When you’re looking for a new crypto exchange, you want liquidity, security, and support. You don’t want to land on a platform where you can’t even find out when it was launched.

AUX Exchange is listed on CoinGecko as a decentralized exchange (DEX), but that’s about all the verified information you’ll find. It supports only three cryptocurrencies and three trading pairs. That’s it. No more. No less. For comparison, even the smallest legitimate exchanges in Australia - like Swyftx or Independent Reserve - offer over 500 tokens. AUX Exchange doesn’t even make the bottom 10% of functional platforms.

What Does AUX Exchange Actually Offer?

There’s no public documentation on how AUX Exchange works. No whitepaper. No technical breakdown of its smart contracts. No mention of the blockchain it runs on. It doesn’t even say if it’s built on Ethereum, Solana, or something else. Major DEXs like Uniswap or PancakeSwap publish their code on GitHub, audit reports from CertiK or Hacken, and detailed fee structures. AUX Exchange? Nothing.

Trading fees? Unknown. Withdrawal limits? No data. Mobile app? Not confirmed. API access? Unmentioned. Customer support channels? Not listed anywhere. You can’t even find a help page or email address. If you lose access to your funds, there’s no one to contact. No live chat. No ticket system. No FAQ. Just silence.

Security? There’s No Evidence It Exists

Security isn’t optional in crypto. It’s the baseline. Every reputable exchange - even the smaller ones - publishes proof of reserves, uses cold storage, offers two-factor authentication, and gets third-party audits. Kraken publishes monthly proof-of-reserves. Swyftx holds ISO27001 certification. OKX Australia is registered with AUSTRAC.

AUX Exchange? Zero transparency. No audits. No certifications. No public wallet addresses. No cold storage claims. No two-factor authentication mentioned anywhere. If you’re depositing real money here, you’re doing it blind. There’s no way to verify if the platform even holds the assets it claims to. That’s not a risk - that’s a gamble with your life savings.

No Regulatory Footprint, No Trust

AUX Exchange doesn’t appear on any official regulatory lists. It’s not registered with AUSTRAC in Australia. It’s not licensed by ASIC. It’s not listed in the U.S. FinCEN database. It doesn’t participate in the ATO’s data-sharing program, which means if you trade on AUX Exchange, you’re on your own when tax season comes around.

Compare that to exchanges like Coinbase or Kraken, which integrate directly with Koinly and Sharesight for tax reporting. AUX Exchange doesn’t even connect to those tools. If you use it, you’ll be manually tracking every trade - and hoping you don’t get flagged by your tax authority because you can’t prove your records are accurate.

Zero User Base, Zero Community

There are no user reviews on Trustpilot. No threads on Reddit. No discussions on Twitter/X. No Telegram groups. No YouTube videos comparing it to other platforms. Raymond La’s April 2025 video on the top five crypto exchanges in Australia didn’t even mention AUX Exchange - and he covered 40+ platforms in his research.

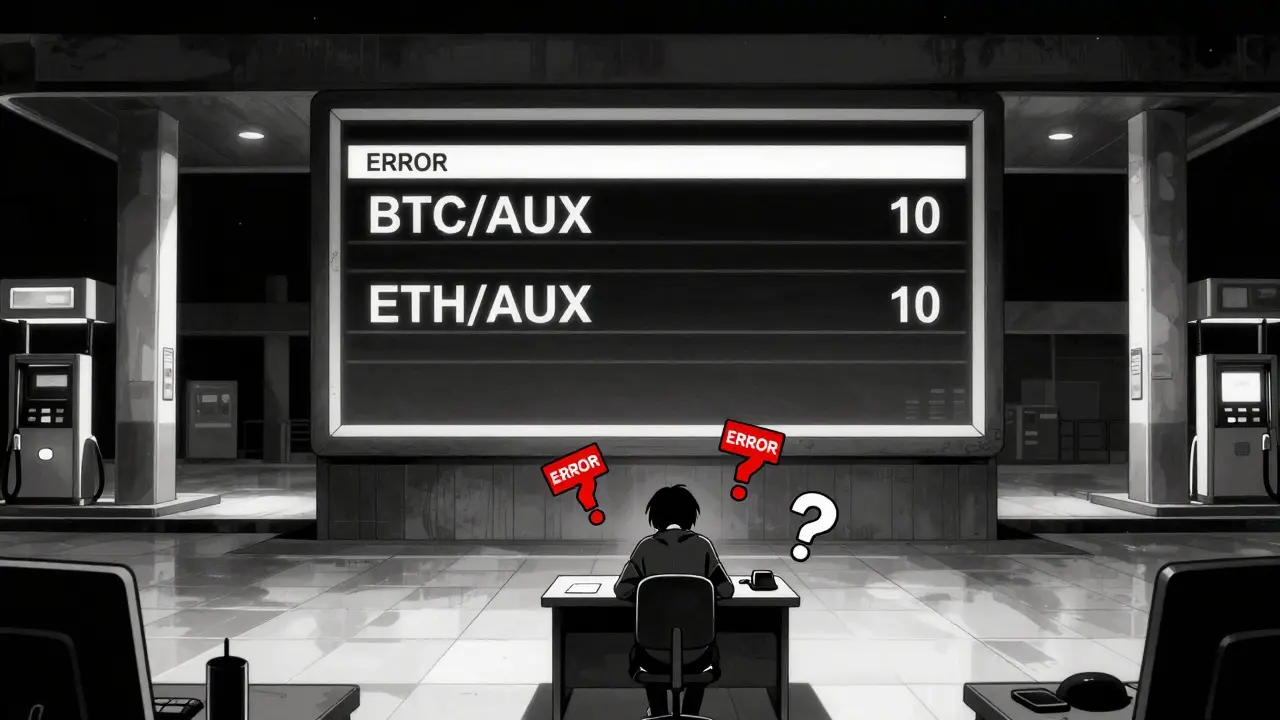

Swyftx has over 700,000 users. Kraken has millions. Even obscure platforms like MEXC have active communities. AUX Exchange? Nothing. If nobody’s using it, why would you? There’s no liquidity. No depth. No volume. You might find a trading pair for BTC/AUX or ETH/AUX, but you’ll be the only one trading it. Slippage will be brutal. Your orders might not fill at all.

Why Is It Even Listed on CoinGecko?

CoinGecko lists thousands of exchanges - some legitimate, some barely alive. AUX Exchange is in the latter group. CoinGecko doesn’t verify security, compliance, or activity. It just tracks what’s publicly visible. If a site has a trading interface and a few pairs, it gets listed. That doesn’t mean it’s safe. It doesn’t mean it’s active. It just means it exists on the internet.

Think of it like a gas station with no fuel. The sign is up. The pumps are there. But the tanks are empty. CoinGecko shows you the pumps. It doesn’t tell you there’s nothing inside.

How Does It Compare to Real Exchanges?

Here’s the reality check:

| Feature | AUX Exchange | Swyftx | Kraken | MEXC |

|---|---|---|---|---|

| Cryptocurrencies Supported | 3 | 500+ | 466+ | 2,500+ |

| Trading Pairs | 3 | 500+ | 1,000+ | 5,000+ |

| Fiat Support (AUD) | No | Yes | Yes | Yes |

| Trading Fees | Unknown | 0.1% | 0.16%-0.26% | 0% spot |

| Security Certifications | None | ISO27001 | Multiple audits | Regular audits |

| Regulatory Compliance | None | AUSTRAC | Global licenses | Global licenses |

| Tax Integration | No | Yes (Koinly) | Yes | Yes |

| User Base | None documented | 700,000+ | Millions | Over 30 million |

There’s no contest. AUX Exchange doesn’t compete. It doesn’t even register as a footnote.

Is AUX Exchange a Scam?

It’s not proven to be a scam - but it’s also not proven to be real. There’s no team, no company registration, no legal entity, no social media presence beyond a basic website. It looks like a placeholder. A ghost site. Maybe it was launched by someone with a template and a dream. Maybe it’s abandoned. Maybe it’s a honeypot designed to drain wallets.

Either way, you’re not buying into a product. You’re betting on a mystery.

Who Should Avoid AUX Exchange?

If you’re:

- Looking for reliable trading

- Wanting to trade AUD or other fiat currencies

- Need tax reporting tools

- Value security and transparency

- Want to trade more than three coins

- Prefer platforms with active communities

Then AUX Exchange is not for you. It’s not a bad option - it’s not even an option. It’s a dead end.

What Should You Use Instead?

If you’re in Australia, use Swyftx, Independent Reserve, or Coinspot. They’re regulated, easy to use, and integrate with tax tools. If you want global access, Kraken and Coinbase are your safest bets. For DeFi trading, Uniswap and PancakeSwap offer real transparency, open-source code, and active communities.

There’s no reason to risk your crypto on a platform that doesn’t want to be found.

Is AUX Exchange safe to use?

There is no verifiable evidence that AUX Exchange is safe. It lacks security certifications, public audits, two-factor authentication details, and any form of regulatory compliance. No user reviews or community discussions exist, making it impossible to confirm its legitimacy. Using it means trusting a platform with zero transparency - which is a high-risk move in crypto.

Does AUX Exchange support AUD deposits?

No. AUX Exchange does not support any fiat currency deposits, including AUD. You cannot deposit Australian dollars, USD, EUR, or any other government-backed currency. This makes it unusable for most traders, especially in regions like Australia where direct fiat on-ramps are standard.

Why isn’t AUX Exchange on Trustpilot or Reddit?

Because no one is using it. Trustpilot, Reddit, and other review platforms require active users to leave feedback. AUX Exchange has no measurable user base, no marketing presence, and no community engagement. Its absence from these platforms isn’t an oversight - it’s a sign the platform is effectively dead or ignored.

Can I trade more than three coins on AUX Exchange?

No. AUX Exchange officially supports only three cryptocurrencies and three trading pairs. That’s the full extent of its offering. If you’re looking to trade Bitcoin, Ethereum, or Solana, you’re limited to whatever pairings they’ve enabled - and even those may have zero volume.

Is AUX Exchange a decentralized exchange (DEX)?

CoinGecko lists it as a DEX, but there’s no proof. No smart contract address. No blockchain documentation. No open-source code. A true DEX like Uniswap or SushiSwap publishes all this information publicly. AUX Exchange provides none of it, so calling it a DEX is misleading at best - and possibly false.

What should I do if I already deposited funds on AUX Exchange?

If you’ve deposited funds, treat them as potentially lost. There is no customer support, no recovery process, and no way to verify if the platform still operates. Do not deposit more. Try to withdraw what you can - but don’t expect it to go through. Move your remaining assets to a reputable exchange immediately. Never use a platform with zero transparency again.

Is AUX Exchange listed on any official Australian crypto exchange lists?

No. AUX Exchange is absent from every major Australian exchange review, including Koinly, Cryptonews.au, Finder.com, NFTEvening, and Arielle.com.au. It’s not mentioned in any official comparison, ranking, or guide. Australian regulators and media sources don’t recognize it as a viable option.

11 Responses

bro aux exchange is just a html template with some crypto jargon pasted on it lol

you think this is just some sketchy exchange? nah. this is a honeypot. someone coded this to drain wallets with fake tx confirmations. i’ve seen this pattern before - zero docs, zero community, and suddenly a ‘liquidity event’ that’s just a rug pull waiting to happen. they’re not trying to build a platform. they’re trying to collect seed money from the gullible. check the domain registration date - it’s probably 3 months old and registered under a privacy shield. classic.

It’s not just about liquidity or features - it’s about the erosion of trust. We live in an age where anonymity is weaponized under the guise of decentralization. AUX Exchange doesn’t just lack transparency - it actively rejects accountability. And when you remove accountability from finance, you don’t get freedom. You get chaos disguised as innovation. This isn’t a failed startup. It’s a moral failure wrapped in a website. If you can’t even name your team, you don’t deserve to touch someone’s life savings.

omg i just checked and there’s literally NO social media accounts linked anywhere 😭 i thought i was going crazy. i even searched ‘aux exchange reddit’ and got one spam post from 2023 that got downvoted into oblivion. this isn’t a ghost town - it’s a haunted house with no doors.

if you’re thinking about using this, just pause. breathe. go use swyftx. it’s free, regulated, and you can withdraw in under 10 minutes. your future self will thank you. don’t gamble on silence.

lol i saw this site last week and thought it was a joke. then i checked the domain age - registered in january. no updates since. no blog. no twitter. no github. just a landing page with three coins. i bet the devs are somewhere sipping chai and laughing at how many people still click ‘deposit’.

i know it’s tempting to chase the ‘next big thing’ - but sometimes the most responsible choice is to walk away. if a platform doesn’t want to be understood, it doesn’t deserve your trust. you don’t have to be harsh about it. you just have to be firm. your money is yours. protect it gently, but protect it fiercely.

as an australian, i can’t even believe this thing is still online. we’ve got legit options with real support teams, tax tools, and actual human beings you can talk to. this? this is a digital ghost. i’d rather trade on a napkin than risk my crypto here. someone’s gotta warn the newbies before they get burned.

the absence of regulatory registration, security disclosures, and community engagement constitutes a material risk under any standard of financial due diligence. while it may not meet the legal definition of fraud, the operational structure exhibits all hallmarks of an unlicensed, non-compliant, and non-viable entity. users should treat this platform as functionally non-existent until verifiable evidence emerges - which, based on current data, is unlikely.

wait - if this is listed on coingecko, does that mean someone at coingecko didn’t check the basics? or do they just auto-list anything with a trading interface? because if that’s the case, then coingecko’s credibility is just as broken as aux exchange’s. we need better filters, not more listings.

so i went digging. i found a wayback machine snapshot from 6 months ago. the site looked exactly the same. same 3 coins. same blank contact page. same ‘coming soon’ footer. nothing changed. not a single pixel. not a single line of code. this isn’t a startup. this is a placeholder that forgot to get deleted. someone’s got a domain and a dream… and 17 people have already sent crypto to a void.