Naira to USDT Exchange Calculator

Official Rate

1 USDT = ₦1,250

(Central Bank of Nigeria)

Black Market Rate

1 USDT = ₦3,500

(Current market average)

Based on article data: Naira has lost 75% value against dollar since 2016. Black market rate is nearly double official rate. In 2023-2024, Nigerians moved $59B in crypto transactions.

USDT Equivalent Value

At official rate: $0.00 USDT

At black market rate: $0.00 USDT

Difference: $0.00 USDT

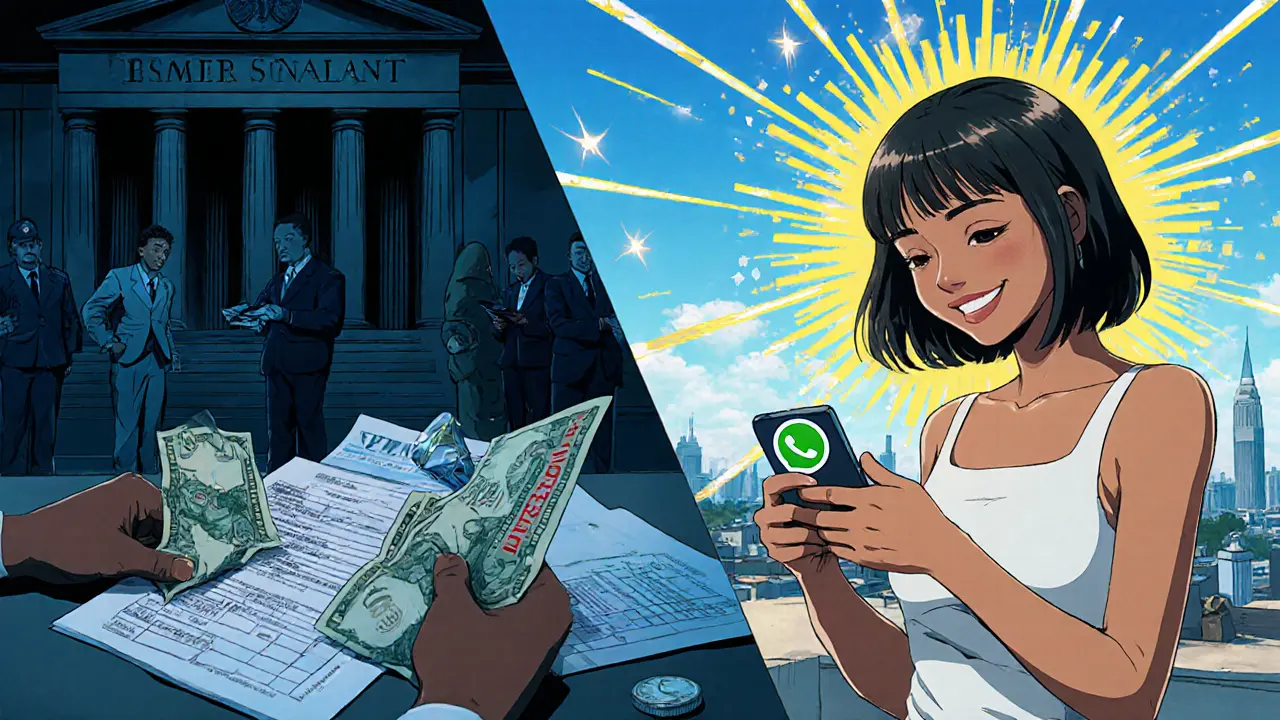

By 2025, over 22 million Nigerians own cryptocurrency - that’s more than 1 in 10 people in the country. And it’s not because they’re chasing get-rich-quick dreams. It’s because the naira has become unreliable. Inflation hit 24% in 2023. The naira has lost over 75% of its value against the dollar since 2016. People aren’t trading crypto for fun. They’re trading it to survive.

Why Nigerians Are Turning to Crypto

When your savings lose value every month, you look for something that holds its worth. For millions of Nigerians, that something is Bitcoin, USDT, and other digital assets. Crypto isn’t a luxury here - it’s a lifeline. The official exchange rate set by the Central Bank of Nigeria (CBN) doesn’t match what’s happening on the streets. In the black market, the naira trades at nearly double the official rate. That gap creates a powerful incentive: why convert your naira to dollars through slow, expensive banks when you can buy USDT directly from a peer in Lagos using WhatsApp? Between July 2023 and June 2024, Nigerians moved $59 billion in cryptocurrency. That’s the second-highest volume in the world, behind only India. Most of those transactions are small - 85% under $1 million. People aren’t investing millions. They’re sending $50 to a cousin in the U.S., buying groceries online from Amazon, or paying for a course on Udemy. Crypto lets them do that without waiting days or paying 8% in fees.The Naira’s Downward Spiral

Every time someone buys USDT with naira, they’re pulling money out of the local financial system. That reduces demand for the naira. Less demand = lower value. It’s basic economics. Traditional remittances used to help stabilize the naira. When someone in London sent money home, it came in as dollars, got converted to naira by a bank, and entered the economy. Now, that money flows directly into crypto wallets. No bank. No conversion. No naira. That’s why the CBN sees crypto as a threat - it’s bypassing the entire system they control. Even worse, the CBN’s own actions made this worse. In 2020, they devalued the naira by 24%. In 2022, they fined six major banks ₦1.31 billion for allowing crypto-related transactions. Instead of stopping crypto, they pushed it underground. People switched to peer-to-peer platforms. They used cash deposits, mobile money, and even informal agents to trade. The more the government cracked down, the more creative people got.

Who’s Using Crypto - And Why

You might think crypto users are tech bros in Lagos startups. But the data tells a different story. Over half of Nigerian crypto owners are under 30. One in three Nigerian adults has bought crypto. And 36% of the population is unbanked - meaning they never had a bank account to begin with. For them, crypto isn’t an alternative. It’s the only option. A student in Kano can buy a $100 crypto card with a phone top-up and use it to pay for Zoom classes. A trader in Port Harcourt can receive payment from a client in Dubai without waiting for a wire transfer that takes three weeks and costs $20. A mother in Abuja can send money to her sister in Canada without going to a bank that might freeze her account for “suspicious activity.” The 2020 End SARS protests were a turning point. When banks froze accounts of protesters, people turned to Bitcoin. Twitter trends showed #Bitcoin as a symbol of financial freedom. That moment proved crypto wasn’t just about money - it was about autonomy. People didn’t want to be trapped in a system that could cut them off at will.The Regulatory U-Turn

For years, the CBN told banks: “Don’t touch crypto.” But by 2024, it was clear the battle was lost. The volume of crypto transactions didn’t drop - it rose. In 2024, inflows hit $55.4 billion, up 25% from 2023. The CBN couldn’t stop it. So they changed tactics. In early 2025, Nigeria passed the Nigerian Investment and Securities Act. For the first time, digital assets were officially recognized as securities. Crypto exchanges could now register with regulators. Token issuers had to follow rules. It wasn’t a ban anymore - it was a framework. This shift didn’t mean the government liked crypto. It meant they realized prohibition was pointless. The real goal now? Control. Tax. Monitor. The CBN still doesn’t want Nigerians avoiding the naira. But they know they can’t stop it - so they’re trying to manage it.

14 Responses

So let me get this straight. People are using crypto because their government is broken? Shocking. Next you'll tell me water is wet.

The data presented here is fundamentally flawed. The $59 billion in crypto volume cited is not indicative of economic resilience but rather capital flight driven by systemic monetary mismanagement. The Nigerian Central Bank's policy failures are not mitigated by decentralized alternatives-they are exacerbated by them, as crypto undermines the very mechanisms required for monetary sovereignty and macroeconomic stabilization. This is not innovation; it's economic collapse dressed in blockchain aesthetics.

I've talked to people in Lagos. They're not crypto bros. They're teachers, drivers, students. They're using USDT because their bank account got frozen for no reason. It's not about speculation. It's about survival. The CBN's crackdown just made it more dangerous and more necessary.

You think this is about inflation? Nah. This is a deep state operation. The IMF, the Fed, and the World Bank have been pushing this for years. Crypto is the Trojan horse to dismantle national currencies so they can install a global digital currency. The CBN didn't lose control-they were handed the keys to their own destruction. Look at the timing. 2020 protests. 2021 crypto surge. Coincidence? Or coordinated economic warfare?

Honestly i think this is the most real thing i've read all week people are just trying to feed their families and the system keeps failing them that's all

This isn't just about money-it's about dignity. 🌍 When your own government turns your savings into paper dust, you don't beg for permission to survive. You build your own system. Bitcoin isn't a currency-it's a rebellion. And Nigeria? Nigeria is leading the revolution. The future isn't centralized. It's decentralized. And it's already here. 💪🔥

The claim that 22 million Nigerians own crypto is statistically absurd. The country's smartphone penetration is under 50%. Mobile internet access is spotty outside major cities. The idea that over 1 in 10 people are actively managing digital wallets is pure fantasy. This article is propaganda masquerading as journalism.

bro this is wild i just saw a guy in abuja pay for his daughter's school fee with usdt using a qr code on his phone like it was nothing 🤯 i mean we're talking about people who don't even have bank accounts but they got crypto running smooth

They're not using crypto to survive-they're being manipulated. The same people who control the banks are now controlling the crypto exchanges. It's all one big scam. They want you to think you're free, but you're just trading one prison for another. The CBN is bad, sure. But the crypto elites? They're worse. They're invisible. They don't answer to anyone. And they're watching you.

So let me get this straight-Nigeria’s entire economy is collapsing because people are using apps on their phones? That’s not a revolution. That’s a failure of leadership. If you can’t fix your currency, you don’t get to blame your people for finding a workaround. You get to fix your corruption, your incompetence, and your arrogance.

I’ve lived in Lagos for five years. I’ve seen mothers use crypto to send money home to rural villages where banks don’t reach. I’ve seen students pay for online courses when their banks blocked international transfers. This isn’t rebellion-it’s resilience. Nigeria’s people aren’t rejecting their currency because they’re anti-government. They’re rejecting it because the government abandoned them first.

Makes sense.

The CBN's 2024 regulatory shift proves one thing: when a government can't control the people, it tries to tax them. This isn't legalization-it's exploitation. They want to monitor every transaction, extract fees, and claim ownership over digital assets. Crypto was supposed to be freedom. Now it's just another state-controlled ledger.

It's fascinating to observe how decentralized finance emerges organically in environments where formal institutions fail. The Nigerian case presents a compelling natural experiment in monetary adaptation. The data suggests that user behavior is responding rationally to systemic disincentives. The CBN's regulatory pivot, while pragmatic, may not address the root causes of currency distrust-namely, persistent inflation and institutional opacity.