CoinWind (COW) Airdrop Calculator

Airdrop Overview

Prize Pool: 30,000 COW tokens

Winners: Up to 1,000 participants

Reward per Winner: Up to 30 COW tokens

Eligibility: CoinMarketCap account, watchlist addition, Twitter follow, Telegram join, retweet

Current Token Stats

Price: $0.002837 USD

Market Cap: ~$0

24h Volume: $0

Fully Diluted Valuation: ~$283.65

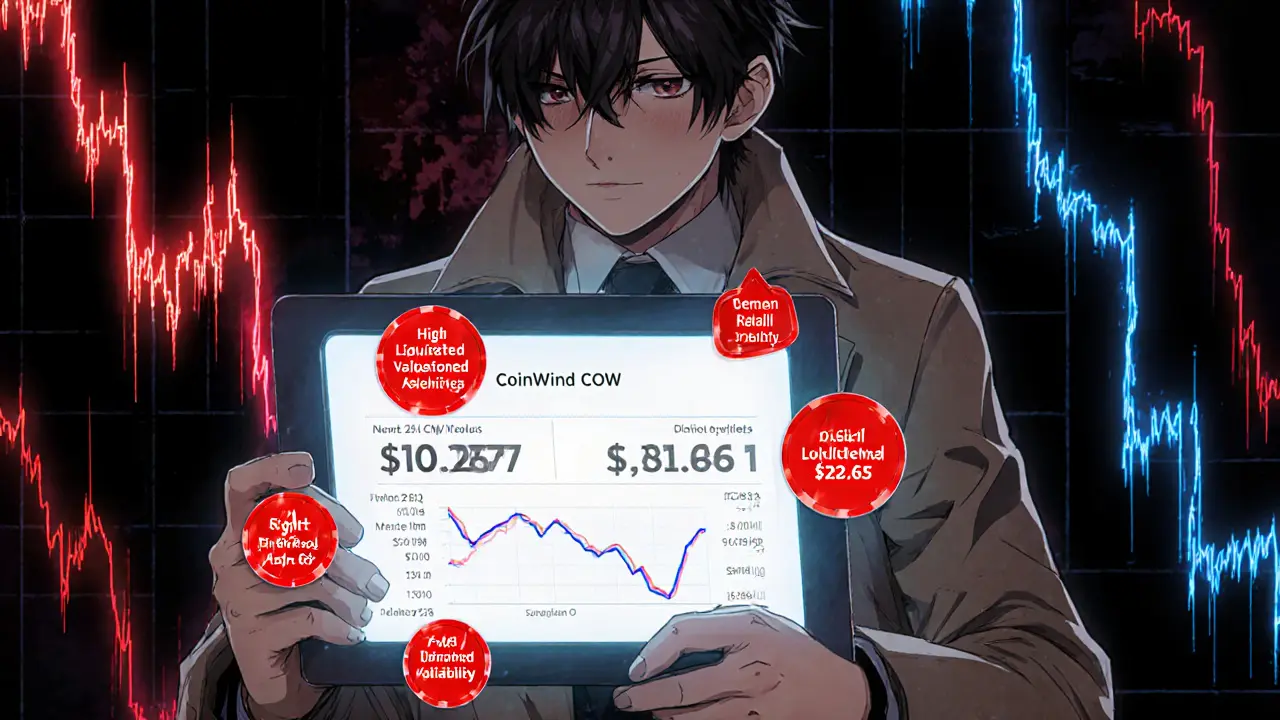

Risk Assessment

High Liquidity Risk Scam Potential Low Utility Data Reliability

Simulate Your Participation

Estimate your chances and potential reward based on the airdrop parameters.

Your Simulation Results

Note: These are estimates based on published airdrop data. Actual outcomes may vary significantly.

Important Notes

- This tool provides simulation-based estimates, not guarantees.

- Actual token value depends on market conditions and adoption.

- Be cautious of phishing attempts and verify all links before sharing personal data.

- Consider the low liquidity and limited utility when evaluating potential investments.

CoinWind (COW) is a low‑value cryptocurrency that recently ran an airdrop on CoinMarketCap. The campaign promised 30,000 COW tokens for 1,000 lucky participants, but the project’s fundamentals are thin and the token trades at a few thousandths of a cent. If you’re wondering whether it’s worth the effort, this guide breaks down the airdrop mechanics, eligibility steps, token economics, common pitfalls, and how CoinWind differs from the similarly named CoW Protocol.

Key Takeaways

- The CoinWind airdrop offered up to 30 COW tokens per winner, with a total pool of 30,000 tokens.

- To qualify you needed a CoinMarketCap account, watchlist addition, Twitter follow, Telegram join, and a retweet.

- COW trades around $0.0028USD, has virtually no 24‑hour volume, and a market cap close to $0.

- Liquidity risk is high; the token can sit idle on most exchanges.

- Don’t confuse CoinWind with CoW Protocol - they are unrelated projects with very different use cases.

What the CoinWind Airdrop Was All About

The airdrop ran from 12:00UTC on July20 to 12:00UTC on August3 (year unspecified). CoinMarketCap hosted the campaign, advertising a fixed prize pool of 30,000 COW tokens. Winners were selected randomly from participants who completed the required tasks, with each winner receiving up to 30 tokens.

Step‑by‑Step: How to Participate (If the Campaign Were Live)

- Create and verify a CoinMarketCap account.

- Add CoinWind to your watchlist on the platform.

- Follow the official CoinWind Twitter account.

- Join the main CoinWind Telegram group and its news channel.

- Retweet the pinned tweet that announces the airdrop.

- Submit your wallet address (usually an ERC‑20 compatible address) on the airdrop claim page.

After the deadline, the project team randomly selected 1,000 participants and distributed the tokens directly to the submitted wallets.

Token Economics (Tokenomics) at a Glance

COW’s price hovers around $0.002837USD. The token shows zero 24‑hour trading volume and a reported market cap of $0, but a fully‑diluted valuation of roughly $283.65. This discrepancy suggests either a data‑feed error or an almost non‑existent secondary market. With such low liquidity, even a modest sell order could push the price down dramatically.

| Aspect | CoinWind (COW) | CoW Protocol (COW) |

|---|---|---|

| Primary Use‑case | Token distribution via airdrop; unclear utility | Decentralized exchange with batch auction & MEV protection |

| Market Cap (approx.) | $0‑$300 (very low) | $98.6M |

| Funding | Not disclosed | $23M from 0x Labs, 1kx, etc. |

| Liquidity | Negligible | Active on major DEXes |

| Community Size | Few hundred followers | Thousands of active traders |

Why the Naming Confusion Matters

Both projects use the ticker “COW,” but they operate in completely different spaces. CoW Protocol is a well‑funded DeFi infrastructure with a clear roadmap and real‑world trading volume. CoinWind, on the other hand, lacks public documentation, a visible team, and any discernible product. Mistaking one for the other can lead to misplaced expectations or accidental investment in a token with almost no utility.

Risk Assessment - What You Should Watch Out For

- Liquidity risk: With near‑zero daily volume, selling COW may be impossible without a significant price drop.

- Scam potential: Airdrop campaigns often attract phishing attempts. Always double‑check URLs and never share private keys.

- Data reliability: Market data shows $0 volume and market cap, indicating possible reporting errors.

- Regulatory exposure: Some jurisdictions treat airdropped tokens as taxable events; consult local tax rules.

How to Verify the Airdrop Status

If you claimed COW during the July‑August window, you can check two things:

- Visit the CoinMarketCap page for CoinWind and look for a "Claims" or "Airdrop" tab that lists processed addresses.

- Use a blockchain explorer (e.g., Etherscan) to search your wallet for incoming transactions from the CoinWind contract address (usually provided in the claim form).

If no tokens appear after a reasonable processing period (typically 2‑4 weeks), the claim may have been filtered out or the airdrop could have been discontinued.

Next Steps for Interested Users

- Join the official CoinWind Telegram to catch any future announcements.

- Monitor the token’s price and volume on CoinMarketCap; sudden spikes could indicate promotional activity.

- Consider diversifying into projects with clearer use‑cases and higher liquidity if you’re looking for long‑term holdings.

- Stay vigilant for phishing messages that mimic the airdrop’s branding.

Frequently Asked Questions

Did the CoinWind airdrop actually happen?

Yes, CoinMarketCap listed a CoinWind airdrop that ran from July20 to August3. The exact year isn’t clear, but the campaign promised 30,000 COW tokens for 1,000 winners.

How many COW tokens can I receive?

Each eligible participant could receive up to 30 COW tokens, depending on the random selection process.

Is CoinWind the same as CoW Protocol?

No. They share the ticker “COW” but are unrelated. CoW Protocol is a DeFi DEX with significant funding, while CoinWind is a low‑value token with minimal publicly available information.

Can I sell COW tokens on major exchanges?

Liquidity is extremely low. Most major exchanges don’t list COW, and the few platforms that do show negligible volume, making sales difficult.

What are the main risks of participating in crypto airdrops?

Airdrops can be phishing bait, may involve tokens with no real utility, and often suffer from poor liquidity. Always verify official channels, never share private keys, and treat any received tokens as speculative.

11 Responses

The airdrop's structure was deliberately simple, requiring just a few social actions to qualify; that simplicity hides a deeper issue of token utility. With a prize pool of only 30,000 COW and a price hovering below a half‑cent, the upside is marginal at best. Participants should weigh the time spent against the potential $0.08 reward per winner. In short, the effort‑to‑reward ratio feels off‑balance.

When one peers beneath the surface of a seemingly benign airdrop, the underlying mechanics demand rigorous scrutiny; the token's price of $0.002837 suggests a market devoid of genuine demand, a signal that liquidity is practically nonexistent. Moreover, the absence of a 24‑hour trading volume betrays a lack of exchange interest, raising the specter of a dormant asset; a dormant asset, in turn, invites speculative manipulation, especially when the fully‑diluted valuation is a modest $283.65. The requirement to juggle a CoinMarketCap account, a Twitter follow, a Telegram join, and a retweet imposes a social engineering veneer that masks the core deficiency-utility. Utility, in the cryptocurrency lexicon, denotes a functional purpose beyond mere speculation; CoinWind offers none that we can verify, leaving participants with a token that resembles digital confetti more than a store of value. Data reliability is another concern, as the reported market cap hovers near zero, a discrepancy that could stem from feed errors or deliberate obfuscation; such ambiguity erodes confidence, prompting the prudent investor to act with caution. The risk matrix further expands when considering regulatory exposure; in many jurisdictions, airdropped tokens constitute taxable events, a nuance that can catch unwary holders off‑guard. Additionally, the token’s ticker “COW” collides with the well‑established CoW Protocol, a fact that breeds confusion and could be exploited by malicious actors seeking to siphon unsuspecting users. Phishing attempts often masquerade as legitimate airdrop communications, leveraging the same branding language to lure victims into disclosing private keys-an outcome no rational participant should tolerate. While the allure of “free” tokens can be tempting, the opportunity cost of time spent completing social tasks should be measured against the negligible financial upside. In essence, the airdrop operates more as a marketing stunt than a genuine community‑building initiative; marketing stunts, while effective at generating buzz, rarely translate into sustainable value for token holders. Consequently, if your portfolio is already diversified across projects with demonstrable utility, allocating resources to CoinWind may not align with a long‑term growth strategy. Finally, the token’s negligible liquidity implies that even if you acquire the maximum 30 COW, exiting the position could depress the price further, rendering the tokens effectively illiquid. All considered, the prudent path leans toward vigilance, thorough due diligence, and a healthy dose of skepticism before committing to claim or trade this token.

Congrats on the free crypto, if you consider fractions of a cent a prize. The real win is the collective eye‑roll from seasoned hodlers.

Quick heads‑up: if you claimed, check Etherscan for the contract address to confirm receipt. Also join the Telegram for any future drops. Stay safe.

Looks like another "free money" scheme that forgets about the post‑airdrop reality-no buyers, no volume, just a token floating in limbo. If you enjoy watching your wallet balance stay the same while you click around, this is your jam. Otherwise, maybe focus on projects with actual product roadmaps.

It's great that you took the time to claim, but remember that diversification is key. Even a small amount of COW can be a learning experience, just keep expectations realistic.

Getting a token for free can feel exciting, but think of it like a test. See how it works, then decide if you want to put more effort into projects that actually solve problems.

i think its important to read the fine print, cuz sometimes these airdrops are just a marketing ploy. also watch out for phising links, they can be sly.

Hey folks, just a quick tip: when you check your wallet, make sure you’re looking at the right network. Some folks accidentally check BSC instead of Ethereum and think they didn’t get anything.

Wow, that airdrop was a wild ride! 🎉

Looks like they’re testing how many people will hand over personal data for a token that barely registers on any exchange-classic data‑harvest ploy hidden behind a "free" label.