impact on Order Book | Consumes liquidity, may widen spread | Adds liquidity until matched |

A Market Order will hit the lowest ask if you’re buying, or the highest bid if you’re selling, regardless of how many price levels it needs to cross. A Limit Order sits in the book until another trader’s market order meets its price.

Visual Tools: Depth Charts & Heatmaps

Reading raw numbers can be overwhelming, especially on fast‑moving pairs. Most exchanges layer visual aids on top of the order‑book data.

- Depth Chart plots cumulative bid volume on the left and cumulative ask volume on the right against price. The point where the two lines intersect is the current market price.

- Heatmap colors each price level based on the amount of orders - darker shades mean larger concentrations. It lets you spot “walls” (big clusters) at a glance.

Both tools are great for spotting where the market might bounce or break. For example, a thick bid wall just below the current price often acts as support, while a thick ask wall above can act as resistance.

Practical Tips for Real‑Time Reading

- Start by locating the highest bid and lowest ask - they set the spread.

- Check the volume at those two levels. If the top bid has 1BTC and the top ask has 0.2BTC, buying could immediately push the price up.

- Scan a few rows deeper (5‑10 levels) to gauge depth. A deep ladder of bids indicates strong buying interest.

- Look for clustering. A sudden surge of orders at a specific price may signal an upcoming price reaction.

- Combine with a depth chart. Confirm that the visual wall matches the numeric data.

- If you plan a large trade, calculate the *slippage* by adding up the amounts from the top of the book until your desired quantity is filled.

- Watch for rapid changes. In high‑volatility markets, the spread and depth can shift within seconds.

By practicing these steps, you’ll develop an instinct for when the market is about to move, when it’s stable, and when your order might get stuck.

Advanced Access: Order‑Book APIs

For algorithmic traders, exchanges expose the same data through Order Book API endpoints. A typical API returns a JSON snapshot with two arrays - one for bids and one for asks - each containing price and amount pairs. You can also subscribe to WebSocket streams for real‑time updates. Using the API, you can:

- Run custom depth‑analysis scripts.

- Feed data into automated trading bots that place limit orders right at identified walls.

- Back‑test strategies against historical order‑book snapshots.

Even if you’re not a coder, many charting platforms integrate these APIs and let you view the raw order‑book data side by side with price charts.

Key Takeaways

The crypto order book is the heartbeat of any exchange. Mastering its visual cues - bid vs. ask colors, spread size, depth ladders, and wall formations - gives you a real‑time advantage over traders who rely solely on price charts. Pair that knowledge with the right order type, and you can enter or exit positions with confidence, minimizing slippage and improving execution quality.

Frequently Asked Questions

What does a narrow spread indicate?

A narrow spread usually means high liquidity - many buyers and sellers are near the same price, so you can trade with minimal price impact.

How can I spot a support level in the order book?

Look for a large cluster of bid orders (a “bid wall”) below the current price. The heavier the wall, the stronger the potential support.

When should I use a limit order instead of a market order?

Use a limit order when you want price certainty - for example, entering a position at a specific resistance level or placing a stop‑loss at a predefined price.

Can I read the order book on mobile?

Most major exchanges offer mobile apps with a compact order‑book view and depth‑chart widgets, so you can monitor spreads and walls on the go.

What is slippage and how do I calculate it?

Slippage is the difference between the expected price of your order and the price you actually receive. Estimate it by adding up the quantities at each price level until your trade size is met, then compare the weighted average price to the top‑of‑book price.

13 Responses

So you finally decided to peek at the order book? 😏 Grab a coffee, because the bids are green, the asks are red, and the spread is that pesky gap you keep hearing about. If you can tolerate a little bit of market noise, you’ll see the highest bid chilling at the top and the lowest ask hovering just above it. Remember, a narrow spread usually means the market’s liquid, which is great if you enjoy smooth trades; a wide spread? Well, that’s a sign to maybe stay on the sidelines. Also, those depth‑chart bars? They’re just visual caffeine – the bigger the bar, the more liquidity you’ve got. Happy hunting, and may your slippage be forever low! 💪

Ah, the order book – a modern tapestry of desire and avarice, where every line whispers the hopes of a trader longing for the perfect price. Yet, we stand here, scrolling through numbers as if they were verses of a poem no one asked us to read. In truth, the spread merely reflects the collective patience (or impatience) of market participants, a silent agreement that the world will keep turning regardless of our tiny orders. If only the market were as patient as philosophers, perhaps we’d find peace in the volatility. Still, the depth chart remains a beautiful reminder that even in chaos, patterns emerge, and we keep chasing them, lazily, eternally.

Let us embark on a vivid voyage through the bewildering yet beguiling landscape of the crypto order book, a realm where numbers parade like flamboyant peacocks and each price level is a stage for drama and destiny. First, picture the bids – those verdant rows of yearning buyers – as eager adventurers climbing an emerald mountain, each step representing a higher price they’re willing to pay, their hopes stacked like colorful bricks. Opposite them, the asks – scarlet serpents of sellers – slither down a ruby staircase, each rung a price they demand, glinting like rubies in the harsh light of market pressure. The spread, dear reader, is the mischievous gap between these two forces, a yawning canyon that can either be a gentle stream or a raging chasm depending on liquidity. When the spread narrows, it’s akin to two lovers standing nose‑to‑nose, the market humming with intimacy; when it widens, they become distant strangers, each side shouting across a void. Delving deeper, the depth chart paints a portrait of cumulative volumes, the green hills swelling on the left, the red valleys deepening on the right, a topographical map of market sentiment. Notice the towering bid walls, those colossal fortresses of order, which can arrest a price decline like a dam stops a river, and the towering ask walls, which can cap a rally like a ceiling of glass. The total column, once merely a number, transforms into a narrative of capital, each dollar a character in an ever‑evolving saga. A savvy trader, armed with this tableau, can anticipate where the market might tumble or surge, reading the order book as a seasoned bard reads a scroll of prophecy. Moreover, the interplay of market orders and limit orders adds another layer: market orders are the reckless knights charging straight into battle, potentially shattering walls, while limit orders are the patient architects, placing bricks with precision and waiting for the right moment. To truly master this art, one must practice patience, observe the rhythm, and occasionally step back to admire the broader canvas – the price chart that dances atop this intricate foundation. In sum, the order book is not merely a table of numbers; it is a living, breathing organism, a theater of hopes, fears, and strategies, awaiting those bold enough to read its signs and act upon them. Embrace the chaos, cherish the patterns, and may your trades be ever in your favor.

The guide does a decent job of laying out the basics, but it barely scratches the surface of why spreads matter in volatile markets. A narrow spread is often overhyped as a sign of health, yet in reality it can mask underlying order‑book manipulation. The article also glosses over hidden liquidity that resides off‑exchange, which can instantly flip a seemingly stable market. For traders looking to scalpe, ignoring these nuances can be costly. In short, more depth and less fluff would serve the community better.

Well, look who's trying to sound all scholarly about spreads. 🙄 If you think a "narrow spread" is some mystical indicator, you're in for a rude awakening when a whale swoops in and wipes the floor. The whole article feels like a bedtime story for novices, while the real action happens in the dark pools where nobody looks. Drama? Absolutely – the market is a stage and most people are just background props.

Interesting take, but I'd argue the opposite – a narrow spread isn't always a blessing. When trades are thin, even a small order can cause price spikes, making it a trap for the unsuspecting. The guide's optimism feels forced, ignoring the reality that many exchanges hide large orders to manipulate perception. So, before you trust the green and red bars, remember the market loves to play tricks.

While the tutorial is certainly comprehensive, one must critique its lack of emphasis on order‑book latency; high‑frequency traders exploit even millisecond delays, which can render the described strategies moot; additionally, the omission of iceberg orders-those hidden depths-leaves a critical blind spot for serious participants; therefore, readers should supplement this guide with a deeper exploration of order concealment techniques before deploying capital.

Delving into the mechanics of order books is akin to unwrapping the very soul of market microstructure, and while the article provides a solid scaffold, it underestimates the profound impact of order flow toxicity that can erode even the most disciplined strategies. One cannot merely glance at the highest bid and lowest ask and presume safety; the hidden liquidity lurking beyond the visible tiers, often concealed behind iceberg orders, can pivot the market in an instant. Moreover, the interplay between market orders and limit orders creates a dynamic equilibrium that is constantly shifting, demanding vigilant monitoring of the depth chart's subtle gradients. A trader who fails to account for slippage calculations based on cumulative volume may find themselves blindsided when a seemingly modest trade cascades through multiple price levels, widening the spread dramatically. In volatile environments, the spread can inflate not merely because of thin liquidity but also as a defensive mechanism employed by large participants to shield their positions from predatory algorithms. Thus, a nuanced appreciation of order‑book dynamics, coupled with real‑time analytics, is indispensable for anyone seeking to navigate the treacherous waters of crypto markets with confidence.

Great tips, keep it simple!

Listen, the previous comment reads like a bedtime story. If you’re not accounting for real‑time order‑book volatility, you’re basically handing over your capital to the market’s whims. Aggressively track delta changes, cut losses instantly, and stop pretending that a pretty chart will save you. The market respects only those who act decisively, not those who wax poetic.

For newcomers, think of the order book as a bustling marketplace where every seller shouts a price and every buyer whispers a bid. Start by observing the top of the book, then gradually drill deeper to see where the real support and resistance lie. Use the depth chart as a visual aid, but always cross‑reference with actual order sizes; numbers tell the truth the colors hint at. Remember, patience and consistent practice are the keys to turning these insights into profitable trades.

Oh wow, another tutorial that tells me to stare at green and red bars. 🙄 As if that’s going to magically make me a trading wizard. Sure, the spread is important, but you’ve completely ignored the impact of hidden liquidity and order‑book spoofing. The market is full of bots that pump and dump, and a simple depth chart won’t protect you. If you want real value, discuss how to filter out fake walls and detect manipulators. Otherwise, this is just a beginner’s bedtime story.

Interesting take, but I’d add that using multiple exchange books can help filter out manipulation.