Mining Pool Reward Calculator

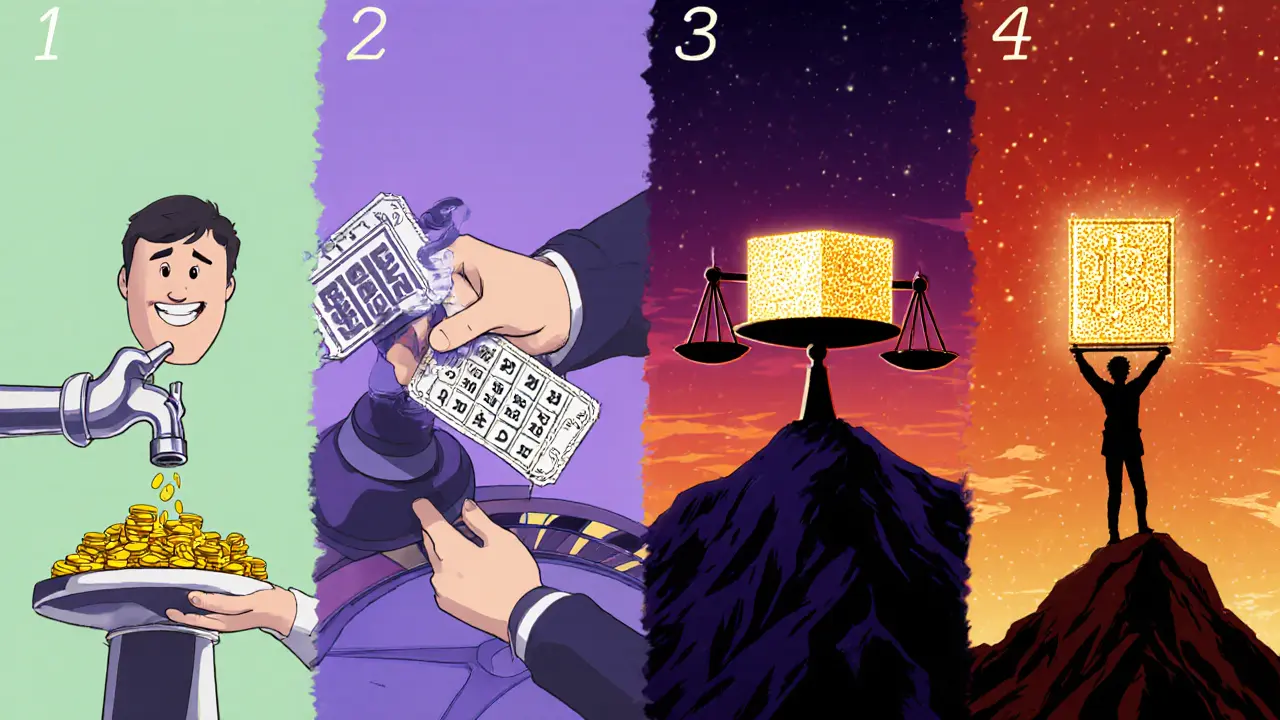

Pay Per Share (PPS)

Fixed payout per share

Fee: 2-4%Instant payout

Pay Per Last N Shares (PPLNS)

Based on last N shares

Fee: 0.5-2%Block-based payout

Proportional (PROP)

Direct share-to-block mapping

Fee: 0-1%Block-based payout

Solo Mining

All-or-nothing approach

Fee: 0%Personal block only

Ever wondered why your crypto mining earnings swing from day to day? It all comes down to how mining pool a collection of miners who combine their computing power to increase the odds of solving a block splits the bounty. Understanding the mechanics behind mining pool rewards can turn that mystery into a clear roadmap for steady income-or bigger spikes-depending on the payout method you choose.

Quick Take

- Rewards are paid out based on shares proof‑of‑work units that meet the pool’s lower difficulty target, not on actual blocks.

- PPS gives a fixed payout per share, ideal for predictable cash flow but carries higher pool fees.

- PPLNS rewards long‑term loyalty; earnings fluctuate with pool luck.

- PROP ties payout directly to the block just found, offering a middle ground.

- Solo mining keeps the whole block and fees, but you must find the block yourself.

Understanding Shares and the Reward Baseline

Every pool sets a custom difficulty that’s far lower than the network’s target. When a miner submits a hash that meets this easier threshold, the pool records it as a share a valid proof‑of‑work submission that proves work contributed to the pool. Shares are the accounting units for all payout models-think of them as tickets in a lottery where each ticket reflects how much effort you’ve put in.

When the pool finally cracks a block, the blockchain rewards the finder with a block reward the fixed amount of newly minted cryptocurrency awarded for each mined block. As of the latest halving (April2024), that reward is 3.125BTC plus whatever transaction fees the fees users pay to have their transactions included in the block the pool collected.

Pay‑Per‑Share (PPS) - Instant, Predictable Payouts

In a Pay‑Per‑Share (PPS) a reward system that pays miners a fixed amount for every valid share submitted the pool assumes all the risk. Whether the pool finds a block that day or not, you get paid immediately for each share you contribute.

How the math works: the pool calculates a PPS rate based on the current block reward, expected network difficulty, and a safety margin to cover days when no block is found. For example, if the pool estimates each share is worth 0.00002BTC, you’ll see that amount credited to your balance the moment the share is accepted.

Pros:

- Steady cash flow-perfect for miners who need predictable income.

- No need to track pool luck or block discovery timing.

Cons:

- Higher pool fees (often 2-4%) to compensate the operator’s risk.

- Transaction fees are usually excluded, so you miss that extra slice.

Pay‑Per‑Last‑N‑Shares (PPLNS) - Rewarding Loyalty

The Pay‑Per‑Last‑N‑Shares (PPLNS) a payout scheme that distributes rewards based on the number of shares each miner contributed during the last N shares submitted across multiple blocks model looks farther back. Instead of paying per individual share, it pools shares over the last, say, 1million shares, then splits any block reward proportionally.

Because the payout window stretches over several blocks, occasional dry spells (days with no block) result in zero earnings for everyone. Conversely, a lucky streak where the pool mines several blocks in quick succession can generate a big payday.

Pros:

- Low fees (often under 2%) because the pool shares risk with miners.

- Discourages “pool hopping” - frequent switching between pools is penalized.

Cons:

- Income can be volatile; patience is required.

- New miners may see tiny payouts until enough shares accumulate.

Proportional (PROP) - Direct Share‑to‑Block Mapping

With Proportional (PROP) a method where miners are paid only when a block is found, and each miner’s payout equals the percentage of shares they contributed to that block, the pool’s earnings and your earnings are tightly coupled. If you contributed 10% of the shares that helped solve a block, you receive 10% of the reward plus any transaction fees.

This system is simple to understand but suffers from the same variance as solo mining-if the pool goes a week without a block, you earn nothing.

Pros:

- Transparent link between effort and payout.

- Typically lower fees than PPS because the pool’s risk is minimal.

Cons:

- High earnings volatility.

- Unpredictable cash flow makes budgeting tough.

Solo Mining - All‑or‑Nothing

Solo mining the practice of mining independently, receiving the full block reward and transaction fees only when you find a block yourself represents the purest form of participation. No pool, no sharing, just your hardware battling the network difficulty alone.

The upside is obvious: if you find a block, you keep the entire 3.125BTC plus fees. The downside is brutal-most solo miners go weeks or months without a find, especially with the current difficulty levels.

Solo mining generally requires top‑tier ASIC application‑specific integrated circuit designed specifically for mining cryptocurrencies, offering the highest hash rates per watt hardware. Some hobbyists still use high‑end GPUs graphics processing units that can be repurposed for hashing, though they’re less efficient for Bitcoin compared to ASICs, but the cost‑to‑hash ratio usually makes solo Bitcoin mining unprofitable for anyone without industrial‑scale rigs.

Comparing the Main Payout Methods

| Method | Payout Timing | Pool Risk | Typical Fee | Income Stability |

|---|---|---|---|---|

| PPS | Per share (instant) | High (operator pays) | 2‑4% | High |

| PPLNS | When block(s) found | Low (shared) | 0.5‑2% | Medium‑Low (depends on luck) |

| PROP | When block found | Low (only when you help) | 0‑1% | Low |

| Solo | Only on personal block | None (you bear all) | 0% | Very low (rare events) |

Choosing the Right Method for Your Situation

Ask yourself three questions before signing up for a pool:

- Do I need predictable cash flow? If yes, PPS is the safest bet.

- Am I comfortable with short‑term swings for potentially higher long‑term gains? Then PPLNS might suit me.

- Do I have the hashpower to realistically expect a solo block? Only then consider solo mining.

Most hobby miners land somewhere between PPS and PPLNS. A common strategy is to split hashpower: run 70% on a low‑fee PPLNS pool for the upside, and 30% on a PPS pool to smooth out dry spells.

Common Pitfalls and the Pool‑Hopping Trap

Pool hopping-jumping from one pool to another based on momentary profitability-looks clever until the payout model punishes it. PPLNS, by design, looks back over the last N shares, so a miner who leaves early forfeits the share of the reward they helped generate.

Another trap is ignoring hardware efficiency. Running a low‑end GPU a graphics card repurposed for mining, offering decent hash rates for altcoins but limited BTC performance in a Bitcoin PPS pool can eat into profits due to high electricity costs. Always calculate watts‑per‑hash and compare against the pool’s fee structure.

Finally, keep an eye on pool reputation. Some pools hide fee changes or alter their payout window without notice, which can turn a once‑stable PPS into an unexpectedly costly service.

Frequently Asked Questions

What is a share in a mining pool?

A share is a proof‑of‑work result that meets the pool’s reduced difficulty target. It counts as a unit of work for reward calculations, even though it doesn’t qualify as a full block on the blockchain.

Why do PPS pools charge higher fees?

PPS pools pay miners for every share regardless of whether the pool finds a block. The operator assumes all the risk, so higher fees (2‑4%) cover potential losses during unlucky periods.

Can I use the same hardware on both PPS and PPLNS pools?

Yes. Most pools accept the same ASIC or GPU rigs. Splitting hashpower manually or via software lets you benefit from both payout models simultaneously.

Is solo mining worth it for a small operation?

Generally not. With current network difficulty, a modest setup will likely go months without a block, making the expected return far lower than pooled mining after accounting for electricity costs.

How do transaction fees affect my payout?

Fees are added to the block reward and are distributed according to the pool’s payout method. PPS pools often omit fees, while PPLNS, PROP, and solo miners receive the full fee amount when a block is found.

10 Responses

Wow, this article really brightens my day! 😄 I always felt lost about pool payouts, now I feel like I finally got a map. Thanks for all the hard work! I realy appreciate the effort you put into it, and it definately helped me understand the stuff better.

Look at the upside – steady cash flow makes mining feel like a safe hobby.

When we examine the nature of collective effort in mining pools, we uncover a microcosm of societal cooperation. Each miner contributes a fragment of computational power, akin to a citizen paying taxes for communal services. The pool then aggregates these fragments and redistributes the bounty, a process that mirrors the philosophy of shared prosperity. One could argue that the payout methods are ethical frameworks, each with its own moral calculus. Pay‑Per‑Share, for instance, guarantees individual compensation regardless of collective luck, resonating with a deontological ethic of duty. Conversely, Pay‑Per‑Last‑N‑Shares embodies a consequentialist view, rewarding those who endure through the vicissitudes of chance. The Proportional method sits somewhere in between, balancing fairness with outcomes. Solo mining, on the other hand, epitomizes the existentialist ideal of self‑reliance, demanding absolute responsibility for one’s fate. Yet the harsh reality of network difficulty forces most participants into cooperative arrangements, a pragmatic acknowledgement of interdependence. This tension between autonomy and collaboration fuels ongoing debates within the crypto community. Moreover, the fee structures imposed by pools act as a subtle tax, influencing the net return of each participant. Understanding these hidden costs is crucial for anyone seeking sustainable earnings. The calculator provided in the article serves as a practical tool, translating abstract concepts into concrete numbers. It invites miners to model scenarios, compare methods, and align choices with personal risk tolerance. Ultimately, the decision rests on one’s philosophical stance toward risk, reward, and communal contribution.

Oh great, another deep dive-just what my coffee needed. You really love to drown us in jargon, don’t you? I mean, who doesn’t want a fifteen‑sentence lecture on shares and ethics while waiting for the next block? It’s almost adorable how seriously you take this.

Remember, the key is to balance risk and reward by diversifying your hashpower across methods. Use a portion on a low‑fee PPLNS pool for upside potential, and keep some on a PPS pool for stable income. Monitoring your daily earnings will help you adjust the split as conditions change.

I get that it can feel confusing at first, but you’re doing fine. Try starting with a small split and watch how the numbers look. Simple steps lead to big understanding.

I think we should all share our pool experince, it helps everyone learn faster. When we post real numbers and fee changes, the community can spot patterns and avoid bad surprises.

But have you noticed how the fees seem to change overnight? Some say the pools are hiding extra cuts, maybe even using hidden algorithms to skim off the top. It’s worth keeping an eye on the fine print.

Let’s be clear: ignoring pool fees is reckless, and the data backs that up. High‑fee PPS pools can erode profits faster than you think.

Your point is valid; consider monitoring fee structures weekly to stay ahead. Consistent tracking ensures you’re not paying more than necessary.