When you trade crypto futures with leverage, you’re not just betting on price moves-you’re playing with fire. One wrong move, and your entire position can vanish in seconds. The number that determines whether you walk away with profits or losses is your liquidation price. This isn’t a suggestion. It’s a hard stop. Once the market hits this price, the exchange closes your trade automatically. No warning. No second chance.

What Exactly Is a Liquidation Price?

Your liquidation price is the exact market level where your margin balance drops below what the exchange requires to keep your position open. Think of it like a bank overdraft limit, but for leveraged trades. If your account can’t cover the losses anymore, the exchange steps in to prevent you from owing more than you deposited. It’s not the same as your bankruptcy price. That’s the point where you lose everything-your initial margin is gone. Liquidation happens before that. The exchange pulls the plug when you’re still technically solvent, but just barely. This protects both you and the exchange from runaway losses. Most major platforms-Binance, Bybit, Crypto.com, and others-use the mark price, not the last traded price, to calculate this. Why? Because last prices can be manipulated during low-volume spikes. Mark price smooths out those distortions by averaging data across multiple exchanges. It’s designed to prevent fake liquidations triggered by flash crashes or pump-and-dump schemes.How to Calculate Liquidation Price (Step by Step)

The formula changes slightly depending on whether you’re long or short. But the logic stays the same: it’s all about how much capital you put up versus how much you’re borrowing. For a Long Position:- Start with your entry price.

- Subtract the difference between your initial margin rate and maintenance margin rate.

- Multiply that by your entry price.

- Start with your entry price.

- Add the difference between your initial margin rate and maintenance margin rate.

- Multiply that by your entry price.

Real-World Example

Let’s say you open a long position on Bitcoin with 10x leverage. You deposit $1,000 as margin. That means you control $10,000 worth of BTC. Your entry price is $60,000. Most exchanges set the initial margin rate at 10% (because 1/10 = 10%). The maintenance margin rate is usually around 0.5%. Plugging into the formula: Liquidation Price = $60,000 × (1 - 0.10 + 0.005) = $60,000 × 0.905 = $54,300 So if Bitcoin drops to $54,300, your position gets liquidated. That’s a 9.5% drop from your entry point. Now, if you went short on Bitcoin at $60,000 with the same leverage: Liquidation Price = $60,000 × (1 + 0.10 - 0.005) = $60,000 × 1.095 = $65,700 Your position gets wiped out if BTC rises to $65,700.Isolated Margin vs. Cross Margin: Big Difference

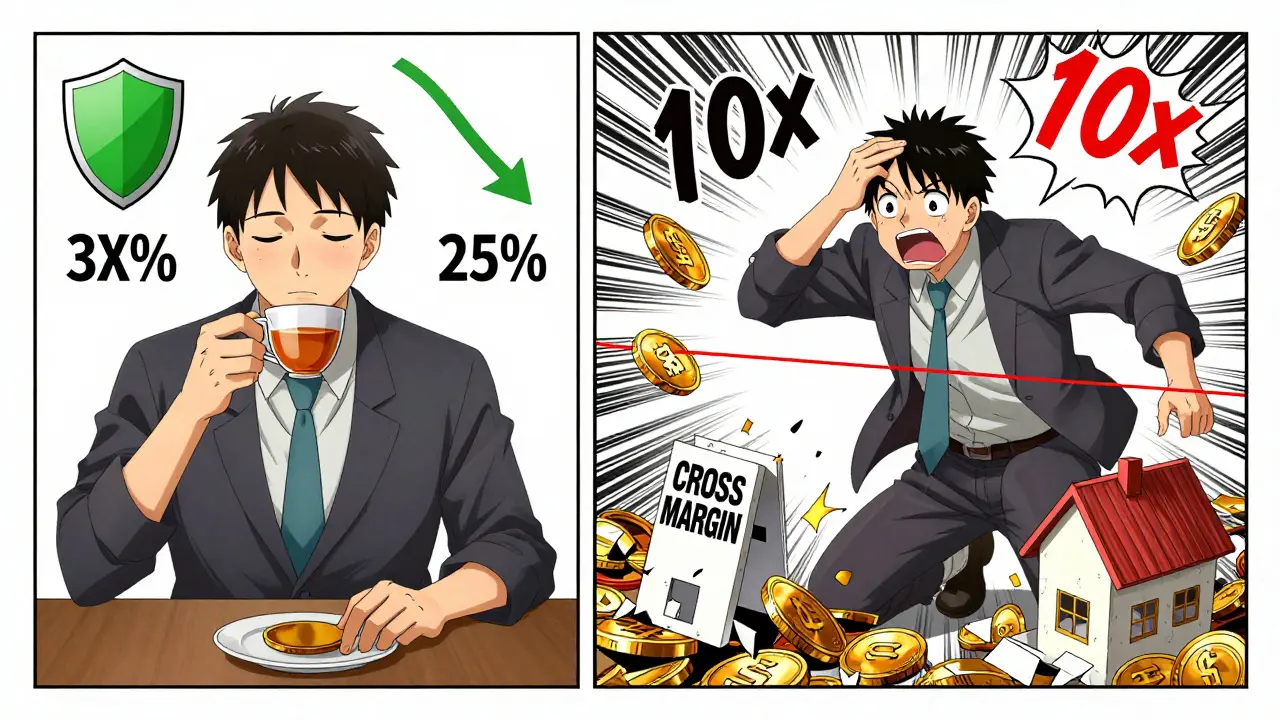

This is where many traders get burned. The type of margin you choose changes everything. Isolated Margin means you assign a fixed amount of funds to one trade. If that trade gets liquidated, only that position dies. Your other trades stay safe. It’s like putting each trade in its own fireproof box. Cross Margin uses your entire account balance as collateral for all open positions. One position tanks? The system drains funds from your other trades to keep it alive. Sounds good, right? Until it doesn’t. During a market crash, cross-margin can trigger a chain reaction. One liquidation pulls money from others, which pushes them closer to liquidation too. It’s a domino effect. In March 2020, during the “Black Thursday” crash, hundreds of traders lost everything because cross-margin positions collapsed in sequence. The same thing happened again in May 2021 and June 2022. If you’re new to leverage, stick with isolated margin. It gives you control.

Why Your Liquidation Price Might Be Wrong

Don’t trust the number shown on your screen. It’s an estimate. A very good one-but still just an estimate. Here’s why:- Slippage: During fast drops or spikes, orders fill at worse prices than expected. Your liquidation might trigger at $54,300 on screen, but if the market crashes hard, your order executes at $53,800.

- Funding rates: If you’re holding a perpetual contract overnight, funding payments eat into your margin. That lowers your liquidation price slightly.

- Low liquidity: For altcoins like SOL, ADA, or SHIB, the order book is thin. A small trade can move the price a lot. Exchanges struggle to calculate accurate liquidation levels here.

- Early liquidation: Some exchanges trigger liquidations slightly before the theoretical price to avoid losses. This happened in January 2022 when Bybit users reported liquidations 2-3% away from their displayed price.

How to Avoid Getting Liquidated

You can’t control the market. But you can control your risk. Rule #1: Never trade close to your liquidation price. Most traders wait until they’re 5-10% away from liquidation before panicking. That’s a death sentence. Professional traders keep at least a 20-30% buffer. During the July 2024 Bitcoin crash-where prices dropped 18% in four hours-traders with 25%+ buffers stayed in the game. Those with 10% buffers? Gone. Rule #2: Use stop-losses. Set your own stop-loss orders 5-10% above or below your liquidation price. This gives you control. If the market moves fast, you exit before the exchange does. Rule #3: Don’t over-leverage. 10x leverage sounds exciting. But it means a 10% move wipes you out. 5x is safer. 3x is smarter. The CFA Institute recommends risking no more than 5% of your total capital on a single leveraged trade. That’s not a suggestion-it’s a survival rule. Rule #4: Monitor funding rates. If you’re long on BTC and funding rates are negative, you’re getting paid. That helps. But if you’re short and funding is positive, you’re paying every 8 hours. That eats your margin. Factor that into your liquidation math.

What Happens After Liquidation?

When your position is closed, the exchange uses an Insurance Fund to cover any shortfall. This fund collects money from profitable traders during liquidations. If your loss is less than your initial margin, the leftover cash goes into the fund. If your loss exceeds your margin (which happens if the market gaps past bankruptcy price), the fund covers the difference so you don’t owe anything. But here’s the catch: the Insurance Fund isn’t infinite. During big crashes, it can run low. That’s when exchanges may trigger “auto-deleveraging” (ADL)-forcing profitable traders to take losses to cover your debt. You don’t want to be the reason someone else loses money.The Future of Liquidation Calculations

By 2026, exchanges will use AI to predict volatility spikes and adjust liquidation thresholds dynamically. Some platforms, like PrimeXBT, already have liquidation simulators that factor in real-time order book depth. These tools reduce false liquidations by 20-25%. But the core math won’t change. It’s based on century-old futures market principles. What’s changing is how well exchanges can predict when and how those rules will be triggered. The bottom line? Liquidation price isn’t a mystery. It’s a calculation. But it’s also a warning sign. Treat it like a red light-not a suggestion to speed up.How do I find my liquidation price on Binance or Bybit?

On Binance, Bybit, or Crypto.com, your liquidation price is displayed in real time on the trading interface, usually next to your position details. It updates automatically as your margin balance changes due to P&L, funding fees, or price movement. Always check the ‘Margin’ or ‘Position’ tab-don’t rely on third-party tools unless they pull direct API data.

Can I get liquidated even if the price hasn’t hit my liquidation level?

Yes. This is called early liquidation. It happens during extreme volatility when the market moves too fast for the system to calculate accurately. Slippage, low liquidity, or sudden funding rate changes can trigger it. Always assume your displayed liquidation price is a guideline, not a guarantee.

What’s the difference between liquidation price and bankruptcy price?

Liquidation price is when the exchange closes your position because your margin is too low. Bankruptcy price is when your losses equal your entire initial margin-you have nothing left. Liquidation happens before bankruptcy. The gap between them is covered by the Insurance Fund.

Why does my liquidation price change even if the market hasn’t moved?

Funding payments, margin adjustments, or changes in your position size can shift your liquidation price. For example, if you’re long and funding is negative, you earn money, which raises your margin balance and pushes your liquidation price farther away. If you’re short and paying funding, your margin shrinks, bringing liquidation closer.

Is cross margin riskier than isolated margin?

Yes. Cross margin uses your entire account balance as collateral. If one trade tanks, it can drag down others. Isolated margin limits risk to one position. For beginners, isolated margin is safer. Even experienced traders use isolated for high-risk altcoins and cross only for well-managed core positions.

What’s a safe leverage level to avoid liquidation?

For Bitcoin and Ethereum, 3x-5x is reasonable for most traders. For altcoins, stick to 2x or less. Higher leverage doesn’t mean higher profits-it means higher chances of being wiped out. The average retail trader gets liquidated within 72 hours when using 10x or more. Risk management beats leverage every time.

12 Responses

So let me get this straight-you’re telling me I need to do math to not lose everything? Wow. I thought crypto was about vibes and moon memes. Now I gotta calculate liquidation like I’m preparing for the SATs? 😅

Important note: always, always, always-yes, I’m shouting-check your margin type before you even click ‘open position.’ Cross margin is a one-way ticket to ‘why is my entire portfolio gone?!’ I’ve seen it happen three times this year alone. Isolated margin isn’t sexy-but it keeps you alive.

The structural integrity of leveraged derivatives markets is predicated upon a rigorous understanding of margin mechanics. The liquidation threshold is not merely a numerical construct-it is a dynamic equilibrium point between risk exposure and capital preservation. Failure to internalize this principle results in systemic vulnerability, particularly among retail participants who treat leverage as a lottery ticket rather than a precision instrument. The mathematical fidelity of the formulae presented herein is non-negotiable.

Furthermore, the prevalence of algorithmic arbitrage and liquidity extraction protocols necessitates that traders adopt a multi-exchange mark-price verification protocol. Relying on a single exchange’s UI is tantamount to navigating a hurricane with a paper map.

Ugh. Another ‘educational’ post from someone who clearly hasn’t lost 80% of their portfolio yet. Let me guess-you’re one of those people who says ‘I’m not gambling, I’m trading’ while using 20x leverage on SHIB? Get a job.

Frankly, the entire premise of retail crypto futures is a tragic farce. The average participant lacks the cognitive framework to comprehend even basic options theory, let alone margin mechanics. The fact that exchanges even allow 100x leverage on altcoins is a regulatory failure of epic proportions. I’ve seen hedge funds with PhD quants lose money on this stuff-what chance does a guy watching TikTok trading clips have? None. Zero. Nada.

Y’all are still using 10x? 😭 I had to watch my cousin get auto-deleveraged last year because he thought ‘it’ll bounce back.’ BOUNCE BACK? Bro, the market doesn’t care about your feelings. You’re not ‘investing’-you’re playing Russian roulette with your rent money. I’ve seen people cry over their liquidated ETH positions. It’s not cute. It’s not brave. It’s just stupid.

3x. That’s it. If you can’t make money with 3x, you shouldn’t be trading. Period. End of story. No exceptions. No ‘but I’m good at reading charts’ nonsense. You’re not Warren Buffett. You’re scrolling Reddit at 2 a.m. with a pizza box next to you.

It’s funny how everyone treats liquidation price like it’s some kind of divine prophecy written in blockchain code. But here’s the truth-it’s a statistical illusion wrapped in a layer of marketing fluff. Exchanges don’t want you to know this, but their ‘mark price’ algorithms are often just weighted averages with a 15-minute lag. And when the market tanks? They don’t recalculate in real time-they just trigger the liquidation engine based on the last known value, which might’ve been 30 seconds ago. So technically, you’re getting liquidated on dead data. That’s not risk management-that’s algorithmic negligence. And yet, we’re supposed to trust it? I mean, come on. If your broker’s algorithm can’t keep up with a 2% price move, maybe you shouldn’t be using leverage at all. Maybe you should just buy BTC and HODL. Or better yet-get a Roth IRA. I know, I know… boring. But at least you won’t be crying in the comments section of a Reddit post about liquidation.

They’re not trying to keep you safe. They’re trying to keep themselves rich. Liquidation isn’t a safety net-it’s a profit center. Every time you get wiped, they take a cut. The insurance fund? It’s just a fancy way of stealing from the winners to cover the losers. And when it runs dry? Auto-deleveraging. Your gains? Gone. Because someone else was dumb enough to use 10x. Welcome to crypto. Where the house always wins-even when you think you’re playing the game.

The concept of liquidation reflects a fundamental asymmetry in modern financial systems: the individual bears the full brunt of systemic risk, while institutions internalize gains and externalize losses. The use of mark price, while ostensibly protective, remains subject to manipulation through coordinated order flow. Furthermore, the proliferation of cross-margin structures creates cascading systemic fragility-a phenomenon observed during the 2020 and 2022 market collapses. One must therefore approach leverage not as a tool, but as a liability to be minimized.

bro i just use 3x on btc and set my stop loss 15% below my entry and chill 😌 sometimes i even sleep through the whole thing. i’ve lost a few times but never got wiped. the real secret? don’t trade when you’re tired. or mad. or after 3 beers. also, if your liquidation price is less than 10% away from your entry… you’re already losing. just walk away. 🌱

OMG I literally just got liquidated last week and I’m still sobbing into my matcha latte 💔 I thought I was so smart using cross margin because ‘it’ll save me’-NOPE. It saved NOTHING. I watched my entire $12k vanish like it was never there. I’m not even mad. I’m just… empty. Like my soul got liquidated too. Who else feels this way? 😭

Liquidation price is a myth. The market doesn't care what you think it should be.