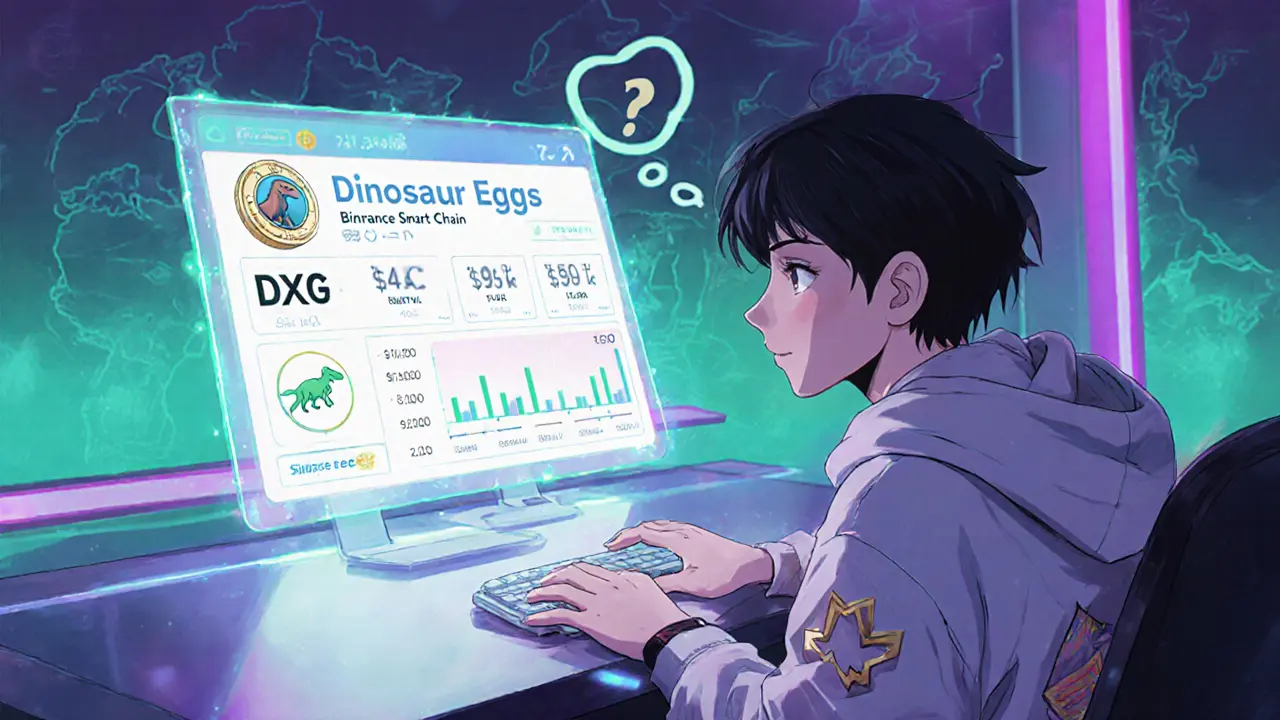

Dinosaur Eggs (DSG) Risk Assessment Calculator

Total Value Locked (TVL)

Current TVL: $926,834

24-Hour Trading Volume

Current Volume: $50,009

Development Activity

Last commit: June 2, 2023

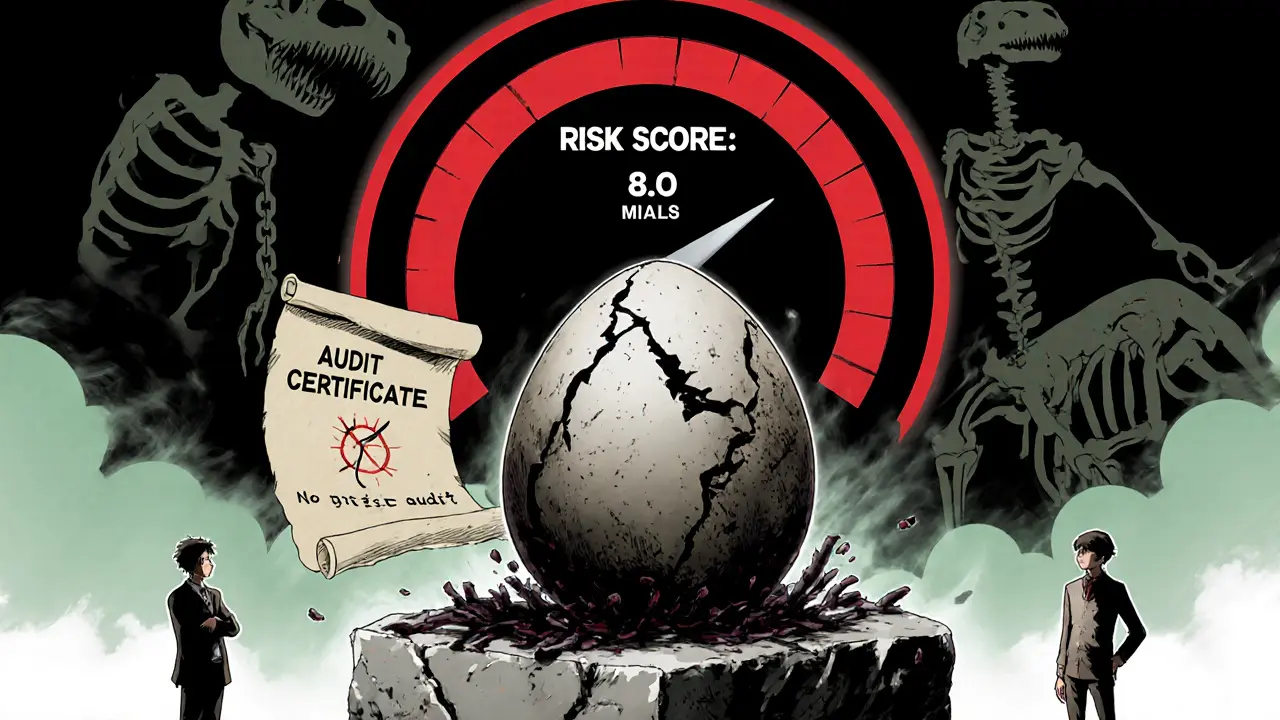

Security Audit Status

Audit status: No public audit

Risk Assessment Summary

When exploring niche decentralized exchanges, Dinosaur Eggs is a Binance Smart Chain‑based DEX and metaverse project that offers token trading and an NFT marketplace often shows up under the ticker DSG. The platform markets itself as "the dinosaur world" and promises future social‑networking features, but its on‑chain data tells a different story.

Quick Takeaways

- TVL sits under $1million (≈$926,834) - indicates limited liquidity.

- 24‑hour volume is roughly $50k, far lower than major BSC DEXs.

- Last code commit was on 2June2023 - no visible development for over two years.

- No public security audit, team details, or fee schedule available.

- High‑risk for traders looking for reliable, actively maintained platforms.

Technical Specs & On‑Chain Metrics

The exchange runs on Binance Smart Chain (BSC), benefiting from low fees but also inheriting the network’s congestion patterns. The native token, DSG, trades at about $0.0002 per token. Its smart contract address (0x9a7864…4abd35) is visible on both BscScan and CoinGecko, but neither site provides a detailed audit report.

Total Value Locked (TVL) - reported at $926,834 - represents the sum of assets currently staked or supplied in the protocol’s liquidity pools. By comparison, PancakeSwap routinely locks over $15billion on BSC, highlighting Dinosaur Eggs’ marginal market share.

24‑hour trading volume stands at $50,008.98 according to CoinMarketCap. Such low turnover suggests thin order books and potentially large price slippage for traders.

Development Activity & Maintenance Signals

GitHub data (last scraped on 9April2023) shows only five weekly commits and twelve monthly commits, with a single developer contributing on both timeframes. The final commit dated 2June2023 means the codebase has seen zero updates for more than two years. In the fast‑moving DeFi world, this signals a high probability of unpatched vulnerabilities and missing feature upgrades.

The absence of a recent security audit further compounds risk. Audited contracts typically come with a public report from firms like CertiK or Quantstamp; none is linked from the project's social channels or the contract explorer.

Platform Features & User Experience

Beyond the DEX, Dinosaur Eggs touts an NFT exchange marketplace where users can buy, sell, and mint dinosaur‑themed collectibles. The documentation is sparse, and the UI is not publicly available via a conventional website, making first‑time access confusing. Without a clear fee schedule, traders cannot estimate transaction costs beyond the standard BSC gas fees (usually $0.02‑$0.05 per swap).

The roadmap mentions a future “social networking” layer, aiming to blend metaverse gaming with DeFi mechanisms. However, no prototype or beta has been released, and the roadmap updates stopped alongside the code commits.

Market Position & Risk Assessment

Listed under the “Decentralized Exchanges” category on CoinMarketCap, Dinosaur Eggs does not rank in the top‑100 DEXs, reflecting its limited adoption. The modest TVL and daily volume translate into higher price impact for even modest trades - a trader swapping $500 worth of DSG could see a 2‑3% slippage.

Given the stale development activity, lack of audited code, and opaque team identity, the platform falls into the high‑risk bracket. Users should treat any funds placed on the exchange as potentially vulnerable to smart‑contract exploits or abandonment.

How to Trade (If You Still Want to)

- Set up a BSC‑compatible wallet (e.g., MetaMask, Trust Wallet) and add the BSC network.

- Obtain BNB for gas fees; you’ll need a small amount to cover swaps.

- Navigate to the DEX interface via the project’s listed URL or directly interact with the contract on BscScan using the "Write Contract" tab.

- Connect your wallet, select the desired trading pair (e.g., DSG/BNB), and confirm the swap.

- Monitor your transaction on BscScan; if the swap fails, funds remain in your wallet.

Because the UI is minimal, many users prefer using a generic DEX aggregator like PancakeSwap to route trades to DSG tokens, which can improve slippage and provide clearer fee information.

Alternatives & Quick Comparison

| Metric | Dinosaur Eggs (DSG) | PancakeSwap | Uniswap |

|---|---|---|---|

| Network | Binance Smart Chain | Binance Smart Chain | Ethereum |

| Total Value Locked (TVL) | ≈ $0.93M | ≈ $15B | ≈ $6B |

| 24‑hr Volume | ≈ $50K | ≈ $1.2B | ≈ $2.4B |

| Last Code Commit | 2Jun2023 | Ongoing (weekly) | Ongoing (daily) |

| Security Audit | None publicly available | Multiple audits (e.g., PeckShield) | Multiple audits (e.g., ConsenSys) |

If you prioritize liquidity, active development, and audited contracts, PancakeSwap or Uniswap are far safer choices. Dinosaur Eggs may only appeal to collectors interested in its dinosaur‑themed NFTs or speculative traders chasing a low‑priced token.

Final Verdict

Dinosaur Eggs presents an intriguing concept-mixing DeFi with a metaverse twist-but the on‑chain reality is a thinly used DEX with stale code, negligible liquidity, and no transparent security posture. For the average crypto trader, the platform ranks high on the risk matrix and low on utility. Unless you have a specific reason to engage with its NFT marketplace or want to hold DSG purely for speculative purposes, allocating capital to more established BSC DEXs is the prudent route.

Frequently Asked Questions

Is Dinosaur Eggs still active?

The smart‑contract address still processes swaps, and 24‑hour volume data shows modest activity, but the project's code has not been updated since June2023, indicating minimal active development.

Can I trust the security of DSG tokens?

No independent security audit has been published. Without an audit, the smart‑contract code cannot be verified for vulnerabilities, so the risk is considered high.

How does the TVL of Dinosaur Eggs compare to other DEXs?

At roughly $0.93million, Dinosaur Eggs’ TVL is less than 0.1% of PancakeSwap’s multi‑billion‑dollar lock‑up, highlighting its limited liquidity.

What fees does the exchange charge?

The platform does not publish a fee schedule. Users only pay the standard BSC gas fee; any additional protocol fee is not disclosed.

Are there any alternatives for trading DSG tokens?

Yes. DSG can be swapped on PancakeSwap via a custom token address, which typically offers better liquidity and lower slippage.

13 Responses

Looking at Dinosaur Eggs feels like watching a secret society pull the rug out from under you; the TVL barely scratches a million, the last commit vanished back in June 2023, and they still brag about a metaverse vision. No audit, no transparent team, just a handful of tokens floating around. It’s the kind of setup that makes you wonder who’s really in control and whether the “social networking” they promise is just a front for a pump‑and‑dump scheme. The risk matrix they show is accurate – high risk, low reward, and a lot of unanswered questions. In my opinion, staying away is the safest move until something concrete changes.

Wow, this read was actually super enlightning! 😅 I love how you broke down the numbers, even if the TVL is kinda tiny. It’s kinda scary tho, no audit and the devs are MIA… 😬 But hey, maybe the NFT side will blow up? Who knows! Anyway, great job on the recap, keep it up! 🙌

Honestly, this DEX is a textbook case of a dead project.

You're spot on about the inactivity; a missing code update for over two years typically signals that the project isn’t being maintained. Low liquidity, as shown by the sub‑$1 M TVL, also means any trade can cause significant slippage, making it unsuitable for serious traders. Without a public audit, smart‑contract vulnerabilities remain unverified, increasing the risk of exploits. For anyone still considering an entry, I’d recommend treating any allocated funds as high‑risk capital and maybe exploring more established BSC DEXs like PancakeSwap instead.

Hey folks, I get the hesitation here – jumping into a platform with shaky foundations can feel like a leap of faith. If you do decide to dip a toe in, consider using only a tiny portion of your portfolio, maybe less than 1 % of your total holdings. Keep an eye on the gas fees and always double‑check the contract address before swapping. And remember, you can always route the trade through a larger aggregator to get better slippage. Stay safe and keep learning!

It sounds like the project has a cool idea, but the numbers don’t back it up. With low liquidity and no recent code updates, it’s risky to put money in. If you’re looking for safety, sticking with bigger DEXs might be a better choice.

i think the whole thing is a bit of a miss‑take, thier idea is fun but the execution is lacking. no audit, low tvl, and the devs havent updated in ages… it feels like a abandoned ship. maybe they will revivve later, but for now i would stay away from putting funds in.

When evaluating a niche decentralized exchange like Dinosaur Eggs, it’s essential to step back and look at the broader ecosystem in which it attempts to operate. First, the sheer scale of its Total Value Locked, hovering just under one million dollars, places it in the lower echelons of liquidity providers, especially when compared to heavyweight platforms that lock tens of billions. This limited liquidity not only hampers efficient price discovery but also introduces sharp slippage for even modest trade sizes, a fact that cannot be overstated for traders seeking predictable outcomes. Second, the 24‑hour trading volume of roughly fifty thousand dollars is a stark indicator that market participants are either unwilling or unable to engage with the token in any meaningful volume, which often translates to thin order books and heightened price volatility. Third, the development activity-or lack thereof-serves as a red flag; a final code commit dating back to June 2023 suggests that the underlying smart contracts have not undergone recent security patches or feature enhancements, leaving them exposed to potential exploits discovered in the intervening period. Fourth, the absence of a publicly available security audit compounds the risk profile, because external auditors typically identify vulnerabilities that internal teams might overlook, and without such a report, users are left to trust the code blindly. Moreover, the project’s roadmap, which promises a “social networking” layer within a metaverse context, remains speculative at best, with no tangible prototypes or beta releases to substantiate those claims. In the competitive landscape of BSC DEXs, seasoned platforms like PancakeSwap continuously iterate, publish audits, and maintain active developer communities, setting a high bar for newcomers. While Dinosaur Eggs may attract niche collectors who are drawn to its dinosaur‑themed NFTs, the token itself appears to be more of a speculative curiosity than a robust financial instrument. Consequently, for the average crypto enthusiast, the prudent strategy would be to allocate capital toward established exchanges that offer transparent governance, audited contracts, and vibrant liquidity pools. If you do decide to experiment with DSG, limit exposure to a fraction of your portfolio, employ a reputable aggregator to mitigate slippage, and stay vigilant for any sudden changes in contract behavior. Ultimately, the high‑risk classification assigned by the review aligns with the observable data, and any potential upside is heavily outweighed by the myriad of operational and security concerns present.

Dinosaur Eggs certainly tries to carve out a niche with its dinosaur‑themed branding, but the hard numbers tell a different story. Low TVL, minimal trading volume, and a stagnant codebase point to a platform that struggles to attract active users. Without a public audit, the security posture remains uncertain, which is a deal‑breaker for many traders. In contrast, the platform’s NFT marketplace could appeal to collectors, yet the lack of a clear fee structure makes it hard to evaluate true costs. Overall, the project feels more like a speculative experiment than a reliable trading venue.

While I see where the concerns come from, dismissing Dinosaur Eggs outright ignores the community‑driven energy that can revive a project. Sometimes low liquidity just means you’re early, and early adopters can reap outsized gains if the team decides to push a proper audit and roadmap updates. Plus, the novelty of a dinosaur metaverse could attract a dedicated fanbase that mainstream DEXs can’t capture. So, I’d say keep an eye on it rather than write it off.

The platform’s inactivity and lack of audit are clear red flags; stick with proven DEXs for safety.

Oh great, another “innovative” DEX that forgot to code after 2023 – just what the crypto world needed 🙄🚀. Low liquidity, no audit, and a vague NFT playground? Sounds like a recipe for a perfect disaster, but hey, maybe it’ll be the next meme sensation. Keep your expectations low, and your exit strategy ready. 😅

Indeed, the data presented, while thorough, undeniably underscores a plethora of concerning variables, namely, the sub‑million dollar TVL, the negligible daily volume, the absence of any public audit, and the stagnant development timeline, all of which coalesce into a high‑risk classification that any prudent investor would duly note; consequently, one must approach this platform with a heightened degree of skepticism, lest one fall victim to the inherent vulnerabilities pervasive in such under‑developed ecosystems.