There’s a lot of noise online about an AST Unifarm airdrop from AST.finance. You’ve probably seen posts claiming you can claim free tokens, or that the airdrop is live right now. But here’s the truth: no official airdrop from AST.finance tied to Unifarm exists - at least not one that’s verified, documented, or publicly announced.

Let’s cut through the confusion. If you’re searching for details on this airdrop, you’re likely running into misleading content from bots, copy-paste social media posts, or fake Telegram groups. These often mix up AST.finance with another project entirely: Aster (AsterDEX). That’s a different token, a different team, and a different blockchain. Aster’s 704 million AST token airdrop in late 2024 had nothing to do with Unifarm or AST.finance. But because both use the ticker AST, scammers and confused users keep blending them together.

What Is AST.finance?

AST.finance is a decentralized finance platform built on the Polygon network. It’s not a big-name project like Uniswap or Aave, but it has a niche following. The platform focuses on yield aggregation and automated strategies for users who want to earn passive income from crypto assets without manually managing positions. Their native token, AST, is used for governance, fee discounts, and staking rewards.

Unlike many DeFi projects that launched with a massive public airdrop, AST.finance never made a big splash with free token distribution. Their token distribution was mostly through private sales, liquidity mining, and early community contributors. There’s no public record of an official Unifarm partnership or airdrop campaign.

What Is Unifarm?

Unifarm is a cross-chain yield farming protocol that lets users deposit assets across multiple blockchains - Ethereum, BSC, Polygon - and earn rewards automatically. It’s designed to simplify farming by pooling strategies and distributing returns without users needing to jump between platforms. Unifarm’s native token is UFI, not AST. There’s no public documentation, whitepaper, or GitHub commit showing any integration between Unifarm and AST.finance.

So if someone says, "AST Unifarm airdrop," they’re either misinformed or trying to sell you something. The two projects operate independently. Unifarm doesn’t use AST as its token. AST.finance doesn’t manage Unifarm’s rewards.

Why the Confusion?

The confusion isn’t accidental. It’s exploited.

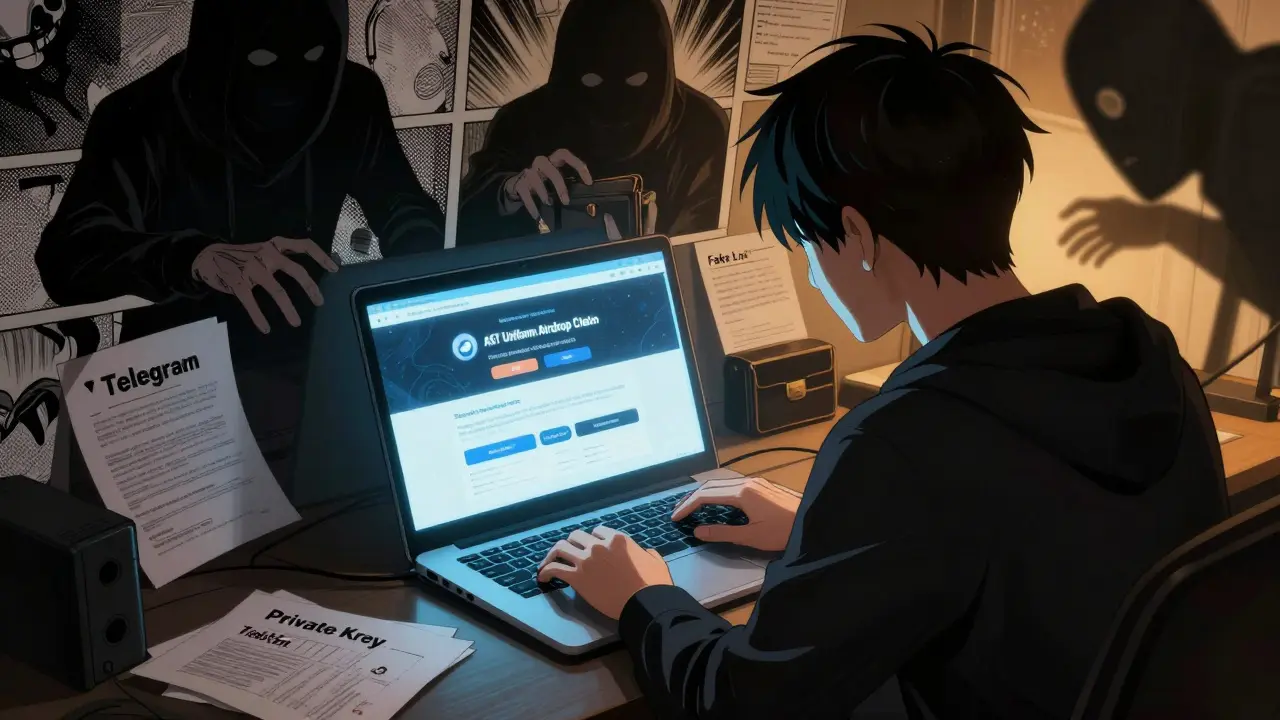

Scammers know that people are hungry for free crypto. When a new airdrop rumor spreads, especially one with a familiar name like AST, it spreads fast. Fake websites pop up with "claim your AST tokens now" buttons. They ask for your wallet private key, or they trick you into signing a malicious transaction that drains your funds. Others push you to join Telegram groups where you’re asked to pay a small fee to "unlock" your airdrop - a classic advance-fee scam.

Even legitimate crypto news sites sometimes get it wrong. In late 2024, one popular aggregator mistakenly linked Aster’s AST airdrop to "Unifarm" because both were trending on Twitter. That error got reshared hundreds of times. Now, six months later, people are still searching for a non-existent "AST Unifarm" event.

What You Should Do Instead

If you’re interested in AST.finance, here’s what actually works:

- Visit the official site: ast.finance (check the URL carefully - no extra letters, no .xyz or .io versions)

- Look for announcements on their Twitter or Discord - not random Telegram channels

- Check their GitHub for active development - if the repo hasn’t been updated in over 90 days, the project may be inactive

- Use only verified smart contracts. If you’re staking or farming, double-check the contract address on Etherscan or PolygonScan

There’s no shortcut. No magic link. No free AST tokens waiting for you to click a button. If you see an airdrop claiming to be from AST.finance and Unifarm together, it’s a trap.

How to Spot a Fake Crypto Airdrop

Fake airdrops follow the same patterns every time. Here’s how to recognize them:

- They ask for your private key or seed phrase - never give that out

- They require you to send crypto first to "unlock" your reward

- The website looks amateurish - poor grammar, low-res logos, broken links

- The announcement is only on Telegram, Twitter, or Reddit - no official blog or documentation

- The token has no trading volume on any major DEX like Uniswap or QuickSwap

Real airdrops don’t ask you to pay anything. They don’t need your private key. They announce details clearly on their official channels. They list eligibility rules, distribution dates, and tokenomics upfront.

What’s the Real Story Behind AST.finance?

AST.finance quietly launched in early 2023. It never raised venture capital. It didn’t do a public token sale. Its team remains anonymous, which is common in DeFi but makes transparency harder. The total supply of AST is 1 billion tokens. As of February 2026, around 280 million are in circulation, mostly held by liquidity providers and long-term stakers.

The platform’s TVL (Total Value Locked) has hovered between $12M and $18M since mid-2024. That’s not huge compared to giants like Aave or Compound, but it’s stable. There’s no evidence of a partnership with Unifarm, nor any blockchain transaction that links AST.finance to a Unifarm airdrop.

If you’re looking for yield opportunities on Polygon, AST.finance might be worth exploring - but only if you’ve done your own research. Don’t chase rumors. Don’t trust influencers who say "just connect your wallet and claim free tokens." That’s how people lose money.

What Should You Do Now?

Here’s your action plan:

- Stop searching for "AST Unifarm airdrop" - it doesn’t exist

- Bookmark ast.finance (double-check the spelling)

- Follow their official Twitter: @AST_finance (verified checkmark, not a clone)

- If you already interacted with a fake airdrop site, check your wallet for unauthorized transactions

- Use tools like Etherscan or PolygonScan to review any contract you’ve interacted with

If you’ve lost funds to a fake airdrop, there’s no recovery. Blockchain transactions are irreversible. The only way to protect yourself is to stop trusting vague promises and start verifying everything.

Final Thought

Crypto moves fast. New projects pop up every week. But the oldest rule still holds: if it sounds too good to be true, it is. No one is giving away free tokens just because you connected your wallet. Real value comes from participation, not magic links.

AST.finance might grow. Unifarm might expand. But there is no merged entity called "AST Unifarm," and there has never been an airdrop for it. Don’t let hype steal your crypto. Stay skeptical. Stay informed. And never click "claim" unless you’ve verified it yourself.

Is there an AST Unifarm airdrop happening right now?

No, there is no active or planned airdrop for AST Unifarm. AST.finance and Unifarm are separate projects with no official partnership. Any website or social media post claiming otherwise is either mistaken or fraudulent.

What is the AST token used for?

The AST token, issued by AST.finance, is used for governance voting, reducing trading fees on the platform, and staking to earn yield. It is not used by Unifarm or any other protocol. The total supply is 1 billion tokens, with around 280 million currently in circulation as of early 2026.

How do I verify if an airdrop is real?

Check the official website, read their documentation, look for announcements on verified social media accounts, and confirm the smart contract address on a blockchain explorer like PolygonScan. Never enter your private key, never send crypto to claim rewards, and never trust links from Telegram or Twitter DMs.

Can I earn AST tokens without an airdrop?

Yes. You can earn AST by providing liquidity to AST.finance pools, staking your assets in their yield strategies, or participating in their governance. These are standard DeFi activities - not free giveaways. Always review contract risks before depositing funds.

Why do people keep talking about AST Unifarm if it’s not real?

The confusion stems from two things: First, AsterDEX (a different project) had a major AST airdrop in 2024, and its token ticker matches AST.finance’s. Second, scammers and bots copy-paste trending keywords to trick users into clicking fake links. The name "Unifarm" adds credibility because it’s a real protocol, even though it has no connection to AST.finance.

14 Responses

Man, I saw this post and just had to say thanks. Been getting DMs all week about "AST Unifarm airdrop" and I kept telling people it was fake. So glad someone finally laid it all out like this. 🙌

It’s not a scam. It’s a cultural failure. You let bots dictate reality. Pathetic.

This is such a needed post. I’ve seen so many newbies get scammed by these fake links. Just want to say-keep educating. You’re saving people’s money. 💪

Lol. Someone actually wrote a 2000-word essay on this. We get it. It’s fake. Move on.

It’s not just fake. It’s a systemic rot. People don’t verify. They just click. And now we have entire communities built on myth. This isn’t crypto. It’s a haunted house with a blockchain logo.

Thank you for this! I’m from India and I’ve had so many friends asking me about this "airdrop." I’ve been trying to explain, but your breakdown makes it so much clearer. I’ll share this with my crypto group for sure. ❤️

The AST Unifarm phantom is the perfect metaphor for late-stage crypto nihilism. A ghost token born from linguistic collision, fed by algorithmic hunger, and worshipped by the desperate. We don’t need airdrops-we need epistemological hygiene. But who’s listening? The bots are louder.

You’re telling me there’s NO free money? That’s the most boring thing I’ve read all year. Who even cares about AST.finance? It’s a ghost chain with 12 users. Unifarm’s the real play. This post is just FUD.

Thank you for the detailed clarification. I appreciate the structured breakdown. Many in our community were confused between AST tokens from different projects. This will serve as a useful reference. I hope official channels adopt this clarity.

You call this an "exposé"? Please. This is just a glorified FAQ. You didn’t expose anything. You just repeated what everyone already knows. The real scandal? People still believe anything written in a Medium post. That’s the real tragedy. And you’re part of it.

Fake airdrop. Got it. Next

Good breakdown. The AST/Aster confusion is classic. I’ve seen this happen with UNI and UniSwap too. The fix? Better token naming standards. Or at least a global registry. But who’s gonna pay for that? Not the devs. Not the users. Just bots.

Thank you for this. I’ve been trying to tell my cousin not to click those links but she didn’t listen. Now I can just send her this. I appreciate how clear it is. No jargon. Just truth. 🤍

You think this stops the scams? Nah. You just gave scammers a playbook. Now they’ll say "Oh this post says it’s fake so it MUST be real!" That’s how this works. You didn’t solve anything. You just made the noise louder. And now they’re using your words to trick more people. Congrats.